After coming into 2023 willing to take on risk to earn higher rewards using fixed income ETFs, sentiment shifted by the end of February. Advisors remained concerned about the likelihood of further rate hikes by the Federal Reserve and favored the still high-income that could be garnered using safer bond strategies such as short-term Treasuries.

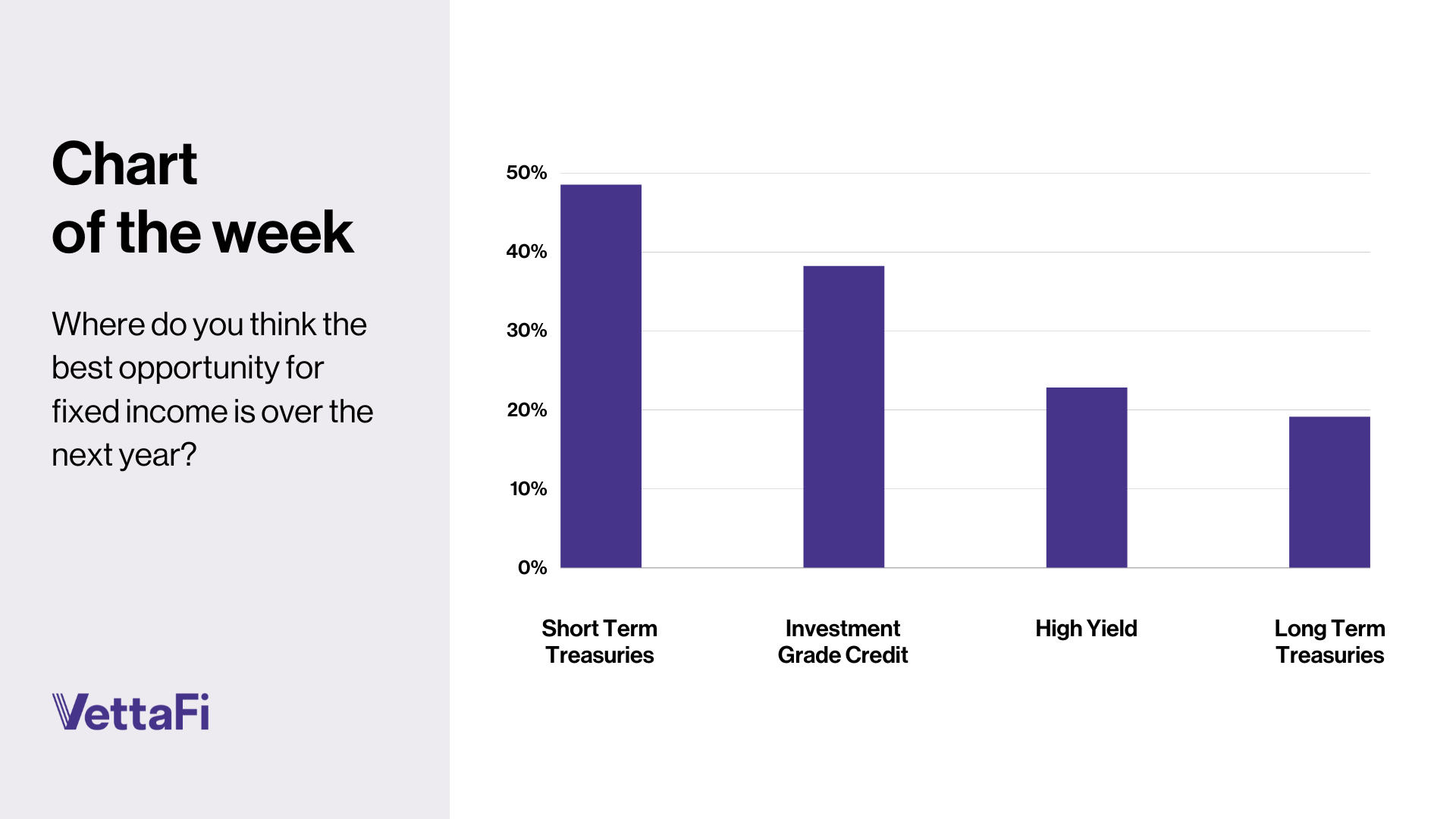

During a webcast with Federated Hermes at the end of February, VettaFi asked advisors, “Where do you think the best opportunity for fixed income is over the next year?” Nearly half of the respondents (49%) chose short-term Treasuries, with investment-grade credit being the second-most popular (38%). High yield (22%) and long-term Treasuries (19%), which incur elevated credit and/or interest rate risk, trailed behind. While short-term Treasuries are normally a good place to turn when there is uncertainty, thanks to prior (and possibly future!) Fed rate hikes, there’s now meaningful income to be earned.

With these weekly pieces leveraging VettaFi’s advisor sentiment data, we typically dive into some of the ETF choices advisors might come across tied to the investment approach because buying the largest or the cheapest fund is not necessarily the right move when one looks inside. With short-term Treasury ETFs, there can be less distinction, but there are still important things advisors should know.

Ultra-short ETFs are funds invested in Treasury bills with less than one year of maturity. The SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) and the iShares Short Treasury Bond ETF (SHV) are a couple of the larger ones with an average duration of 0.15 years and 0.29 years, respectively. However, BIL’s 4.3% and SHV’s 4.5% 30-day SEC yields are compelling given the limited risk.

Meanwhile, short-term Treasury ETFs incur modestly higher interest rate risk than ultra-short offerings, in exchange for slightly higher current yields. The Vanguard Short-Term Treasury ETF (VGSH) and the iShares 1-3 Year Treasury Bond ETF (SHY) sport yields of 4.7% and 4.6%, respectively, each with an average duration of 1.9 years. The $19 billion VGSH has a lower expense ratio than the $26 billion SHY does (0.04% vs. 0.15%).

Ultra-short or short-term Treasury ETFs like the ones listed above help advisors protect against the negative impact of rising interest rates using fixed rates. However, some other ETFs invest in floating-rate Treasury notes that could offer more income as interest rates rise. The rates such notes offer reset based on weekly Treasury bill auctions, further limiting the risk.

The WisdomTree Floating Rate Treasury Fund (USFR) and the iShares Treasury Floating Rate Bond ETF (TFLO) each offer a 30-day SEC yield of 4.7% with effective duration close to zero. Both ETFs charge a 0.15% expense ratio and had a median bid/ask spread of 0.02% over the last 30-day period ended March 3.

While advisors could earn 8% yields investing in high yield ETFs like the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and the SPDR Bloomberg High Yield Bond ETF (JNK), according to VettaFi data they would prefer a safer investment alternative.

For more news, information, and analysis, visit the Modern Alpha Channel.