Though managed futures have been around for over a decade, it’s only because of the ETF wrapper that broad investors now have access to the hedge fund strategy. One managed futures replication ETF, the iMGP DBi Managed Futures Strategy ETF (DBMF), offers better annual performance than both mutual fund and hedge fund averages.

Managed futures invest in the futures market across several asset classes, including equities, treasuries, currencies, and more. They invest in how asset classes are currently trending and can optimize market dislocations that catch portfolios in unfavorable positions.

Managed futures strategies like DBMF garnered a great deal of attention last year due to their stellar outperformance. DBMF was one of just a handful of funds to offer consistent, strong performance when equities and bonds both fell.

This year brought challenges for many managed futures strategies on the abrupt reversal of the inflation trade in March. On the heels of regional bank failures, DBMF dropped nearly 10%. Because managed futures strategies entail investing in how stocks are actually trading and trending and are not based on future performance forecasts, it results in a dynamic strategy.

This dynamism meant that the fund quickly pivoted as managed futures hedge funds moved into and out of unfavorable positions in the wake of a mini-bank crisis. Since the fund’s lows on March 24, DBMF has gained 7.55% as of August 23, 2023.

See also: “3 Reasons to Buy and Hold DBMF”

Beating the Performance Averages Through Fees

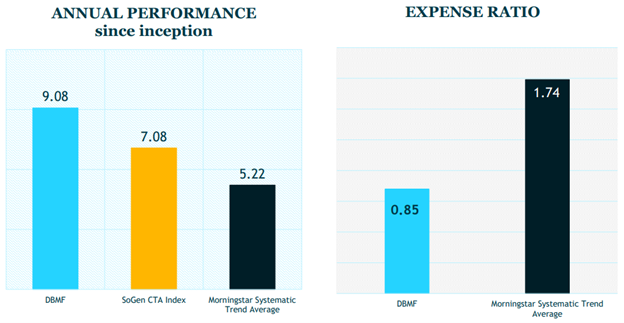

Since the fund’s inception in May 2019, it’s generated better annual performance than the SocGen CTA Index as well as the Morningstar Systematic Trend Average.

Data from 5/7/19 through 07/31/23

Image source: Dynamic Beta investments

The fund capitalizes on its lower fees, allowing for better alpha capture by the strategy. It’s what Andrew Beer, co-founder of Dynamic Beta investments and co-PM of DBMF, often refers to as “fee alpha”.

DBMF is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds. DBE then determines a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.