It’s been a challenging year for trend-following strategies such as managed futures. Despite prolonged market uncertainty, many funds continue to recover from first quarter crashes. One such fund is the iMGP DBi Managed Futures Strategy ETF (DBMF), which seeks to outperform its hedge fund peers over the long term through fee savings and alpha.

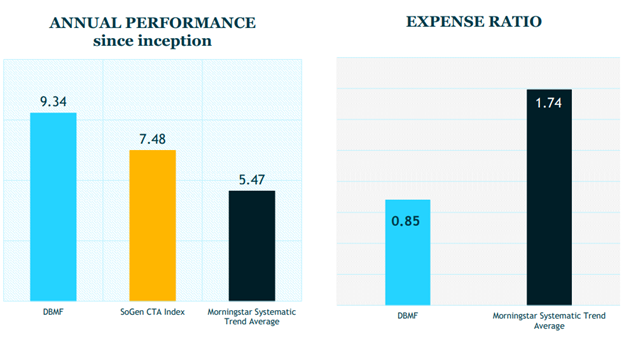

DBMF seeks to capture the average return of the 20 largest managed futures hedge funds, measured by the SocGen CTA Index. By offering the strategy within the cost-efficient ETF wrapper, DBMF seeks to provide similar performance with significantly reduced management fees.

While replication strategy ETFs have continued to grow in popularity in recent years, DBMF consistently proves that its methodology works to maintain high correlations through any market environment.

“Replication is an approximation, not a perfect copy, for obvious reasons,” explained Andrew Beer, co-founder of Dynamic Beta investments and co-PM of DBMF in a recent video.

Despite a precipitous mid-March drawdown on the heels of bank collapse, DBMF maintains high correlations. Compared to its benchmark, the SocGen CTA Index, correlations were above 90% as of the end of June.

Capturing the diversification opportunities of the managed futures strategy within an ETF wrapper allows for greater preservation of capital. The savings in management fees between DBMF and similar managed futures mutual funds and hedge funds is significant.

“Combined with the tailwind of lower fees, our goal is to potentially outperform over time through lower fees and expenses,” Beer explained.

Image source: Dynamic Beta investments

See also: “Managed Futures: The Rapid Responders in Crisis and Beyond”

Portfolio Diversification and Fee Alpha With DBMF

The iMGP DBi Managed Futures Strategy ETF (DBMF) is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

Currently, DBMF is long on the one-year Treasury bill, gold, the euro, and the S&P 500. The fund is short on MSCI EAFE, crude oil, emerging markets, the yen, 10-year Treasuries, and more.

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.