Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Karrie Gordon and Nick Peters-Golden discuss the case for trading in the old 60/40 portfolio for an alts augmented 50/30/20 portfolio.

Karrie Gordon, staff writer, VettaFi: Nick, I can’t wait to dive into the world of alternatives with you and why boosting their weighting in a portfolio just makes sense these days. In a panel from the recent Fixed Income Symposium hosted by VettaFi, Hamilton Reiner of JPMorgan Asset Management said something that really stuck with me. While Reiner anticipates investors will employ a 60/40 traditional portfolio mentality for risk, the actual modern portfolio will likely be closer to a 50-30-20 composition. This means 50% allocation to stocks, 30% to bonds, and 20% to alternatives and other enhancement strategies like covered calls.

A 20% allocation to alternatives and alternative strategies may seem significant but it makes sense. We’re in a new market regime now that the decade-long Fed put on markets is gone. That means greater volatility as a base case, and boosting portfolio diversification beyond just stocks and bonds seems logical to me in such an environment.

Nick Peters-Golden, staff writer, VettaFi: Look, I appreciate the desire for diversifying away from the 60/40 portfolio. That’s pretty much the definition of “thinking outside the box.” However, to lean on another idiom, investors also don’t need to reinvent the wheel. Alts have drawbacks of their own that investors and advisors need to consider. I think that may create an outlook just as murky – if not more so – as the 60/40’s outlook right now.

An Elegant Alternative for a More Modern Age

Gordon: Alternatives span several asset classes and aren’t the soaring, consistent returns producers that equities are. They’re not meant to be, though. The non-correlated return stream means that in times of equity or bond crisis, they can help keep returns afloat.

I can’t talk about alts without first talking about liquid alts, given their somewhat recent popularity. Liquid alts ETFs have really stepped into their own in the last few years, gaining increasing investor attention when equities, bonds, and markets plummeted. You need look no further than the $1 billion in inflows into the iMGP DBi Managed Futures Strategy ETF (DBMF) last year for proof that these hedge fund strategy ETFs can offer real value to portfolios during market dislocation and stress.

Liquid alts offer a wide range of strategies, from equity long/short to managed futures and more. They’re complex funds, but they’re well worth the extra education if you ask me. While they’re often quiet, albeit steady performers when markets are calm, it’s during dislocations and market stress that these funds typically shine. Let’s look back again at the COVID crash of 2020.

When the S&P 500 plummeted over 30%, liquid alts ETFs declined significantly less. The iMGP Dbi Hedge Strategy ETF (DBEH) dropped 17% between February 1 and March 23, 2020, when the S&P 500 hit its lowest point. Over the same period, the ProShares Hedge Replication (HDG) dropped 12.8% while DBMF dropped 2% on a total return basis. By the end of 2020, DBEH outperformed broad equities, up 23.53% in total returns compared to SPY’s 18.42%.

