The constantly evolving economic and market outlook prevented any clear trend from emerging in the first half. This in turn created a broad headwind for trend strategies; without consensus on the outlook, asset classes rose and fell on the ever-changing narrative. Despite the challenges of this year, there is real value in buying and holding managed futures strategies like the iMGP DBi Managed Futures Strategy ETF (DBMF) in the long term for three core reasons.

Managed Futures Hedge Fund Diversifier

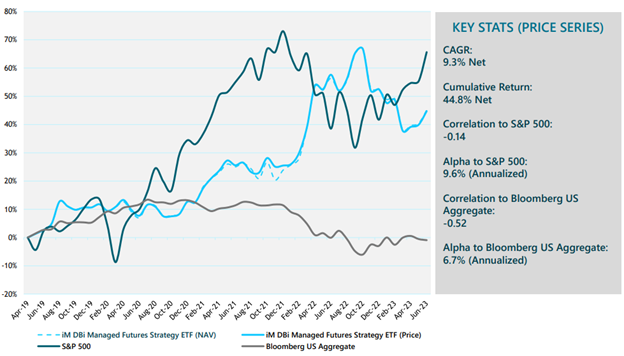

DBMF is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. Managed futures provide inherent portfolio diversification due to their low correlations to stocks and bonds. DBMF in particular provides additional diversification within the managed futures space because of its replication methodology.

The position that the fund takes is determined by the Dynamic Beta Engine, which looks at the trailing 60-day performance of the 20 largest SocGen CTA hedge funds. By averaging the performance of these 20 hedge funds, investors can capture the performance of multiple funds all in one.

The benefit to averaging the performance, particularly in CTAs, is that it eliminates single-manager risk. The performance of trend strategies can vary wildly, depending on each individual manager’s methodology. Capturing the average SG CTA performance helps contain the potential for excessive risk that following a single manager in the space entails.

Captures Alpha in Factor Rotations

Managed futures are able to offer long-term positive performance when market volatility is low, making them a valuable inclusion in portfolios. When volatility spikes and market dislocations occur, they can be an invaluable enhancement to a portfolio.

Managed futures have been dubbed the “crisis alpha” generators for their noteworthy performance during times of market stress. Because they are able to rapidly pivot to capture the new market environment during a dislocation, they capitalize on asset class opportunities that slower-moving strategies often miss.

The contracts that DBMF takes positions in span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). By taking long and short positions across a number of asset classes, DBMF has historically generated outperformance during most strong equity drawdowns since inception.

“Our constant refrain is that managed futures should be a strategic allocation in every diversified portfolio,” said Andrew Beer, co-founder of Dynamic Beta investments and co-PM of DBMF, in a recent video. “I think many investors fear that managed futures will perform poorly when equities rise. That clearly is not necessarily the case.”

DBMF Provides Significant Fee Savings

By capturing the CTA strategy in an ETF wrapper, investors are able to save significantly on management fees. DBMF has a management fee of 0.85%. In comparison, the Morningstar Systemic Trend Average has an expense ratio of 1.74%. Hedge funds typically charge 2/20, with 2% management fees and an additional 20% of profits made above a certain benchmark should the fund do well.

This creates fee alpha for DBMF, as it allows for the fund to retain more alpha generated by the strategy. Even in period of reduced volatility, this fee alpha creates the opportunity for DBMF to generate consistent returns.

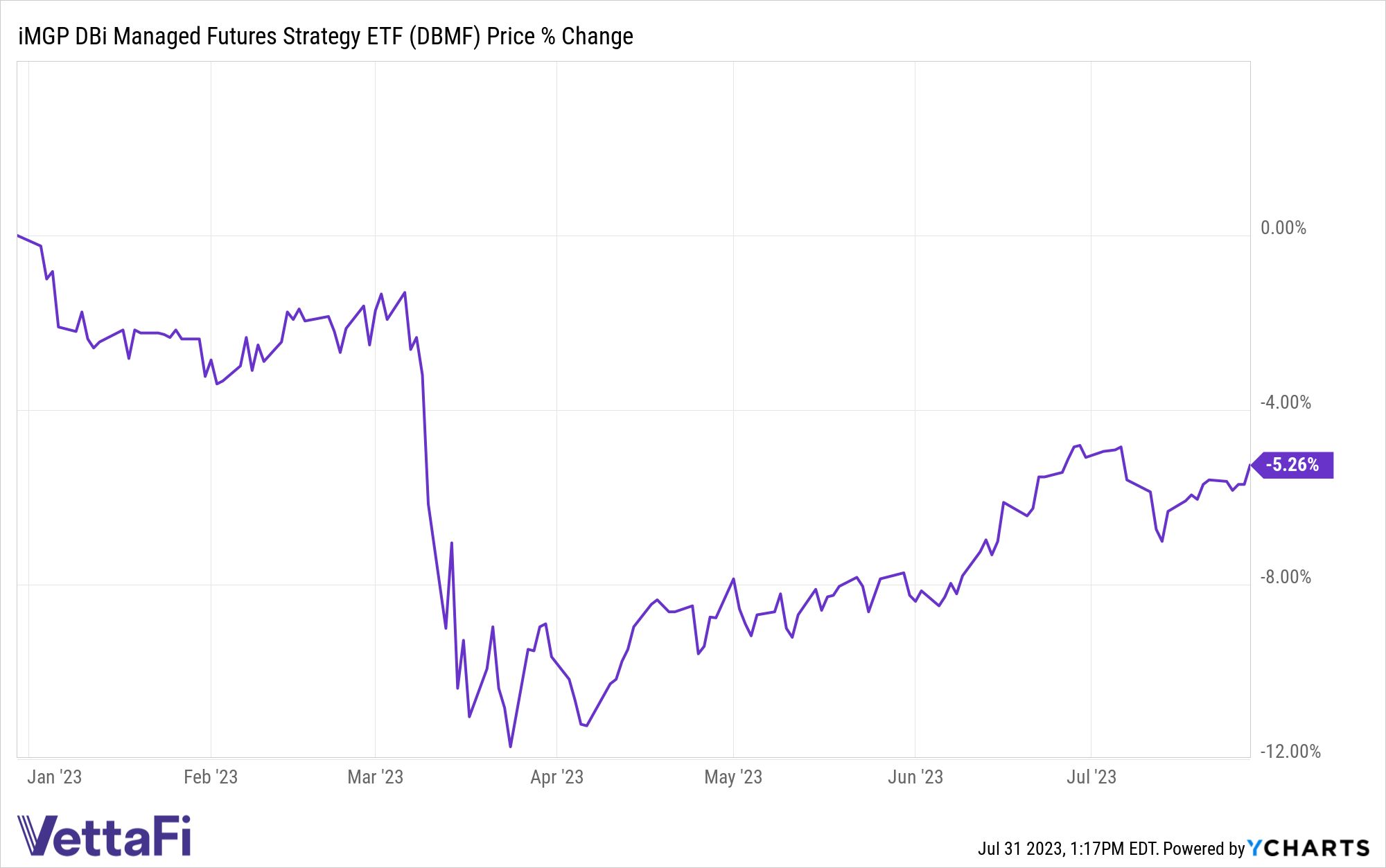

DBMF is down 5.26% YTD in the wake of the mid-March regional banking failure. This created a crash of the inflation trade the fund was positioned in for months. DBMF continues to make gains, however. The fund is up 7.16% since March 24 lows.

Investors have a window of opportunity to add this long-term portfolio diversifier at reduced prices. Given the multitude of diversification and alpha potential in the fund, DBMF is a noteworthy fund to consider.

For more news, information, and analysis, visit the Managed Futures Channel.