The 2020’s may well go down as the decade that laid to rest the traditional 60/40 portfolio and underscored the need for non-correlated allocations to stocks and bonds. Given prolonged volatility and market uncertainty, portfolio diversification plays an increasingly integral role in performance in the years to come.

“On the macro front, it’s safe to say that confusion reigns supreme,” explained Andrew Beer, co-founder and managing member of DBi and co-PM of the in a recent video. “The economy just isn’t supposed to be this resilient in the face of 500 bps of Fed rate hikes.”

The Correlation Conundrum

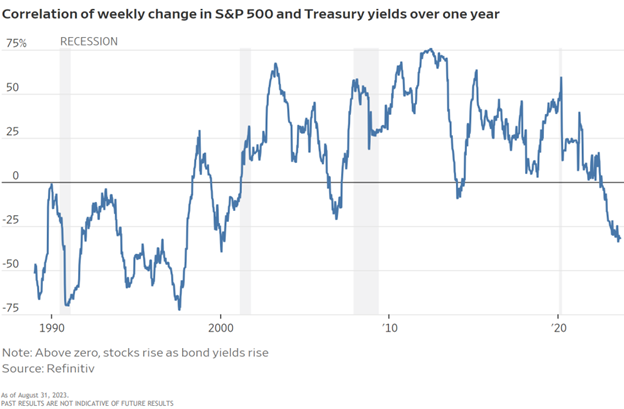

Bonds have been a great hedge against equity underperformance for much of the last two decades. It’s a reality that looks to be changing though as correlation increasingly aligns. DBi charted out the correlation between stocks and bonds over the last 30 years with assistance from Refinitiv.

Image source: DBi

Anything above zero means bonds are functioning as a hedge. Anything below zero means equities and bonds move in tandem, whether that’s up or down. With the Fed put withdrawn from markets and rates likely to remain high for an extended period of time, longer-term correlation between equities and bonds could spell disaster for traditional portfolios.

“This is DefCon 5 for $5 trillion of model portfolios – the cornerstone of which is how combining the two major asset classes can give clients a smoother ride. If that line stays below zero, a 60/40 portfolio will be a scary rollercoaster over the coming decade,” Beer explained. “Clients do not like when you put them on scary rollercoasters.”

The best portfolio diversifiers of the next decade will be those not linked to stocks or bonds, according to Beer. Strategies like managed futures that carry low and often negative correlations to both will become integral parts of portfolios looking ahead.

“We think every allocator out there should drop everything else and look for diversifiers that have no correlation to either stocks or bonds,” Beer said. “If you’ve already bought into a strategy like managed futures, then you might want to materially increase your allocation.”

Exactly how much should allocators be considering for managed futures? Beer estimates 10% or higher over the remainder of the 2020’s for portfolio optimization.

Why Inflation Remains A Very Real Threat

In late summer, investors and markets increasingly embraced the narrative that inflation and inflationary pressures were easing enough that rate hikes were likely done. Economic data at the beginning of September instead revealed a strong labor market and higher-than-expected second-quarter wage gains. Now investors are forced to confront the potential that rate hikes still have further to go.

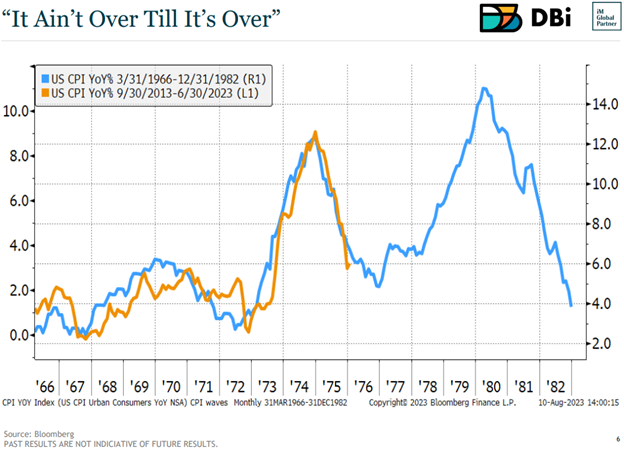

The Fed remains insistent in ensuring that inflation is well and truly in hand this go around. The regulator wants to avoid repeating the mistakes of the 1970s when inflation appeared tamed only to come soaring back the moment the Fed eased tightening. Given how closely today’s inflation mirrors that of the late 1960’s and early 70’s, the aggressive stance isn’t surprising.

Image source: DBi

There are two conclusions that economists generally draw from the above chart, according to Beer. The first and clearest point is that inflation is far from tamed. Secondly, expect the Fed to remain tight-gripped on rates until it’s undoubtedly clear that inflation is well in hand.

“The smart money these days seems to think rates will remain high, which happens to be when stock and bond correlations tend to be positive,” Beer explained. Such has been the case of the last year and a half, and Beer anticipates will be the norm looking ahead. “Maybe not a single, violent shockwave, but rather a series of ‘rolling crises’ like SVB (Silicon Valley Bank) in March.”

In such an environment, including managed futures as a portfolio diversifier is a logical choice.

See also: “Why Looking Beyond Brands Matters in Managed Futures”

Boost Portfolio Diversification With DBMF

The iMGP DBi Managed Futures Strategy ETF (DBMF) is an actively managed fund. It uses long and short positions within futures contracts primarily, as well as forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary). Because the strategy transacts in futures, it offers low to negative correlation to stocks and bonds.

The Dynamic Beta Engine determines the position that the fund takes within domestically managed futures and forward contracts. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the average of the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.