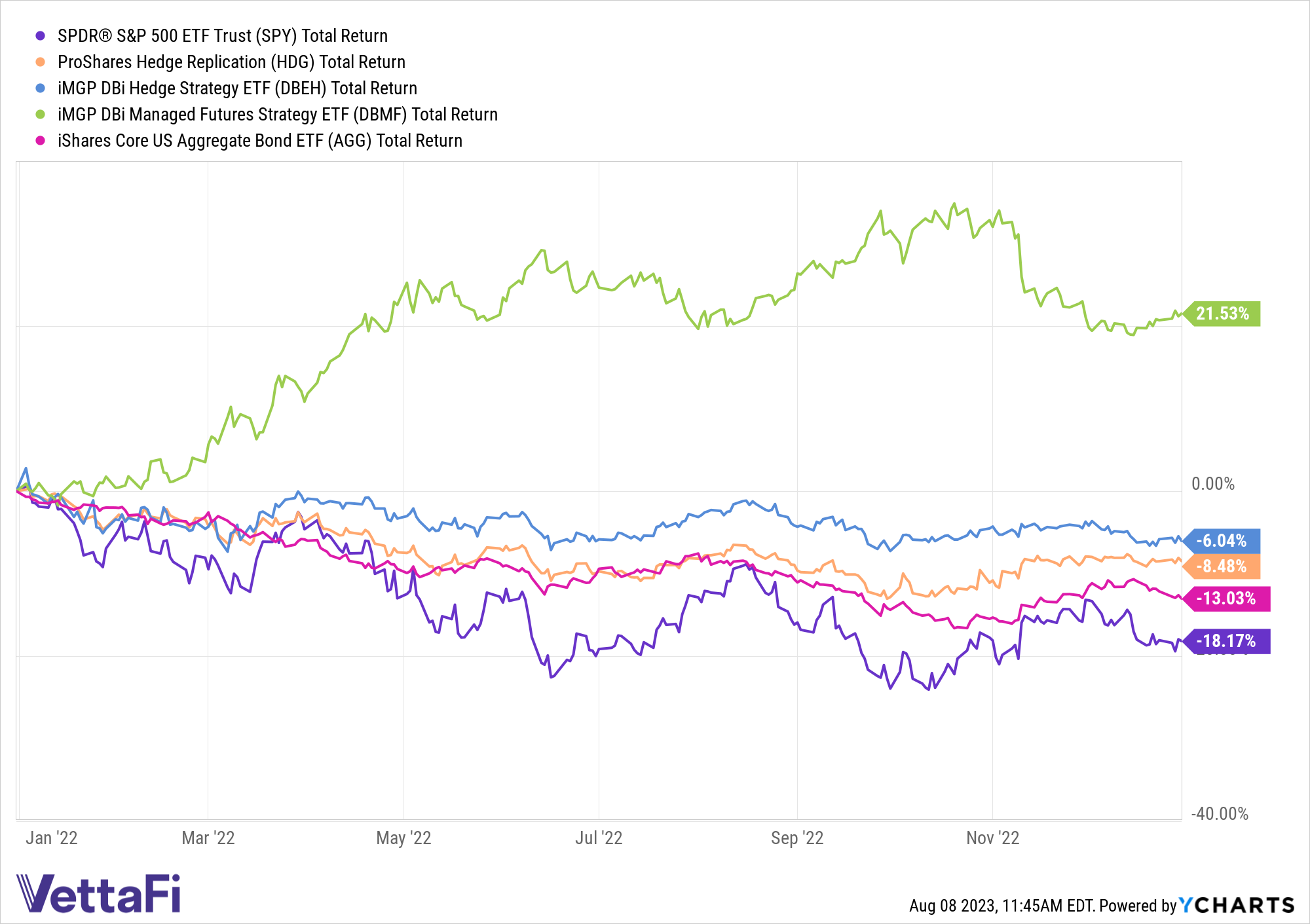

How Do Alts Perform During Prolonged Volatility?

These funds also held up in the prolonged volatility and challenges of 2022 considerably better than broad equities and bonds. DBMF ended the year up 21.53% on a total return basis while DBEH dipped 6.04%. HDG fell 8.48%, the iShares Core US Aggregate Bond ETF (AGG) dropped 13.03% and the SPDR S&P 500 ETF Trust (SPY) tumbled 18.17%. What’s more, most outperformed stocks and bonds with less volatility.

I’d also like to note that in the equity outperformance of this year, HDG and DBEH are both up 4.8% and 5.8% respectively. DBMF is down 4.91% but continues to recover from the trend reversal in the wake of the March banking crisis. Even this year’s sharpest drawdown for DBMF (14%), the largest since launch in 2019, still pales in comparison to the 35% drawdown in the S&P 500 over the same period.

Liquid alts offer strong diversification opportunities with their low correlations. They are general enhancements to portfolios during times of market calm, and significant performers when markets are under duress. Expanding your portfolio to include more of these strategies in the new market regime of greater volatility seems like a long-term win to me.

Alts: Liquid Enough?

Peters-Golden: We talk about alts as a diversifier in a scenario in which equities and bonds both struggle and again, I can see the appeal. Alternative investments aren’t the silver bullet for volatility, however. First of all, a huge swathe of alts strategies lack the liquidity that investors need in such environments.

Many of these strategies owe their approaches to hedge funds where illiquidity is standard. Investing in private equity, art, hedge funds, crypto, or even real estate can pose thorny liquidity questions. There’s a reason why alts managers are adapting existing alternative strategies to gear them more towards retail investors.

Investors cite liquidity as a key concern about getting into alts. Nearly half of the advisor respondents to a recent 2023 investing trends survey pointed to liquidity as a concern when considering adding alts to client portfolios.

Now, of course, we’re in the ETF world where the real conversation focuses on liquid alternatives. Liquid alt funds exploded after the Great Financial Crisis of 2007-2008, but they’re not much better. Plugging illiquid assets into a liquid format doesn’t magically make those assets more maneuverable.

However, to me, the big concern with liquid alts is that they come with big opportunity costs. Sure, you can get those assets out “somewhat” faster than in a private equity fund. Yes, that might mollify clients in a big downturn.

