Markets remain choppy as investors weigh the path forward for interest rates and inflation. In an environment of higher inflation, stocks and bonds are likely to have higher correlations. It’s a reality that challenges traditional portfolios and underscores the need for non-correlated diversifiers like the iMGP DBi Managed Futures Strategy ETF (DBMF) in uncertain markets.

Stocks and bonds move in correlation with greater frequency in a high inflation environment, according to Andrew Beer, co-founder of DBi and co-PM of DBMF, in a recent video. Given the likelihood of prolonged higher inflation, this correlation can squeeze traditional 60/40 portfolios. Managed futures offer a strong diversification alternative for portfolios, given their low correlations to both stocks and bonds.

See also: “The 60/40 Portfolio: What Happens When Correlation is Causation”

Dynamic Portfolio Diversification in Uncertain Markets

Despite a challenging year for trend-following strategies due to prolonged investor uncertainty, DBMF still offered a strong September performance. DBMF gained 4.6% on a price and NAV basis in September.

“More importantly, those gains were delivered in a month where pretty much everything else went down,” explained Andrew Beer, co-founder of DBi and co-PM of DBMF, in a recent video.

The fund offers strong diversification and the strategy remains dynamic in changing markets.

Image source: iMGP and DBi

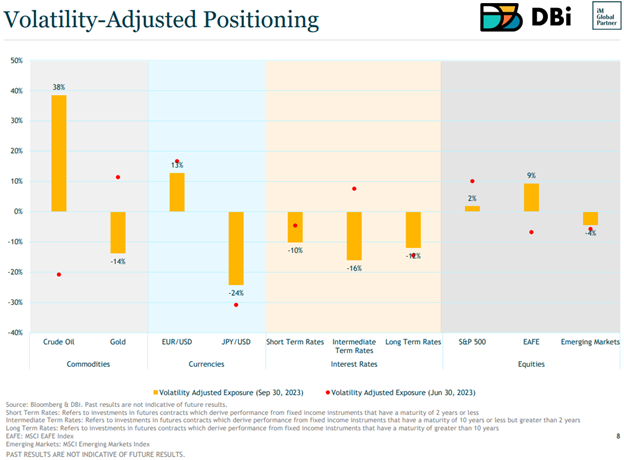

Beer demonstrated the portfolio’s volatility-adjusted positions in a chart instead of notional positions. The fund may hold a significant position in an asset class that carries less risk. Meanwhile, the fund may hold a small position in a significantly riskier asset class that drives more volatility. Only looking at the notional position does not indicate the risk contributed by individual exposures.

Managed futures strategies are known as crisis alpha generators. This is because of their ability to rapidly change positions to capture a dynamic, changing market environment. When market dislocations happen, managed futures reverse or drop unfavorable exposures. It’s a strategy that takes an average of 2 weeks to roll its portfolio to better reflect the current market environment.

It’s a strategy that remains dynamic and is highlighted in DBMF’s recent holdings.

“This month we’re also showing it relative to June 30 to underscore how dynamic the portfolio has been over the summer,” Beer explained.

From June 30 to September 31, the fund moved from short crude oil to long. It also flipped from long gold to a short position. DBMF continues to hold a long position in the euro, though is shorter than the yen. It remains short all Treasury holdings. The fund also holds a “modestly long” equity position after unwinding a trade that bet on the S&P 500’s outperformance compared to emerging markets and developed market stocks outside the U.S.

DBMF Captures the Managed Futures Strategy in an ETF Wrapper

The iMGP DBi Managed Futures Strategy ETF (DBMF) is actively managed and uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). Because the strategy transacts in futures, it offers a low to negative correlation to stocks and bonds.

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

By offering the hedge fund strategy in an ETF wrapper, DBMF can generate “fee alpha” through significant savings in fees compared to a 2/20 hedge fund fee structure.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.