It’s been a challenging year for many managed futures strategies but they continue to offer long-term potential for portfolios. The benefits of trend-following strategies are numerous and worth consideration for inclusion in any alternatives sleeve.

Trend following doesn’t invest based on the forward-looking price-to-earnings of a company or on any of the traditional metrics by which companies are measured. Instead, it invests in what is currently happening in markets and how asset classes are trading.

Benefits of Managed Futures

Managed futures strategies remove the perception of how an asset might perform from the equation. They are entirely data-driven strategies based on how an asset is currently performing. Specialized analysts (quants) use a variety of models and equations to anticipate how an asset or class of assets is most likely to trend based on an asset’s current performance.

These types of strategies are antithetical to traditional “buy and hold” strategies because they trade constantly. Trend-following funds continuously alter their allocations, taking long or short positions on any number of assets.

One of the greatest strengths of managed futures is the ability to go short on an asset close. Equity indexes and bonds all only allow for long allocations or the belief that the investment will do well over time. Futures allow assets to be shorted if an investor believes they will underperform, thus allowing a profit to be made on the underperformance.

Another core benefit to managed futures strategies is the diversification potential they provide portfolios. Managed futures offer low and sometimes negative correlations to equities and bonds. They provide the potential of a diversified income stream for investors and act as a sort of longer-term insurance policy for a portfolio. This is due largely to their performance potential during market dislocations and regime shifts when equities and/or bonds underperform.

See also: “A Historical Look at Managed Futures Returns and Performance“

Managed Futures Strategies Invest in Market Movements

Managed futures strategies capture disconnects between investor sentiment and actual market movement. They historically perform well during market drawdowns and dislocations, earning the moniker of “crisis alpha”.

Often investors can be somewhat slower to respond to market changes. They are more likely to hold onto positions that might not serve them best in the current environment in the hopes that there will be a return to the previous market circumstances that benefited those positions.

Managed futures funds largely outperformed last year as market regimes shifted, but many managed futures strategies face challenges this year. Investors — and markets — remain uncertain as to the path of the economy, the Fed, and any number of other potential risk factors. In an environment of steep uncertainty, no clear trends have emerged in the wake of the regional bank collapse in mid-March.

Invest in Managed Futures Long-Term With DBMF

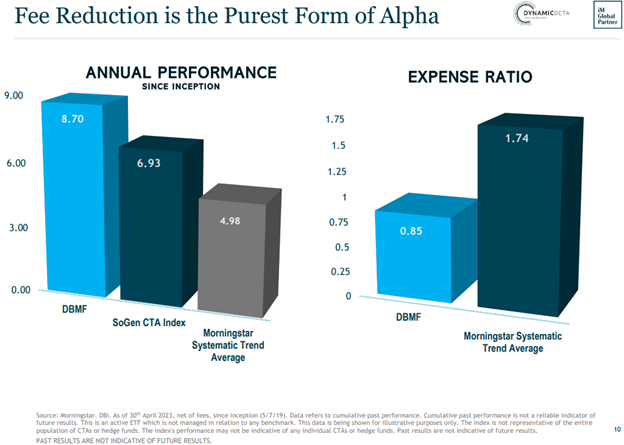

The iMGP DBi Managed Futures Strategy ETF (DBMF) seeks to capture the average return of the 20 largest managed futures hedge funds. By offering the strategy within the cost-efficient ETF wrapper, DBMF seeks to provide similar performance with significantly reduced management fees. This “fee alpha” potential allows for greater return capture potential compared to hedge funds that often carry significant fees.

Image source: Dynamic Beta investments

It is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets that are anticipated to grow in value. It also takes short positions in derivatives with exposures expected to fall in value. Under normal market conditions, the fund seeks to maintain volatility between 8%–10% annually.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.