Equities churn higher as investors increasingly bet on the ability of the Fed to navigate a soft landing. Underneath continued surprising outperformance of equities as they continue to rally this year, however, lie a rash of signals that all is not well with the economy.

The S&P 500 closed Tuesday at its highest level since the beginning of April 2022. Equities continue to surprise to the upside this year, carried higher by mega-cap tech company outperformance. Its performance thus far remains fairly constricted to a handful of names centered around a few growth themes.

Concentration has eased marginally in the last month. That said, with just a short list of companies carrying the majority of gains, it leaves equities in a perilous position should the economy or narrative turn for the worse.

“There’s not a lot of leeway for bad news right now in equities,” Mike Mullaney, director of global markets research at Boston Partners, told WSJ.

As Equities Rally, Recession Indicators Remain Elevated

As of now, the economic horizon looks ominous.

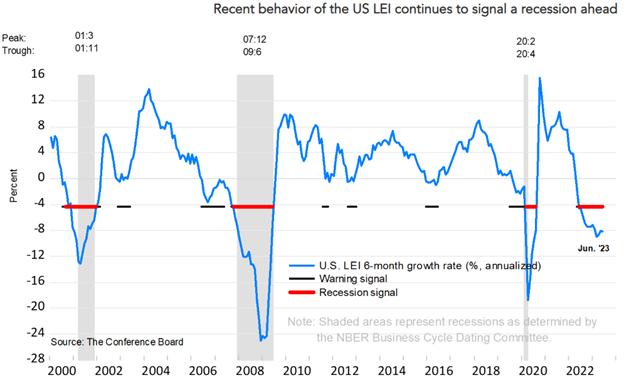

The Conference Board Leading Economic Index, which measures the direction and state of the economy currently, fell again in June by 0.7% to 106.1. It declined more rapidly in the last six months (4.2%) than it did during the preceding six months between June and December 2022 (3.8%).

Image source: The Conference Board

“The Leading Index has been in decline for fifteen months—the longest streak of consecutive decreases since 2007-08, during the runup to the Great Recession,” said Justyna Zabinska-La Monica, senior manager, business cycle indicators, at the Conference Board in a press release. “Taken together, June’s data suggests economic activity will continue to decelerate in the months ahead.”

Currently, the Conference Board forecasts a recession from this quarter to first quarter 2024. It’s a prediction that aligns somewhat similarly with the Fed’s predictions for mild recession in the fourth quarter and first quarter of next year, followed by recovery.

Active investors and hedge funds remain positioned extremely cautiously. Financial Times reported that hedge funds’ exposure to cyclical companies versus defensive companies is the lowest it has been since 2011, according to Bank of America data. What’s more, managers of long-only funds continue to avoid cyclical consumer companies as exposure nears its lowest levels on record.

“The risk of recession is still real in our view,” Raphaël Thuin, head of capital markets strategies at Tikehau Capital, told FT. Thuin went on to explain that the alternative asset management firm’s position “in both equities and fixed income are focusing on quality companies that will have more resilience during a recession and be less sensitive to the economic cycle.”

The resilient labor market and a possible end in sight for Fed rate hikes could prove advantageous for cyclical companies, but for now, caution abounds.

Managed Futures Perform Regardless of Market Direction

Managed futures strategies are particularly beneficial in an environment of changing tides due to their ability to rapidly adapt to new market trends and outlooks. Should recession indeed play out, the major managed futures hedge funds maintain positions to capture continued slowing. If the economy manages to navigate a soft landing and then lift off, the funds will pivot rapidly to capture the new performers.

See also: “Managed Futures: The Rapid Responders in Crisis and Beyond”

The iMGP DBi Managed Futures Strategy ETF (DBMF) is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.