Interest in India ETF strategies has risen lately, and that’s already made an impact on EPI, an earnings-focused India fund. EPI, the WisdomTree India Earnings Fund, recently reached a notable AUM milestone, surpassing $1 billion in assets, per VettaFi. That may present investors interested in India equities with a new opportunity to jump in themselves, considering EPI’s approach and other factors.

The Case for India ETFs

What’s driving interest in India ETFs right now? The Indian stock market hit record highs in June, with Goldman Sachs and India’s Finance Ministry both reporting positive news. Those reports also arrived as the U.S. government has sought to deepen ties with India and its tech industry.

Perhaps the bigger question is whether the nation’s outlook is indeed that positive. Deloitte added its two cents back in April, seeing 6.5% growth in the medium term. That outlook highlights both the nation’s consumption-driven growth caused by a burgeoning, young, upper-middle-income population and plenty of room for private investment in the future.

EPI stands out from other India ETFs, and not only because it’s hit a significant AUM milestone. The strategy weights Indian equities by earnings rather than market cap. That limits the drawbacks of the cap-weighting approach, which can take big hits as market regimes shift. At the same time, such an index approach might miss a big growth story or up-and-comer.

See more: “Why a July Fed Rate Hike Helps Japan ETF DXJ”

Digging Into India ETF Performance

EPI has a notable track record that speaks to its approach, tracking the WisdomTree India Earnings Index. The India ETF has returned 10.3% YTD, outperforming its ETF Database category and FactSet segment averages. It’s returned 12% over the last three months alone.

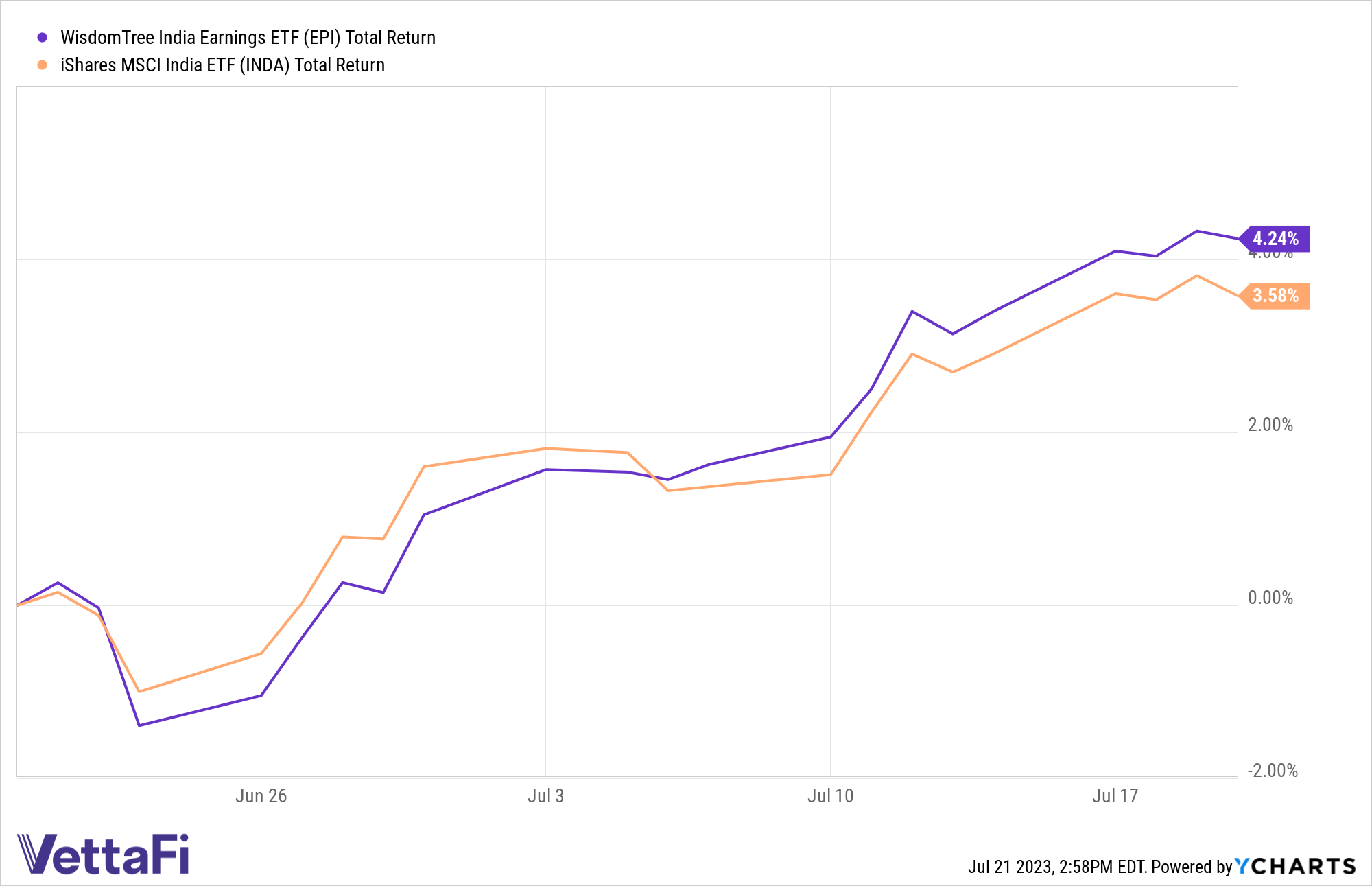

Most importantly, EPI has outperformed the iShares MSCI India ETF (INDA) over the last month, 4.1% to 3.3%. EPI’s approach leads it to weight the non-energy minerals and energy minerals sectors higher than INDA does, with the latter strategy placing more than 25% of its assets in finance stocks.

India ETF EPI uses an earnings-weighted approach, and has outperformed INDA over one month, per YCharts.

The WisdomTree India Earnings Fund has also shown some interesting tech action. The ETF’s price sat at $35.84 as of Friday, July 21, per YCharts. That’s well above both its 50- and 200-day simple moving averages (SMAs), suggesting strong momentum for the strategy’s price. The combination of its new AUM level, its performance, and its tech indicators make an intriguing case for the India ETF. Charging 84 basis points, EPI may be one to watch for those looking for an intriguing India strategy.

For more news, information, and analysis, visit the Modern Alpha Channel.