By Matthew Aydemir, WisdomTree.

We implemented significant changes to our WisdomTree Managed Futures Strategy Fund (WTMF) in June, with the goal of enhancing risk-adjusted performance. While we are cautious about drawing too many conclusions from short-term results, we can now provide a few remarks on what we have observed in WTMF post-revamp.

Fund Performance (Post-Revamp)

Naturally, the focus is on how the Fund has performed since changes were made to the model.

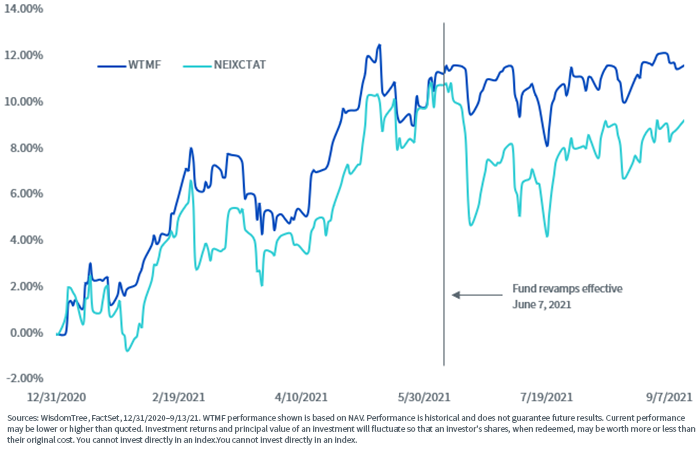

It has been a relatively slow quarter for the managed futures sector as evidenced by the recent decline in the SG Trend Index (NEIXCTAT), an equally weighted index of 10 of the largest trend-following commodity trading advisors (CTAs). Despite a lackluster quarter for the managed futures space, the revamped WTMF has retained and added to the gains from the past year. The Fund also outperformed the benchmark at NAV while experiencing lower volatility. The comparison is best illustrated in the figure below.

Figure 1: WTMF vs SG Index Performance

Standardized performance for WTMF is available here.

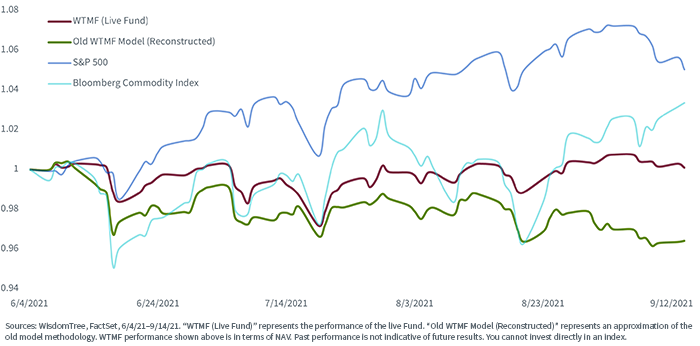

Another useful point of comparison is the previous WTMF model. In the figure below, we show the reconstructed old model compared to the live model. While the reconstruction is not a perfect replication of the old Fund performance, it gives us a reasonable idea of what we could have expected from the old model in the past few months.

Figure 2: Fund Performance vs Old Model Approximation (Post-Revamps)

For definitions of terms in the table, please visit the glossary.

As we have mentioned in previous blog posts, one of the additions to the Fund was a tactical equity model. Although it’s only a few months’ worth of history, the strong performance of equities during this time has boosted Fund performance. The tactical equity model has also reduced the volatility of the Fund during periods when commodities have declined.

The main takeaway here is that the revamps have had a positive impact both return and volatility this past quarter.

Current Positioning

The September rebalance (effective 9/7/21) saw a flip from net-long to short exposure in Energy, specifically oil. Despite this, the Fund remains net-long in commodities.

Rates continue to remain low, and that has resulted in a net-long position in our rates contracts. The currency model has been long USD for the past couple of months and remains long this month. After a strong performance in August, the tactical-equity component increased exposure from 32% to the full 40% nominal weight. The Fund positioning for September 2021 is summarized in the following table.

For a current list of holdings, click here.

Incorporating Managed Futures into a Portfolio

One of the main uses of managed futures is diversification. A more traditional approach has been to incorporate a fixed income component. But in a low interest rate environment, the contribution from a fixed income component is limited.

Furthermore, given how low rates are, it is questionable how well a fixed income component will be able to hedge equity drawdowns in the future. Incorporating managed futures into a portfolio can further diversify the risk factors of a portfolio by providing long/short exposures to a variety of asset classes. WTMF invests in a wide set of uncorrelated assets spanning equities, commodities, currencies and rates, making it an excellent candidate for portfolio diversification.

In our previous blog post, we outlined the advantages of combining managed futures with our Efficient Core Fund. The result is a capital-efficient portfolio with a strong risk-adjusted return profile. Given the solid performance of WTMF post-revamps, there may be an even stronger case for constructing a capital-efficient portfolio in this manner. It is likely still early to draw too many conclusions from the data, but it will be exciting to see how the fund performance evolves as the year goes on.

Originally published by WisdomTree, September 17, 2021.

Important Risks Related to this Article

WisdomTree shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total returns are calculated using the daily 4:00 p.m. net asset value (NAV). Market price returns reflect the midpoint of the bid/ask spread as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

There are risks associated with investing including possible loss of principal. An investment in this Fund is speculative, involves a substantial degree of risk and should not constitute an investor’s entire portfolio. One of the risks associated with the Fund is the complexity of the different factors that contribute to the Fund’s performance, as well as its correlation (or non-correlation) to other asset classes. These factors include the use of long and short positions in commodity futures contracts, currency forward contracts, swaps and other derivatives. Derivatives can be volatile and may be less liquid than other securities and more sensitive to the effects of varied economic conditions. The Fund should not be used as a proxy for taking long-only (or short-only) positions in commodities or currencies. The Fund could lose significant value during periods when long-only indexes rise or short-only indexes decline. The Fund’s investment objective is based on historic price trends. There can be no assurance that such trends will be reflected in future market movements. The Fund generally does not make intra-month adjustments and therefore is subject to substantial losses if the market moves against the Fund’s established positions on an intra-month basis. In markets without sustained price trends or markets that quickly reverse or “whipsaw,” the Fund may suffer significant losses. The Fund is actively managed, thus the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.