Liquid alts remain a grey area of investing for many, given the complexity and wildly varied performance of different managers and strategies. This is particularly apparent within managed futures hedge funds and mutual funds, highlighting the importance of looking beyond just a single manager within the space.

Managed futures strategies entail taking long and short positions via futures on four core asset classes. These include equities, rates, commodities, and currencies. Whether a hedge fund manager takes a long or short position depends on how that asset class is currently trending.

Fund managers use quantitative models to determine the positions they should take in futures. These models often have drastically different parameters depending on the individual manager’s methodology. It results in a wide array of performance and returns at any given point across individual funds.

“There is no one on Planet Earth who has figured out which managed futures fund will do well going forward,” Andrew Beer, co-portfolio manager of iMGP DBi Managed Futures Strategy ETF (DBMF) and co-founder and managing member of DBi, said in a communication to VettaFi.

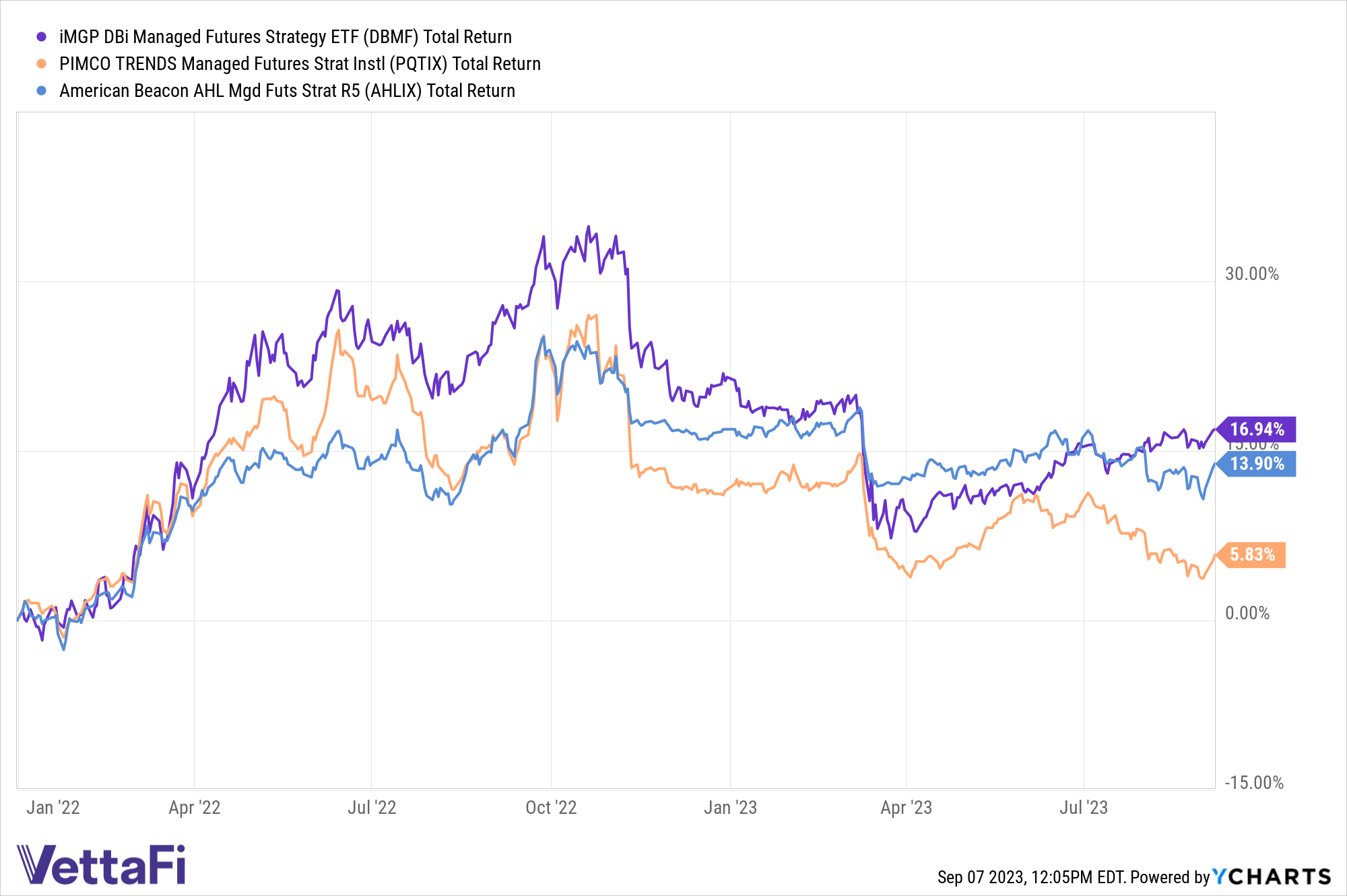

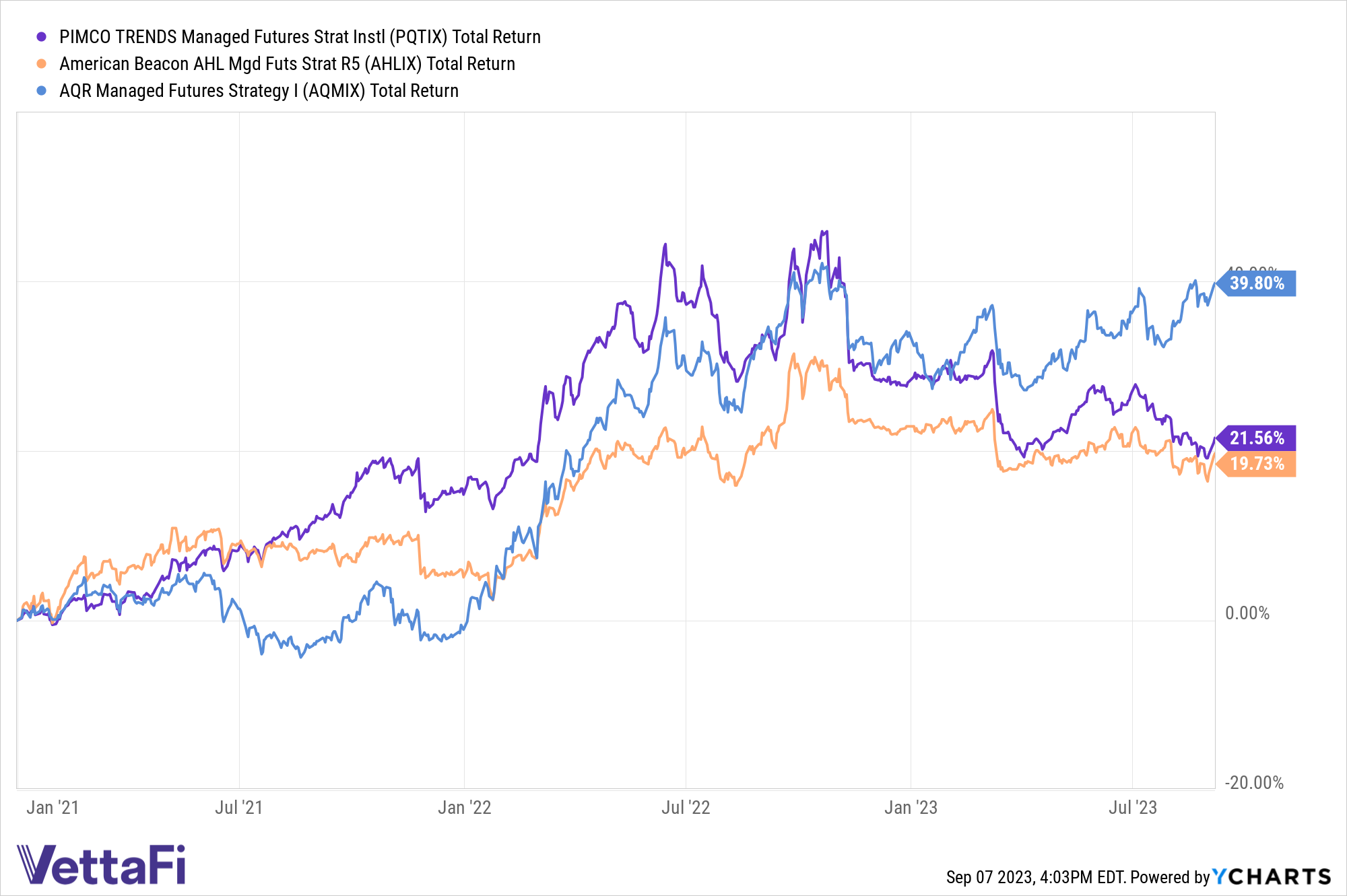

It’s an issue that extends beyond just hedge funds. These kinds of mutual funds are equally varied in their performance.

