It’s been a rocky year for managed futures performance after strong outperformance in 2022. Despite temporary setbacks in changing trends, the strategy still offers a number of potential benefits to portfolios long-term. The iMGP DBi Managed Futures Strategy ETF (DBMF) is worth consideration for its performance and “index-plus” approach to managed futures investing.

Andrew Beer, co-founder of Dynamic Beta investments and co-PM of DBMF, walked through the fund’s performance in a recent video. His detailed analysis of managed futures performance and historic returns was covered previously here.

Capturing Hedge Fund Performance in an ETF

DBMF falls into the bucket of hedge fund replication strategies that more ETFs have been offering. The fund seeks to replicate the average performance — not positions — of the largest managed futures hedge funds.

Beer refers to the approach as “index-plus” or “index-lite” within managed futures.

“When we looked at the returns of the strategy, it was reported after all fees and expenses,” Beer said of the hedge funds. “And those fees and expenses are… drumroll… a lot. Maybe 500 basis points a year on average.”

Image source: Dynamic Beta investments

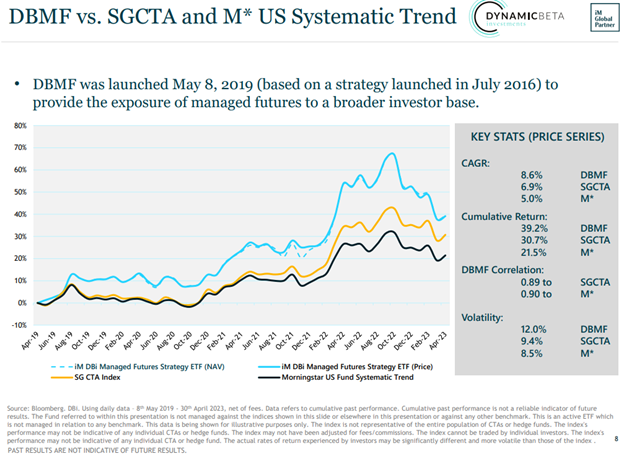

Since inception in 2019, DBMF has maintained a correlation of 0.89 to the SC CTA Index comprised of managed futures hedge funds. It also maintains a 0.90 correlation to the Morningstar US Fund Systematic Trend Index of mutual funds.

“This is the idea of ‘index-plus,’” Beer explained. An investor can receive “‘index-like’ diversification by targeting the average positions of lots of funds.”

The fee alpha of the fund from reduced expenses and fees that ETFs inherently carry generates the “plus” portion of “index-plus.”

DBMF also has yielded significant outperformance since inception. DBMF’s performance is nearly double that of the average managed futures mutual fund on a cumulative basis.

See more: “Under the Hood of DBMF: April Performance”

Invest in “Index-Plus” Opportunities With DBMF

The iMGP DBi Managed Futures Strategy ETF (DBMF) allows for the diversification of portfolios across asset classes uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within the futures market. Positions on asset classes include: domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The Dynamic Beta Engine determines the fund’s position within domestically managed futures and forward contracts. DBE analyzes the trailing 60-day performance of CTA hedge funds. It then determines a portfolio of liquid contracts that would mimic the hedge funds’ averaged performance (not the positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets likely to grow in value. It also takes short positions in derivatives with exposures expected to fall in value.

DBMF has management fees of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.