This year remains a challenging year for most asset classes and strategies, managed futures included. The strategy is a compelling one, however, when looking back at long-term historical performance, returns, and correlation.

Andrew Beer, co-founder of Dynamic Beta Investments and co-PM of iMGP DBi Managed Futures Strategy ETF (DBMF) dove into historical performance in a recent video. Comparing the managed futures strategy against stocks and bonds reveals a compelling investment case.

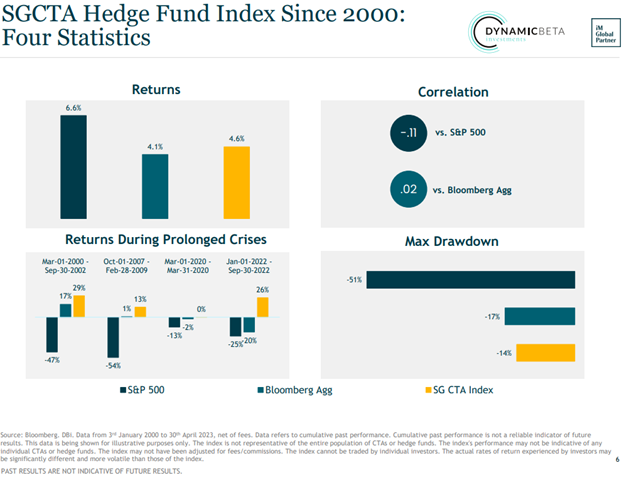

To look back at long-term strategy performance, Beer used the SocGen CTA Hedge Fund Index from 2000 through April 2023. The index tracks the average performance of the 20 largest managed futures hedge funds.

Managed Futures Offer Competitive Returns

The findings revealed that managed futures offered returns that fell between bonds and equities over the last 23 years. What’s more, it provided these returns with markedly fewer maximum drawdowns.

Image source: Dynamic Beta investments

“The index of hedge funds has delivered returns between stocks and bonds, with roughly zero correlation to each,” Beer explained. It has also “tended to perform best during prolonged market crises.”

It’s this performance during crises that often catches advisor and investor attention. Managed futures invest in how asset classes are actually trending compared to forward-looking forecasts. In times of market dislocations, investors can often be slower to respond, providing opportunities for trend strategies like this.

Capturing Hedge Fund Performance With ETF Savings

The iMGP DBi Managed Futures Strategy ETF (DBMF) allows for the diversification of portfolios across asset classes. It is actively managed and is uncorrelated to traditional equities or bonds.

The fund’s position within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. DBE analyzes the trailing 60-day performance of CTA hedge funds and then determines a portfolio of liquid contracts that mimic the hedge funds’ averaged performance (not the positions).

By replicating hedge fund performance in an ETF, the fund offers significant savings on management fees. This translates to alpha potential in fee savings alone for DBMF.

Beer believes this replication can be done “efficiently with around ten core factors, which keeps our trading costs as low as possible.” The daily transparency the fund offers hopefully helps to make the strategy “easier to understand and explain” Beer said.

DBMF is an actively managed fund that uses long and short positions within the futures market on several asset classes. These include domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

DBMF has management fees of 0.85%

For more news, information, and analysis, visit the Managed Futures Channel.