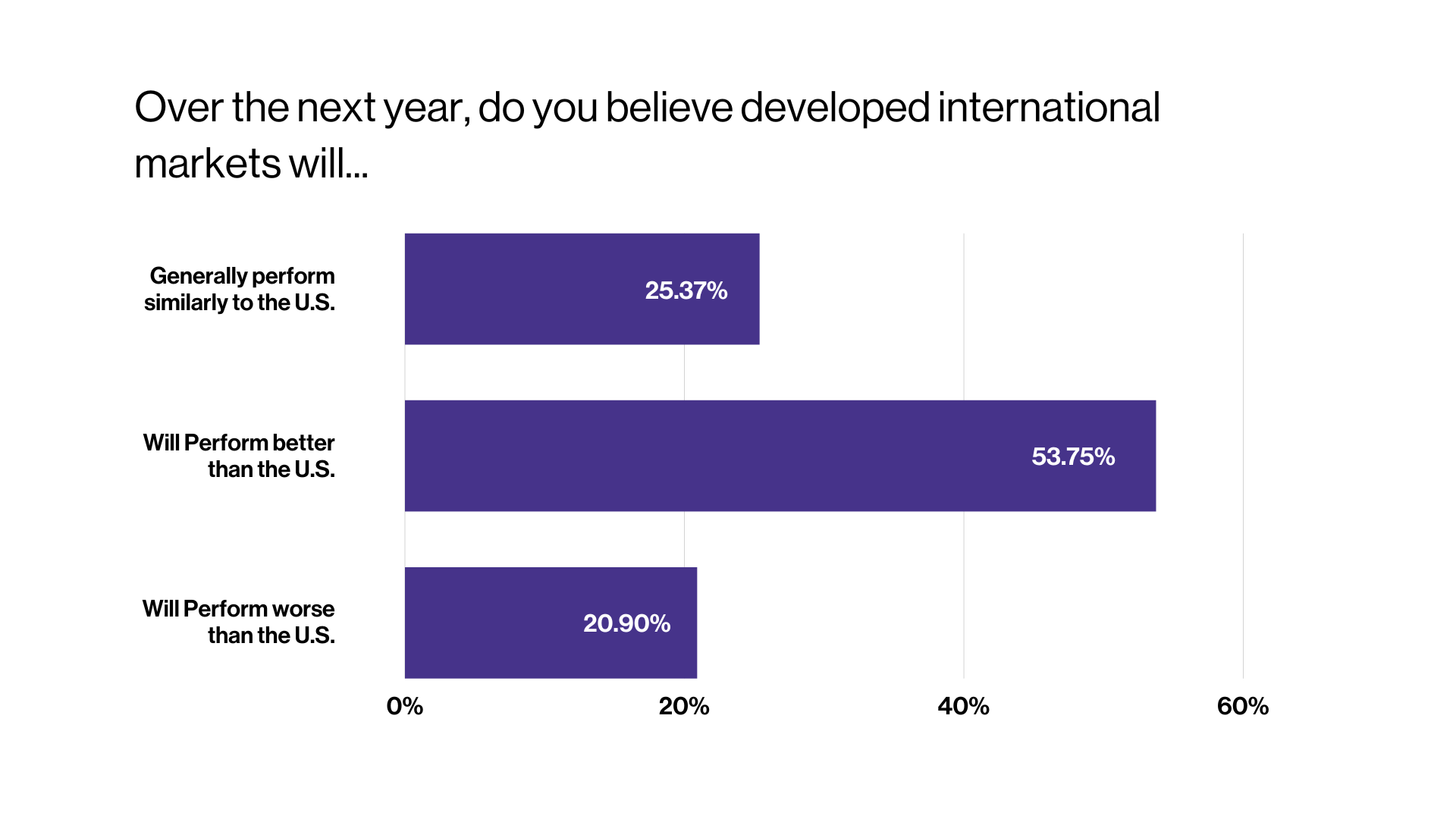

After years of a home bias, international equity ETFs have gained in popularity compared to U.S. equity funds to start 2023. Year-to-date through March 10, international stock funds pulled in $29 billion of new money, while investors redeemed $6 billion of U.S. stock funds. To understand whether this trend can potentially persist, VettaFi turned to financial advisors. During a March webcast with Bank of New York Mellon, we asked advisor attendees how they believed developed international markets will perform relative to the U.S. going forward.

Most respondents (54%) think such overseas markets will perform better than the U.S. in the year ahead, while only 21% expect developing international markets to perform worse; just over 25% expect a similar level of performance for both markets.

The two most popular developed international equity ETFs are the Vanguard FTSE Developed Markets ETF (VEA) and the iShares Core MSCI EAFE (IEFA), which combined manage $200 billion in assets. Though VEA has a slightly lower expense ratio (0.05% vs. 0.07%), IEFA was the outperformer in the one-year period ended March 13 (up 0.8% vs. down 1.1%). The performance differential stems from what’s inside the two ETFs.

Both VEA and IEFA are heavily invested in Europe and Japan, but there are notable distinctions. For example, Canada represented 9.9% of VEA’s assets, making it the third-largest country weight behind Japan (20%) and the United Kingdom (13%), but IEFA does not invest in any North American market. Meanwhile, VEA had a 4.6% stake in South Korea, which is considered an emerging, and not a developed, market per MSCI, the index partner for IEFA. Samsung Electronics and Toronto-Dominion Bank are top-20 positions in VEA but are excluded from IEFA. Meanwhile, IEFA has more exposure than VEA to France, Switzerland, and other developed European markets.

The SPDR Portfolio Developed World ex-US ETF (SPDW) is a $15 billion developed international ETF that gathered $1.2 billion to start the year, matching VEA’s cash haul despite being much smaller. SPDW also has exposure to Canada and South Korea along with Japan, the U.K., and much of Europe.

As we recently noted, many advisors also told VettaFi that they plan to use active ETFs more in 2023. Though there’s a relatively limited supply of active equity ETFs focused on developed international markets, advisors have some options.

For example, the Dimensional International Core Equity Market ETF (DFAI) is an active strategy that favors companies based on high profitability and low valuation. The ETF owns approximately 3,300 holdings with top stakes in Nestle, Roch Holding, and Shell. DFAI charges a 0.18% fee and was up 0.2% in the past year.

Meanwhile, the Harbor International Compounders ETF (OSEA) is a more concentrated ETF with just 37 holdings and sports a different risk/reward profile for those seeking international equity exposure. While the fund has relatively large stakes in ASML, Novo Nordisk, and Sony Group holdings from developed markets, OSEA also has a top-10 position in HDFC Bank, which is based in India. OSEA has a 0.55% expense ratio and had outperformed VEA by nearly 100 basis points year-to-date as of March 13; the active ETF launched in September 2022.

So, if you are like the majority of advisors that responded to the VettaFi survey question and believe it is a good time to be investing in developed markets, make sure you know what’s inside the fund you choose and how much discretion the active managers have.

For more news, information, and analysis, visit the Market Insights Channel.