Inflation remains a key, overlooked player in markets despite investor optimism. While inflation remains above 2.5%, it threatens traditional model portfolios that rely on stock and bond inversions for risk reductions. In a high-inflation environment, it becomes necessary to look further afield for genuine diversifiers as correlations increase.

Elevated inflation increases the odds of stocks and bonds moving in correlation, according to Andrew Beer, co-founder and managing member of DBi and co-PM of the iMGP DBi Managed Futures Strategy ETF (DBMF).

“It’s become clear that most risk reduction in models came from that very powerful inverse correlation of stocks and bonds,” said Beer in a November video. “It’s far more common, especially when inflation is above 2.5%, for correlations to flip positive.”

Stock and Bond Correlations Rise With Inflation

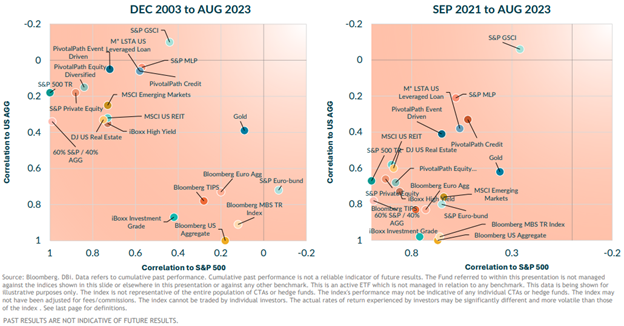

That’s been the experience of the last almost two years, with stocks and bonds often moving in tandem. What’s more, in the current high inflation environment, traditional diversifiers such as REITs, private equity, and even gold have become more correlated to stocks and bonds.

It’s a compounding problem as most diversifiers historically already carried a high correlation to either stocks or bonds.

Image source: DBi and iMGP

What’s striking about the data aggregated by DBi is the visible impact of a high inflation environment on almost every asset class. Portfolios that rely primarily on the inverse correlation of stocks and bonds for hedging and risk protection became more volatile in the last two years in a high-inflation environment.

Traditional 60/40 portfolios did fairly fantastic in an environment of suppressed volatility and relatively tamed (read 2%) inflation of the 2010s. Those same portfolios now face a new market regime where the primary risk protections have largely evaporated.

“Over the past two years, we’ve moved from a two-legged stool to a one-legged stool,” Beer explained. “It’s a visual and visceral way of explaining why even more diversified portfolios among advisors are undulating up and down more than they used to.”

See also: “The 60/40 Portfolio: When Happens When Correlation Is Causation”

Managed Futures Offer True Diversification

The Fed currently forecasts for inflation to remain above its 2% target through next year and into 2025. Although broad inflation was flat in October month-over-month, it still rose 3.2% year-over-year. Core CPI that excludes food and energy rose 0.2% in October and 4% year-over-year.

While inflation remains elevated, the threat of increased stock and bond correlations persists. Managed futures offer genuine diversification opportunities for investors.

The iMGP DBi Managed Futures Strategy ETF (DBMF) is actively managed and uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). Because the strategy transacts in futures, it offers a low to negative correlation to stocks and bonds.

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

By offering the hedge fund strategy in an ETF wrapper, DBMF can generate “fee alpha” through significant savings in fees compared to a 2/20 hedge fund fee structure.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.