The last several years will likely go down as unprecedented moments in market history. Traditional portfolios responded by expanding their allocations beyond just stocks and bonds to include several alternatives and strategies. With the hope of a soft landing now added back into the narrative, the reflex might be to return to traditional allocations. However, some alternative strategies such as managed futures offer long-term benefits to portfolios and are worth retaining.

Market volatility in the last 18 months was pronounced, driven by investor uncertainty as to the path ahead. Equity and bond underperformance last year in the wake of the global geopolitical crisis opened up a window for trend strategies to prove their mettle and their value.

Funds like the iMGP DBi Managed Futures Strategy ETF (DBMF) soared, offering stunning performance when little else did. Managed futures strategies invest in several asset classes in the futures market, meaning they offer non-correlated returns to equities and bonds.

The key to why managed futures strategies usually stand out during periods of market crisis and dislocation is that they invest in how assets are actually trading. Because they trade in futures, these strategies take long and, more notably, short positions on asset classes. Through futures, these strategies can generate returns on underperforming asset classes as well as long positions on asset classes outperforming.

Why Holding the Line Can Hurt in the Short-Term

Experienced advisors know the importance of keeping an eye on the long term and not backing out of falling positions in response to market panic. This means that experienced investors are likely to hold onto positions that might not benefit them in the short to medium term.

Managed futures are the rapid responders in crisis. They invest in how asset classes are actually trending, not based on longer-term forecasts and sentiment. They capture the market dislocations that happen as trends reverse but investors remain in less favorable positions for longer. It’s where much of their alpha potential is generated.

A study published in the International Review of Financial Analysis last year found that on average, the indexes of managed futures hedge fund strategies (CTAs) took just 15 days to completely change their positions. This means that in a crisis, within two weeks managed futures funds are positioned for the new, evolving environment.

“I personally think the great competitive advantage of managed futures is that they will coldly exit positions when they stop working,” explained Andrew Beer, co-founder of Dynamic Beta Investments and co-PM of DBMF, in a recent video. “That’s why managed futures were so successful in 2022 – inflation came back too fast for most allocators to adapt.”

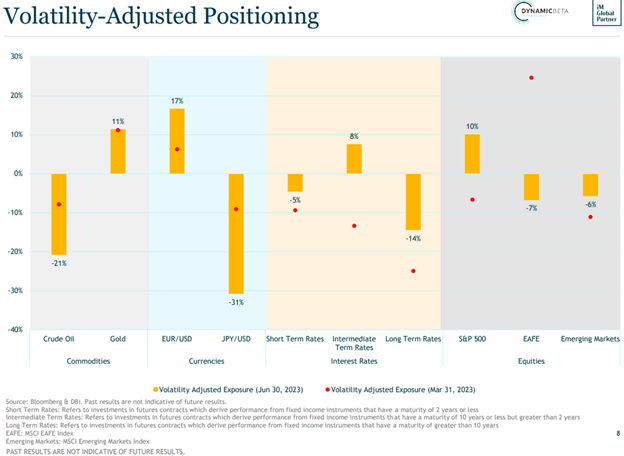

Image source: Dynamic Beta investments

DBMF brought in over $1 billion in AUM as investors flocked to the hedge fund strategy last year. This year brought the threat of a banking crisis and a strong, immediate trend reversal that caught many trend-following strategies in unfavorable positions. Since March lows, DBMF continues to gain ground and remains positioned to capture a number of trends should they break out on investor confidence in the narrative looking ahead.

“I view managed futures as a hedge against a world that keeps changing fast,” Beer explained. “That certainly seems to describe the world today.”

Augmenting Your Portfolio Long-Term With Managed Futures

Because of their ability to rapidly respond to changing markets, managed futures strategies are worth inclusion in portfolios long-term. Like first responders, these strategies have the potential to help hold the line. They are strategies to mitigate potential losses — and volatility — in market dislocations. Trend-following strategies provide the ability to capture how asset classes are actually trending. This creates alpha potential while the rest of the portfolio pivots more slowly.

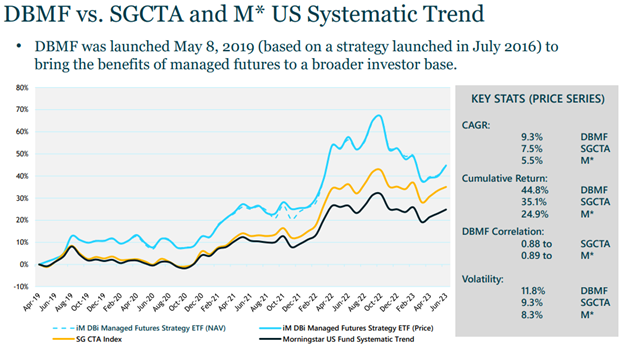

Image source: Dynamic Beta investments

Beyond crisis, they are strategies that offer performance potential, particularly when rolled up into the ETF wrapper. The fee savings potential of the ETF vehicle allows for better capital capture for the strategy. Since its inception, DBMF consistently outperformed both the SG CTA Index and the Morningstar US Fund Systematic Trend.

The iMGP DBi Managed Futures Strategy ETF (DBMF) seeks to capture the average return of the 20 largest managed futures hedge funds. By offering the strategy within the cost-efficient ETF wrapper, DBMF seeks to provide similar performance with significantly reduced management fees.

DBMF is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.