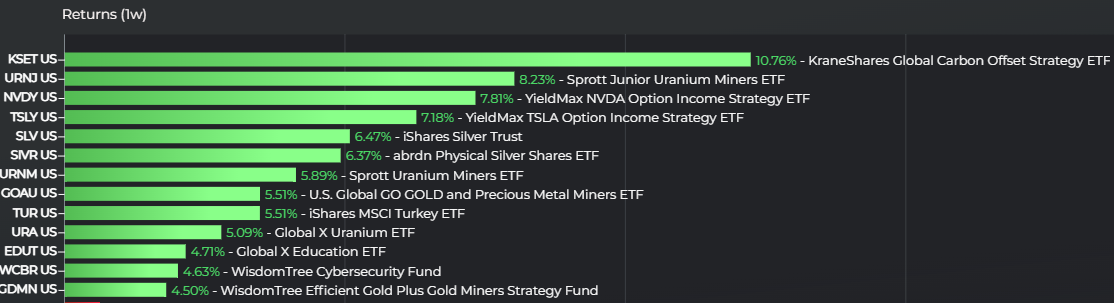

Not all that glitters is gold, but in 2023, certain parts of tech have come close. At the same time, commodity metals themselves have started to build a hot streak based on returns. According to data from Logicly, the top ETFs of the last week focused on metals from silver to gold to uranium. Digging into those returns can help guide investors and advisors regarding which trends are driving the markets’ thinking.

A few firms took multiple slots in the top ETFs of the last week per Logicly. WisdomTree, Global X, iShares, Sprott, and YieldMax all saw two ETFs meet that top twelve ranking. For WisdomTree, that not only includes the WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN). It also includes, interestingly, the WisdomTree Cybersecurity Fund (WCBR). WCBR tracks an index of firms in the world of cybersecurity, holding names like Datadog (DDOG) up 27.4% YTD.

See more: “Q2 Earnings Review: Punting to the Fall”

Sprott, a firm which focuses on metals, saw its Sprott Junior Uranium Miners ETF (URNJ) and Uranium Miners ETF (URNM) return 8.2% and 5.9% respectively. A third ETF, the Global X Uranium ETF (URA), also focused on the critical heavy metal. That uranium interest may owe to ongoing, global interest in nuclear energy as both a clean alternative to fossil fuels and in Europe as a defensive hedge against overreliance on Russian methane gas.

Silver also did well in the top ETFs of the week. The iShares Silver Trust (SLV) returned 5.6% over the last week. The abrdn Physical Silver Shares ETF (SIVR) returned 6.4%, meanwhile. So what is driving interest in gold and silver? Some market watchers attribute fallout from Fed Chair Jerome Powell’s speech at in Jackson Hole, Wyoming as one factor. Markets are nervous about continued punishing high rates from the central bank, perhaps pushing interest in metals as a hedge.

Per LOGICLY, silver, gold, uranium, and even some tech strategies find their place in the top ETFs of the week.

Visualizations and data provided by LOGICLY, which is a wholly owned subsidiary of VettaFi.

For more news, information, and analysis, visit the Modern Alpha Channel.