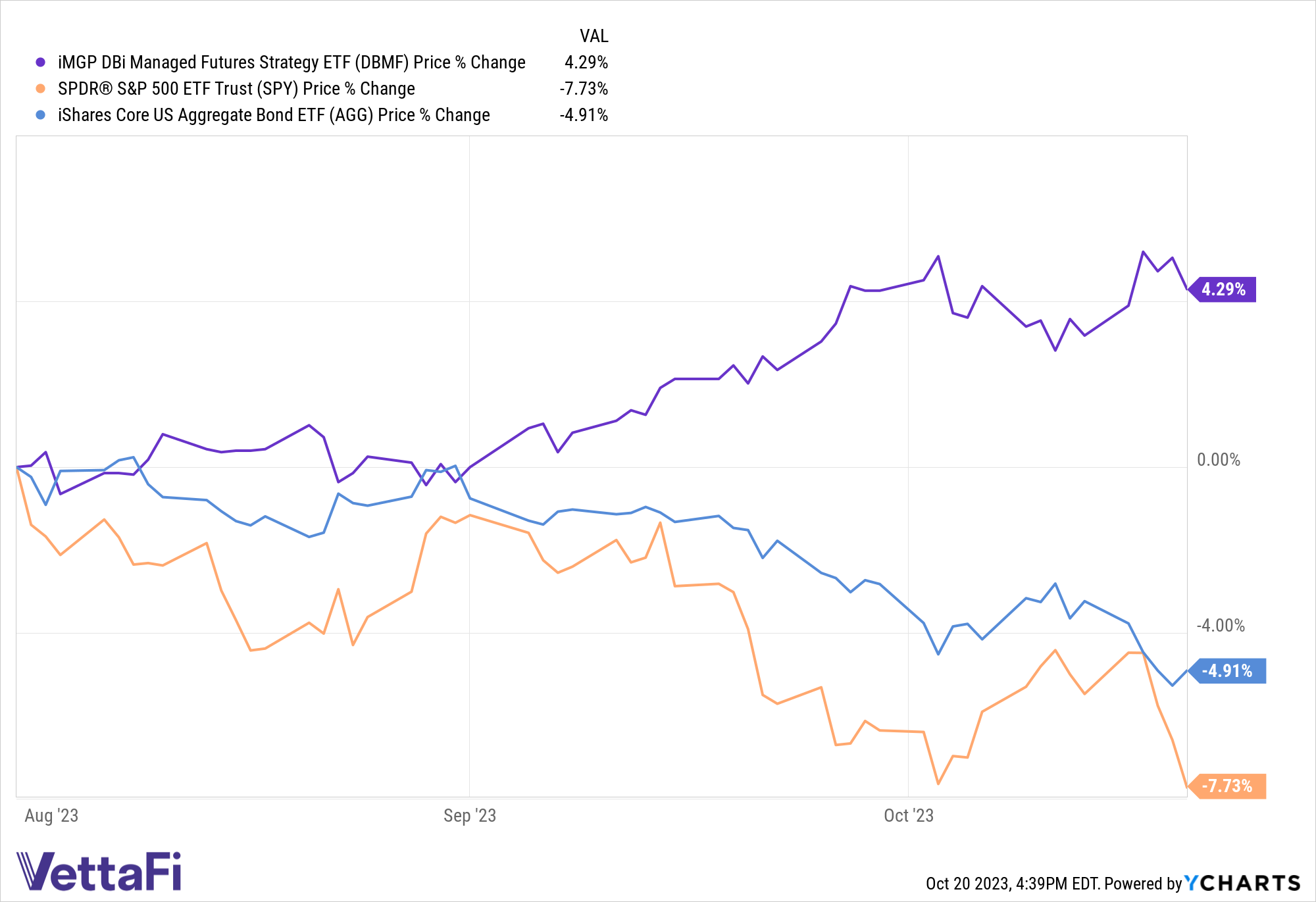

Markets slipped further Friday on news of the 10-year Treasury yield crossing 5% late Thursday. It’s part of an ongoing, larger downtrend since August for stocks and bonds. Meanwhile, the noncorrelated iMGP DBi Managed Futures Strategy ETF (DBMF) remains elevated, highlighting the value of the strategy as a diversifier.

The 10-year Treasury yield crossed a key threshold late Thursday afternoon, reaching 5% for the first time in 16 years. Levels above 5% were last experienced in July 2007. Stocks fell most of the day in trading Friday as investors weighed recession risk and the health of the economy.

“The stock market is watching the bond market and doesn’t like what it sees,” David Donabedian, CIO of CIBC Private Wealth Management, told CNBC. “Yields are rising, even with the relatively good news about inflation.”

Market volatility remains the norm this year as investors try unsuccessfully to predict the Fed’s interest rate path. As long as elevated inflation persists, the threat of higher rates for longer looms large in the minds of investors.

“The bond market actually has been the leading indicator for the equity market,” David Grecsek, managing director of investment strategy and research at Aspiriant, told CNBC. “In order for the equity market to really stabilize and consolidate here, the rate volatility’s got to calm down a little bit. And it’s going to be hard for equities to really settle down until that happens.”

See also: “The 60/40 Portfolio: What Happens When Correlation Is Causation”

DBMF: Noncorrelated Performance When It Matters

Since August 1, the iMGP DBi Managed Futures Strategy ETF (DBMF) rose 4.29% on a total returns basis. These gains happened at a time when broad markets dropped on diminishing investor confidence and spiking risk factors. The SPDR S&P 500 ETF Trust (SPY) dropped 7.73%, while the iShares Core US Aggregate Bond ETF (AGG) decreased by 4.91%.

DBMF offers a noncorrelated return stream for portfolios to stocks and bonds. It’s a strong portfolio diversifier and could prove a boon in times of equity and bond correlations and elevated volatility. The fund does not always outperform during periods of market stress. However, over a longer time horizon, DBMF offers consistent, noncorrelated performance.

The fund is actively managed and uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). Because the strategy transacts in futures, it offers a low to negative correlation to stocks and bonds.

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

By offering the hedge fund strategy in an ETF wrapper, DBMF can generate “fee alpha” through significant savings in fees compared to a 2/20 hedge fund fee structure.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.