Consumers proved resilient this summer, prompting growing investor hopes of a soft landing this fall. Services are the only real benefiters of consumer spending this summer, however, as weakness in goods grows. It could mean troubled waters ahead, and advisors should consider adding diversification through funds like the iMGP DBi Managed Futures Strategy ETF (DBMF).

The strength of the U.S. consumer continues to be remarked upon in earnings calls this month. “Just look at the consumer, right? I mean, consumer in the U.S. is up at 10% T&E [travel and expenses] is still very, very strong,” said Stephen Squeri, chairman and CEO of American Express, on the recent earnings call.

The Fed’s Inflation Agenda Plays Out in Goods

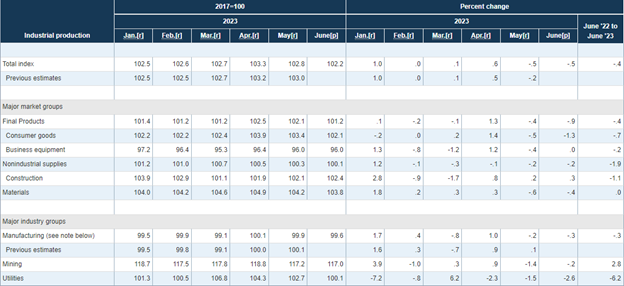

It’s a completely different story on the goods side, however, as aggressive rate hikes dampen demand. Industrial production in the U.S. fell in June for the second month as demand for goods fell too. Consumer goods production dropped significantly in June, falling 1.3% in the strongest decline since the beginning of 2021, according to the Federal Reserve report. Declines were noteworthy across the board: Utilities fell 2.6%, and manufacturing dropped 0.3%. It’s the largest drop in manufacturing production since March of this year.

Image source: Federal Reserve

“Manufacturing output peaked in October and has seen broad-based declines in back-to-back months,” explained Phil Mackintosh, chief economist at Nasdaq, in the most recent Market Makers email.

The continued drawdown in goods is directly reflected in freight. J.B. Hunt reported in its recent earnings call that June brought only a slight moderation to recent declines in volume. Volume dropped 4% year-over-year in June compared to 9% in April. For the quarter, volume declined 7% YoY.

While it’s a small reprieve, the company remains cautious regarding its second half outlook.

“June had some positive signs in it. Again, we’re still in a wait-and-see mode for the rest of the year,” said Darren Field, EVP and president, intermodal at J.B. Hunt, on the recent earnings call.

Managed Futures Provide Flexibility in Changing Environments

Markets are increasingly hopeful that the Fed could navigate a soft landing in the second half. Given the continued impact of the Fed’s inflation fight on demand for goods and the drawdowns already happening, it seems prudent to remain both cautious and flexible in portfolio positioning. Though inflation continues to fall, markets currently forecast for high rates through the end of this year.

Managed futures strategies are particularly beneficial in an environment of changing tides due to their ability to rapidly adapt to new market trends and outlooks. Should recession indeed play out, the major managed futures hedge funds maintain positions to capture continued slowing. If the economy manages to navigate a soft landing and then lift off, the funds will pivot rapidly to capture the new performers.

See also: “Managed Futures: The Rapid Responders in Crisis and Beyond”

The iMGP DBi Managed Futures Strategy ETF (DBMF) is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.