This year continues to be full of surprises for markets as equities proved resilient and bond yields soared. However, it’s all part of a larger global macro trend, in which the narrative remains centered around U.S. Fed tightening. 2023 is the year of the “one trade market,” according to Andrew Beer, where prolonged uncertainty presents ongoing challenges and volatility.

In a global environment dominated by Fed tightening and FOMC meeting outcomes, investor uncertainty remains pronounced. Markets have proven unable to reliably predict the Fed’s path this tightening cycle, creating sharp swings in market performance every few months.

“One month, everyone thinks we’ve hit peak rates, and this reverberates across asset classes,” Andrew Beer, co-portfolio manager of the iMGP DBi Managed Futures Strategy ETF (DBMF) and co-founder of Dynamic Beta investments, explained in a video detailing DBMF’s May performance. “The next month, we’re back to sticky inflation and the ripple effects start all over.”

2023 and One Trade Market Challenges

The overarching uncertainty creates significant challenge for trend-following strategies in particular. Beer noted that at the end of March, investors were predicting recession within weeks, which hasn’t manifested.

Although bank tightening is on the horizon, regional banks continue lending for now. An earnings season comprised of expectation beats sent equities higher, and profits continue to prove resilient. The geopolitical arena, although tense, hasn’t deteriorated significantly this year.

“Price moves, not fundamentals, keep driving the market narrative,” Beer said.

The constant shifting tides create challenges for trend-following strategies like managed futures. This quarter in particular remains dominated by a lack of any singular trend emerging in the wake of the regional banking collapse mid-March.

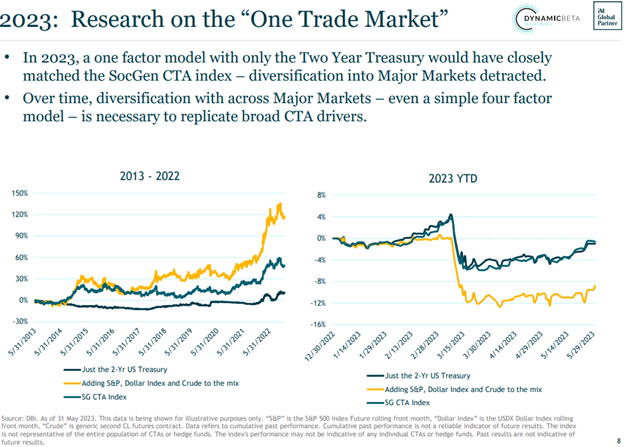

Diversification proved to hinder performance in 2023, an effect of the “one trade market”

Image source: Dynamic Beta investments

A Guide to DBMF Positioning in May

Dynamic Beta investments predicts that global markets “will break in one direction at some point soon, which should produce durable trends across the major markets we trade.”

The iMGP DBi Managed Futures Strategy ETF (DBMF) seeks to capture the average return of the 20 largest managed futures hedge funds. By offering the strategy within the cost-efficient ETF wrapper, DBMF seeks to provide similar performance with significantly reduced management fees.

The fund is currently positioned in a manner that could allow it to capture gains for several potential trends. DBMF maintains a long position in gold, a beneficial position if high inflation persists. It’s also short on oil, a potential hedge should recession strike, and short on the two-year Treasury.

“Equity positioning keeps moving around — not surprisingly, given the market gyrations,” Beer explained. The fund is also significantly short on the Japanese yen, a position that paid off in 2022.

DBMF is an actively managed fund that uses long and short positions within derivatives (mostly futures contracts) and forward contracts. These contracts span domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The position that the fund takes within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine. This proprietary, quantitative model attempts to ascertain how the largest commodity-trading advisor hedge funds have their allocations. It does so by analyzing the trailing 60-day performance of CTA hedge funds and then determining a portfolio of liquid contracts that would mimic the hedge funds’ performance (not the positions).

DBMF takes long positions in derivatives with exposures to asset classes, sectors, or markets that are anticipated to grow in value. It also takes short positions in derivatives with exposures expected to fall in value. Under normal market conditions, the fund seeks to maintain volatility between 8%–10% annually.

DBMF has a management fee of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.