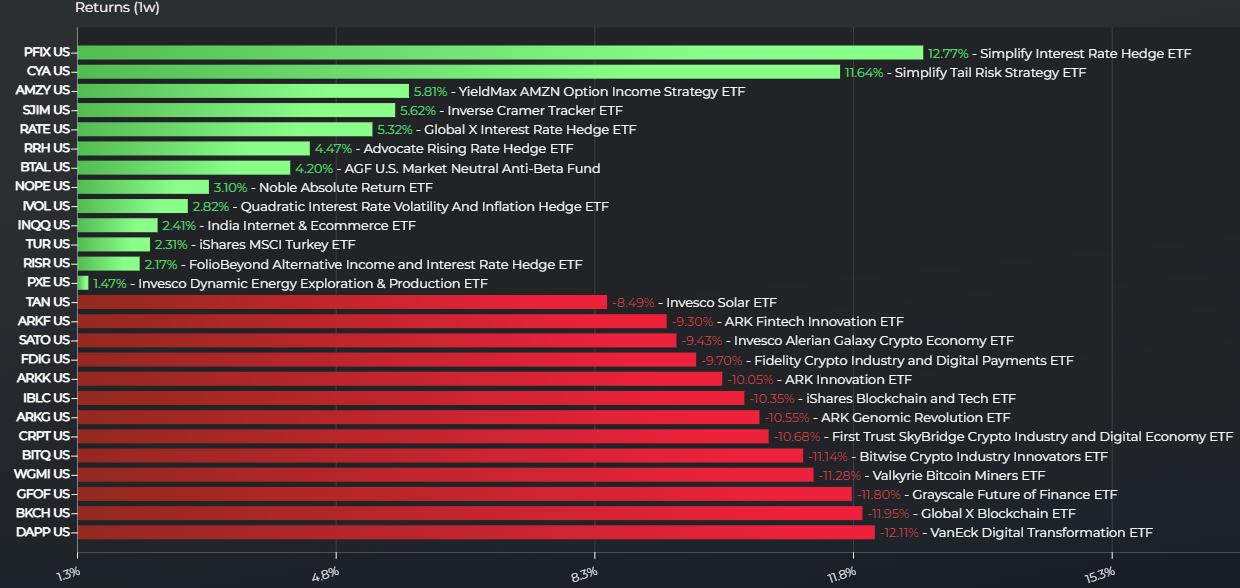

In this edition of the top-performing ETFs, a wide variety of strategies proved their worth in one-week returns. Various rising rate strategies took the lead along with India ETFs mostly at the expense of crypto strategies. While crypto strategies had done well in recent weeks, they took the bottom places among all ETFs over the week.

Looking abroad, the India Internet & E-Commerce ETF (INQQ) returned 2.4% for the week. INQQ tracks the India Internet & Ecommerce Index – Benchmark TR for an 86 basis point (bps) fee. INQQ launched in 2022 and focuses on the internet and e-commerce sphere in India with a market cap-weighted approach.

Looking Around India ETFs

Investors interested in India ETFs may want to look elsewhere, however. The WisdomTree India Earnings Fund (EPI) presents an appealing alternative. EPI launched back in 2008 and as such adds a longer track record. EPI tracks its India index with an earnings-weighted portfolio as opposed to a cap-weighted approach. Taken together, it’s helped EPI return 11% over the last year compared to 0.6% for INQQ in that time.

See more: “Is Your Portfolio Ready for an Indian Equities Boom?“

A pair of Simplify ETFs took top positions over the last week. The Simplify Interest Rate Hedge ETF (PFIX) saw the highest returns at 12.8%, while the Simplify Tail Risk Strategy ETF (CYA) returned 11.6%. PFIX charges 50 bps to actively hedge against a sharp rise in long-term rates. A tactical investing tool, PFIX uses TIPs, Treasuries, and rate options. CYA actively invests as a fund-of-funds ETF picking U.S. fixed income and income-generating ETFs. CYA also uses derivatives to hedge tail risk for an 84 bps fee.

Rising Rate ETF Alternatives

For investors looking at rising rate ETFs, but put off by high fees and options-heavy approaches, USFR may appeal. The WisdomTree Floating Rate Treasury Fund (USFR) invests in floating rate notes (FRNs) that can respond to short-term rate hikes. The rate offered by FRNs rises or falls based on how interest rates move, resetting every 90 days. Charging just 15 bps, it presents a notable alternative.

One top performer to note for the week, the Inverse Cramer Tracker ETF (SJIM) returned 5.6% in that time. SJIM of course looks to take the opposite position to the market moves endorsed by CNBC TV host Jim Cramer.

Cramer hosts the Mad Money program where he announces his stock selections. As such, SJIM looks to take the inverse positions, actively buying short positions in his favored stocks. Holding between 20 and 50 domestic and foreign firms of all cap sizes, SJIM charges a robust 120 bps fee. The strategy returned 5.6% for the week. SJIM launched in March and remains a tiny ETF by AUM at $3 million.

India ETFs, rising rate ETFs, and the Inverse Cramer ETF stand out in this week’s top-performing graph per LOGICLY.

For more news, information, and analysis, visit the Modern Alpha Channel.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.