Markets dropped on news of Fitch Ratings’ downgrade of the U.S. credit rating from AAA to AA+ Wednesday. While stocks and bonds fell, one fund remaining afloat was the iMGP DBi Managed Futures Strategy ETF (DBMF), proving once more its value in times of market turbulence.

Fitch Ratings, one of the three major rating agencies globally, downgraded the U.S. long-term foreign currency issuer rating this week. The rating agency cited governance erosion and rising debt as primary reasons. The S&P downgraded the U.S.’s credit rating in 2011, citing political risk as a key driver for the change. Only Moody’s maintains the U.S. at a top rating of AAA.

“The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years,” according to the Fitch Ratings press release. “The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management.”

Currently, the countries retaining a AAA score with all three agencies include Norway, Sweden, Switzerland, Denmark, Netherlands, Germany, Luxembourg, Singapore, and Australia.

As of midday trading, the S&P is down 1.2%, the Russell dropped 1.4%, the Nasdaq tumbled over 2%, and bond prices fell as well as investors shifted to risk-off. Meanwhile, the iMGP DBi Managed Futures Strategy ETF (DBMF) held relatively steady in trading while equities and bonds fell.

See also: “3 Reasons to Buy and Hold DBMF”

DBMF Rides Market Turmoil After U.S. Rating Downgrade

Managed futures remain noteworthy for the portfolio diversification they provide with their low correlations to both stocks and bonds.

DBMF is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

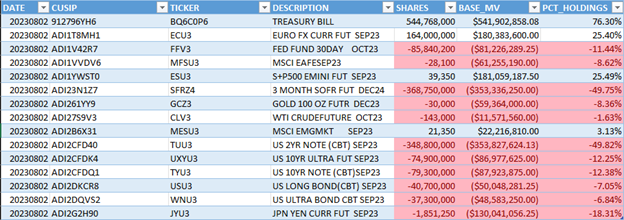

DBMF Holdings 08/02/2023

Image source: iM Global Partners

DBMF is currently long in only four asset classes: the one-year Treasury Bill set to mature in September, the euro, the S&P 500, and MSCI emerging markets. The fund is short all other exposures, including gold, crude oil, the yen, longer-duration Treasuries, and more.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.