What would a boom in Indian equities mean for investors? Foreign markets have offered significant opportunities for investors through the years, with Japan and China standouts. What about India, however? Is the South Asian giant a paper tiger, or is the country truly ready to drive global growth? A new insight at WisdomTree Investments addresses this very question of whether Indian equities are on the cusp of an economic boom.

What are the key points to consider when looking at the Indian economy? It’s difficult to look past demographics to start. With a median age of just under 29 years old, India has a large, growing middle class with a growing skilled workforce. The nation is growing literacy and improving education standards, with ample room to skill up workers even more.

India’s human capital isn’t the only source of excitement, with infrastructure growth offering another source of excitement. Nearly 2,500 projects are under development right now as part of the country’s National Infrastructure Pipeline (NIP) with a value nearing $2 trillion. Almost half of those, per WisdomTree’s research, focus on transportation. That presents an increasingly rosy picture for logistics and supply chains.

See more: “What’s Driving Interest in India Equities ETFs?”

Finally, the country is seeing growing Foreign Direct Investments (FDI) inflows. With controversial Prime Minister Narendra Modi pushing a “Make in India” plan to boost manufacturing in the traditionally services-oriented Indian economy, the country could see even more diversified growth.

Rounding out the case for an Indian equities boom are factors like internet penetration surging, e-commerce growing, and India’s continued role as the world’s pharmacy, with made-in-India medicines contributing 20% of global generics market volumes.

An Indian Equities ETF

Taken together, a possible boom for Indian equities makes the case to consider how an ETF like the WisdomTree India Earnings ETF (EPI) can boost a portfolio. EPI offers investors earnings-weighted equities exposures rather than market cap-weighted holdings. Charging 84 basis points (bps), the strategy tracks the WisdomTree India Earnings Index and weights non-energy minerals, finance, and energy minerals as its three highest-weighted sectors.

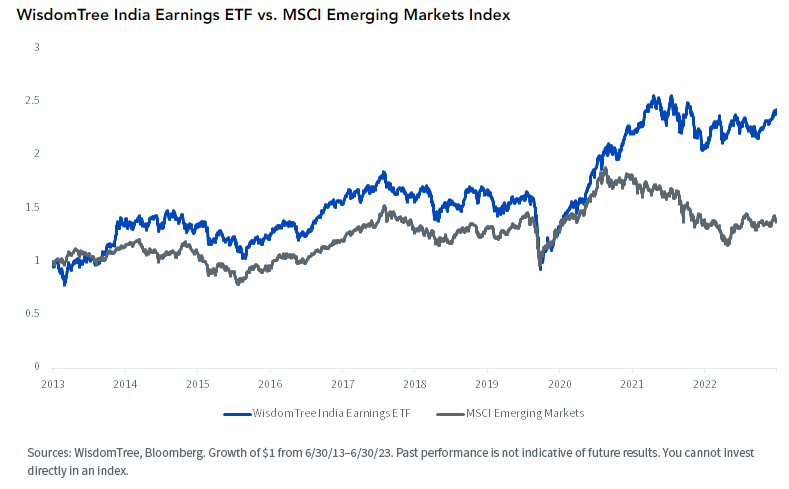

India equities ETF EPI has outperformed MSCI over a 10-year or so range, per WisdomTree data.

EPI has returned 10.3% YTD, outperforming both its ETF Database Category and Factset Segment averages. For those looking to boost their foreign investments and believe in the case for an Indian equities boom, EPI may be worth watching, hitting $1 billion in AUM this month.

For more news, information, and analysis, visit the Modern Alpha Channel.