Traditional portfolios have faced several challenges in the last few years as risk factors grow in markets. Perhaps the largest and most overlooked risk to the 60/40 portfolio in a changing market regime is that of correlation. The popular portfolio diversifiers of the last decade have become increasingly correlated to stocks, bonds, or both. It creates exaggerated pain points and challenges for advisors and investors in today’s markets.

Yields on the 10-year Treasury edge ever closer to 5%, a key level not reached since 2007 and the Great Financial Crisis. As bond yields rise, their prices decline. Meanwhile, equities continue their decline; from August 1 through October 19, the S&P 500 is down 5.7%.

The downtrend of both equities and bonds is a painful reminder of last year’s overall market performance. In 2022, the correlated drawdowns of both stocks and bonds led to significant losses for traditional portfolios. Many of the traditional diversifiers are failing to provide stability as stocks and bonds move in tandem.

Volatility Reverts to Mean

The increased correlation of stocks and bonds in the last few years isn’t an anomalous occurrence. In fact, it’s a return to normalcy for markets. The issue instead is that traditional portfolios were built to capture the artificial market environment of the last decade. The Fed’s quantitative easing policy of the last 10 years created an environment of suppressed volatility and “unrealistically high” returns, according to Andrew Beer, co-founder and managing member of DBi.

Throughout the mid and late- 2010s, the S&P 500 compounded at 10-20% per annum. Stocks and bonds remained negatively correlated for almost the entirety of the 2010s. This meant that PMs looking for equity diversifiers needed to look no further than bonds.

What’s more, the Sharpe ratio for a traditional 60/40 portfolio remained elevated. Throughout the 2010s, the Sharpe ratio for traditional portfolios remained above 1.0, reported Beer. It’s a level that was “approximately double the long-term average.” The 60/40 portfolio reigned.

When inflation began its meteoric ascent, the Fed responded in kind, sluggishly at first and then increasingly aggressive. Alongside continued interest rate hikes, the Fed began offloading bonds from its bloated balance sheets. After a decade of artificial dampening, volatility has returned to markets.

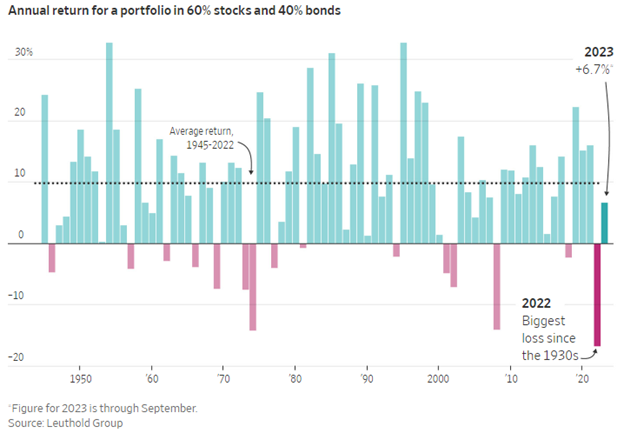

In today’s environment of persistent inflation, a still resilient economy, and rising interest rates, stock and bond correlations are increasingly likely. This leaves the traditional portfolio particularly vulnerable to drawdowns. Last year, a 60/40 portfolio lost approximately 17% according to analysis by Leuthold Group.

Image source: WSJ

“It doesn’t mean that 60-40 is dead,” Beer wrote recently on LinkedIn. “Rather, it means that the risk of a 60-40 portfolio is double what it was several years ago and that the standard diversification playbook isn’t working.”

The Diversification Disaster

Diversifiers are the clear solution to the issue of increased correlations. The problem, however, is that after the environment of the last decade, most traditional diversifiers became correlated themselves.

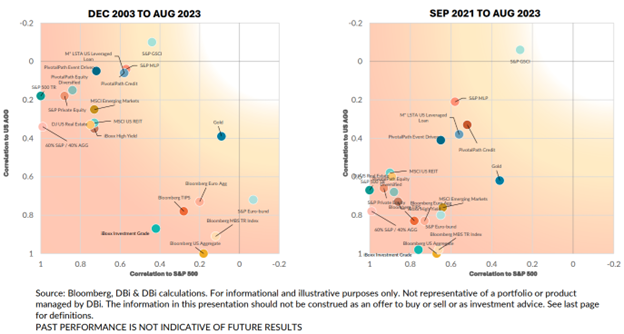

Image source: DBi

Between December 2003 and August 2023, asset classes like gold, MLPs, MSCI emerging markets, and private equity all offered low correlations to bonds. From September 2021 to August 2023, each of those asset classes increased its correlation to bonds, either marginally or substantially.

Likewise, gold, investment-grade corporate bonds, and mortgage-backed securities all offered low correlations to equities from 2003-2023. That’s also changed in the last two years, with all more closely correlated to equities currently.

Beer’s graphs demonstrate the clear shift of traditional diversifiers towards increased stock and bond correlations. So where are investors to look for true diversification in today’s markets? There are a few options but a predominant choice is managed futures.

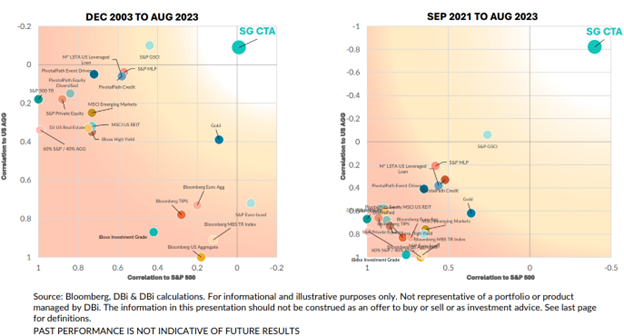

Image source: DBi

Managed futures, as measured by the SG CTA Index, have become less correlated in the last two years. The SG CTA tracks the largest managed futures hedge funds open for new investments. These funds invest across four core asset classes via the futures market. Because they invest in futures, managed futures offer low and often negative correlations to stocks and bonds currently.

Invest in Managed Futures With DBMF

Managed futures offer potential portfolio stabilization in a changing market regime. In an environment of increased volatility (comparatively speaking) and greater correlations, they’re worth consideration.

The iMGP DBi Managed Futures Strategy ETF (DBMF) is actively managed and uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). Because the strategy transacts in futures, it offers a low to negative correlation to stocks and bonds.

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

By offering the hedge fund strategy in an ETF wrapper, DBMF can generate “fee alpha” through significant savings in fees compared to a 2/20 hedge fund fee structure.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.