“Allocators simply are not rewarded for taking single manager risk. There’s a small chance you’ll get it right, and a big chance you just stepped on a landmine,” Beer cautioned. So what’s the solution in managed futures? According to Beer, it’s pretty simple; “Spread your bets and sleep at night.”

See also: “The ETF Replication Revolution: Why Managed Futures are Best”

Eliminating Single Manager Risk

Managed futures fall into the buy-and-hold bucket of portfolios, providing long-term diversification. While many investors bought into the strategy last year when equities and bonds fell, Beer warns against chasing after performance in the space. The cost of returns chasing is most easily seen in mutual funds.

“Allocators pulled from AQR and threw money at American Beacon AHL Managed Futures and Pimco,” Beer explained of mutual fund flows in recent years. “Sadly, they are vastly poorer today because of it — manager selection via returns chasing is a very bad idea.”

The iMGP DBi Managed Futures Strategy ETF (DBMF) seeks to replicate the performance of the SocGen CTA Index. The index tracks the 20 largest managed futures hedge funds. By taking the average performance of this index, the fund eliminates single manager risk and the temptation of returns chasing.

By looking beyond any one single manager, investors have an opportunity to capture the strategy and diversification with DBMF. Moreover, the fund offers significant fee savings as an ETF, creating the opportunity for fee alpha.

Invest With DBMF

DBMF is an actively managed fund. It uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.