Increasingly more replication strategy ETFs are coming to market, allowing more investors to gain access to institutional investment strategies. Managed futures may both the most elegant and the most sensical asset class to capture via ETF replication, according to Andrew Beer, co-founder of Dynamic Beta investments.

Alternatives continue to gain ground this year as prolonged market volatility underscores the utility of alts as portfolio diversifiers. Managed futures funds are noteworthy diversifiers with their low to negative correlation to stocks and bonds and adding them to portfolios has never been simpler via replication strategies.

Managed futures are a class that despite their complexity, can be efficiently captured through replication. Andrew Beer, co-portfolio manager of iMGP DBi Managed Futures Strategy ETF (DBMF) and co-founder and managing member of Dynamic Beta investments, broke down why managed futures are the ideal asset class for replication in an article on Institutional Investor.

“Research shows that replication, rather than investments in single manager funds, may make sense as the cornerstone managed futures allocation for most portfolios,” Beer wrote.

Managed Futures as “Wave Detectors”

Managed futures generally invest across four broad asset classes: equities, rates, commodities, and currencies. They invest through the futures market where they take long or short positions on an asset. That position depends on how the asset is trending recently.

“You can think of them as ‘wave detectors’” Beer explained. “They constantly monitor 50, 70 or more individual futures contracts across the market sea. The funds are best at detecting slow moving waves – those that gradually build momentum over months, not days.”

Beer went on to explain that one of the most overlooked aspects of this trend following strategy is that over time, managed futures identify wave clusters. It’s in these clusters that alpha potential lies. One recent example is in the inflation trade last year when shorting bonds proved enormously profitable.

“Following this framework, an efficient replication model analyzes managed futures funds to determine the key clusters today,” Beer said.

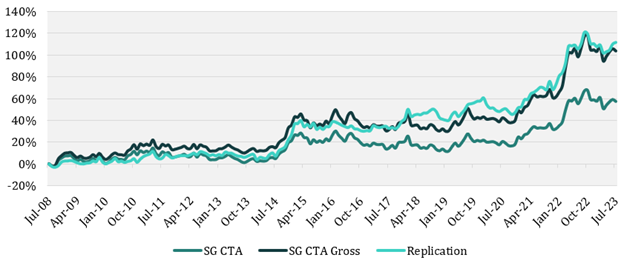

The model that DBMF employs looks at the investment clusters happening in the SocGen CTA Hedge Fund index, an index of managed futures hedge funds. The model then seeks to replicate the index’s performance clusters through just one futures contract per asset class. Beer demonstrated the efficacy of the replication strategy by further distilling replication down to just one future for each of the four asset classes covered.

Comparison of the replication strategy (gross fees but net of estimated trading costs) to pre-fee SG CTA returns

Image source: DBi

DBi utilized long and short positions in the S&P 500, crude oil, the 10-year Treasury and Euro contracts for replication. In a period from July 2008 to July 2023, this resulted in a 0.8 correlation between the replication strategy and the SG CTA Index. What’s more, the replication strategy “would have had a beta to both equities of approximately zero and negative beta to bonds — plus meaningful alpha,” Beer explained.

The Strengths and Limitations of ETF Replication

Capturing the hedge fund strategy via replication in an ETF like DBMF allows for a meaningful reduction of fees. The fund has both the ability to outperform its benchmark as well as the fee alpha potential. It makes for an alluring addition to the diversification sleeve of any portfolio. Add in the daily transparency and the focus on only the most liquid contracts to reduce front-running risk, and DBMF becomes an attractive diversifier.

There are limitations to replication in that it’s not an exact duplicate of the benchmark. DBMF’s model also looks at the trailing 60-day performance of the SG CTA index. Because it’s slightly backwards looking, it can sometimes trail marginally in performance when trends reverse sharply. Also, as DBMF only employs a small sample of futures for replication, it may not always be “sufficiently representative of the ‘cluster’”, Beer cautioned.

“Replication… provides a straightforward and efficient way to access an asset class whose complexity belies its simple appeal: long-term diversification,” Beer said in a communication to VettaFi.

DBMF is an actively managed fund. It uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.