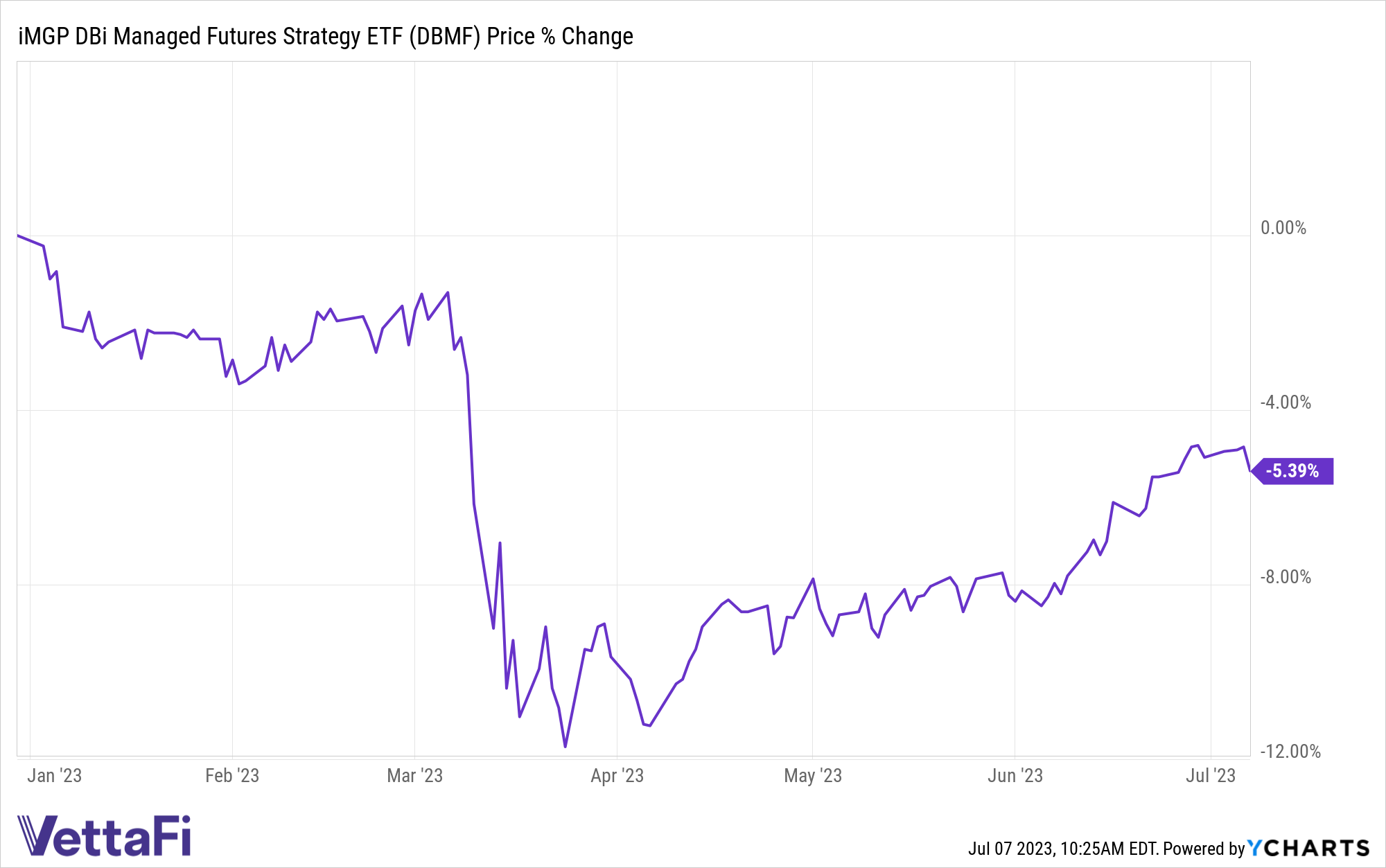

Fears of more Fed rate hikes sent markets spiraling Thursday as investor uncertainty spiked once more. Despite the challenges that such an uncertain environment creates for trend following strategies, iMGP DBi Managed Futures Strategy ETF (DBMF) continues to recover from March lows.

Market volatility Thursday on the strong jobs report from the private sector proved yet another thread in the tapestry of 2023 as markets attempt to guess the path of inflation, the Fed, and the economy this year. It’s also a narrative that continues to prove difficult to get right, creating prolonged volatility and uncertainty, particularly in the wake of the banking crisis in March.

DBMF is up 7.16% since March 24 when the fund hit a low for the year. The precipitous fall was driven by the banking crisis and regional bank failure mid-March. This resulted in an abrupt reversal of the inflation trade that buoyed DBMF through much of 2022. Since March 24, the fund continues to recover in a challenging environment for trend following strategies.

See also: “Andrew Beer: 2023 Is the Year of the One Trade Market”

DBMF Continues Recovery Post Banking Crisis

The iMGP DBi Managed Futures Strategy ETF (DBMF) seeks to capture the average return of the 20 largest managed futures hedge funds. By offering the strategy within the cost-efficient ETF wrapper, DBMF seeks to provide similar performance with significantly reduced management fees.

DBMF is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

Currently, DBMF is long the 1-year Treasury Bill, the 10-year Treasury Note, gold, the euro, and the S&P 500. The fund is short MSCI EAFE, crude oil, emerging markets, the yen, and more.

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.