Still, it takes time – valuable time when many investors stay out of the market too long in bear environments. Some estimates find that poor market timing cost investors about 50 basis points of return annually between 2005 to 2019. Adding more time delay makes it harder to take advantage of the market bottoming out. When looking at your market neutral, long-short equity, or managed futures strategies, remember the opportunity cost of missing out on the market bottom.

Commodities Help Hold the Line in Crisis

Gordon: Fees are most assuredly something to be aware of when looking to liquid alts, but all three funds that I mentioned before currently have management fees of less than 1%. When you compare that to the significant fees that hedge funds carry with their 2/20 model, it’s noteworthy savings. The ETF vehicle provides access to these strategies previously reserved for institutional investors at reasonable costs.

The role of alternatives as a loss-mitigating mechanism cannot be overstated. Let’s pivot to look at this through the lens of commodities, one of the most well-known alternatives to stocks and bonds. While they are cyclical, carrying a diversified portfolio of commodities allows for capture as some commodity classes “cycle on” when the unexpected happens, such as Russia’s invasion of Ukraine in 2022, or the COVID-19 pandemic onset.

Carrying exposure to energy commodities such as oil via the ProShares K-1 Free Crude Oil Strategy (OILK) during the equity and bond crash last year proved enormously valuable. OILK ended the year up 27.53% on a total return basis compared to SPY’s -18.11% return or AGG’s -13.03% return.

Let’s step back even further to the COVID-19-induced crash in March 2020. Between February and March 2020, SPY dropped more than 30% on a total return basis. We all know that gold becomes enormously popular when market panic reaches a certain level, and in times of market stress, it proves its mettle.

The max drawdown of the SPDR Gold Shares (GLD) was a 13% drop between February and March 2020. It’s worth noting that by the end of October 2020, GLD was up 23.30% compared to SPY’s 2.94% and AGG’s 6.10% total returns. Alternatives like commodities help portfolios hold the line when equities or bonds crumble – or, more rarely, when both crumble simultaneously.

Transparency, Fees, and Outcome Dispersion

Peters-Golden: Alts and liquid alts strategies in some ways privilege a defensive, cautious mentality – which is why it’s so surprising that they’re so convoluted. These strategies lack transparency, and their complexity makes it harder for investors to plan – a key reason why they’re sought after in the first place. Investors losing money unexpectedly because a complicated liquid alts strategy responds to market events differently than expected hurts quite a bit.

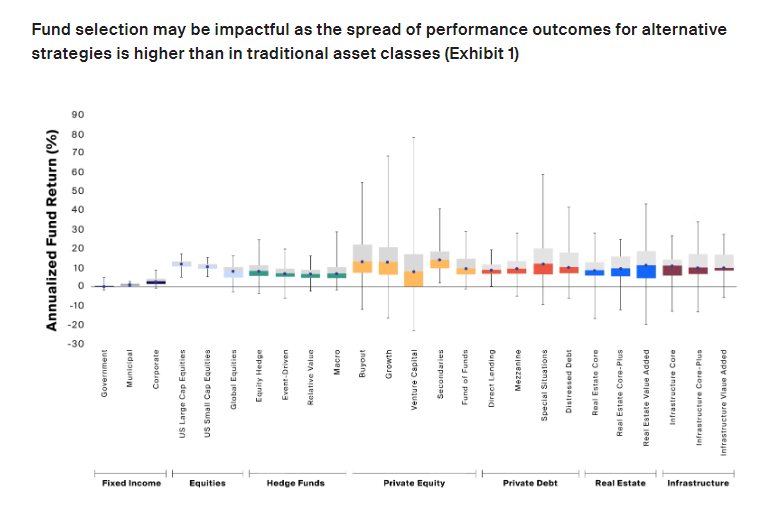

That gets at this idea that alts products can be “safer.” Alts investments produce much more return dispersion than stocks and bonds do. So yes, say we get another year like 2022 where fixed income is moot and equities are down. You could lean on alts in hedge fund-like strategies or private equity, but that’s a risky proposition. Look at this graph from CAIS: yes, you could do very well – but that’s not the reason many advisors look to alts. If portfolios are down, you need ballast, not more risk.

Image source: CAIS

I’d like to quote BlackRock here on return dispersion in alts, if I may: “Past returns and category rankings can be helpful in selecting traditional investments, but in the universe of alternative investments, they can lead you to a product that does not serve the purpose you intended and can even have a detrimental effect on your portfolio.” Can some alts products give you that meaningful “anti-beta” approach? Yes. But you have to pick the right one.

Alts as Diversifiers, but at What Cost?

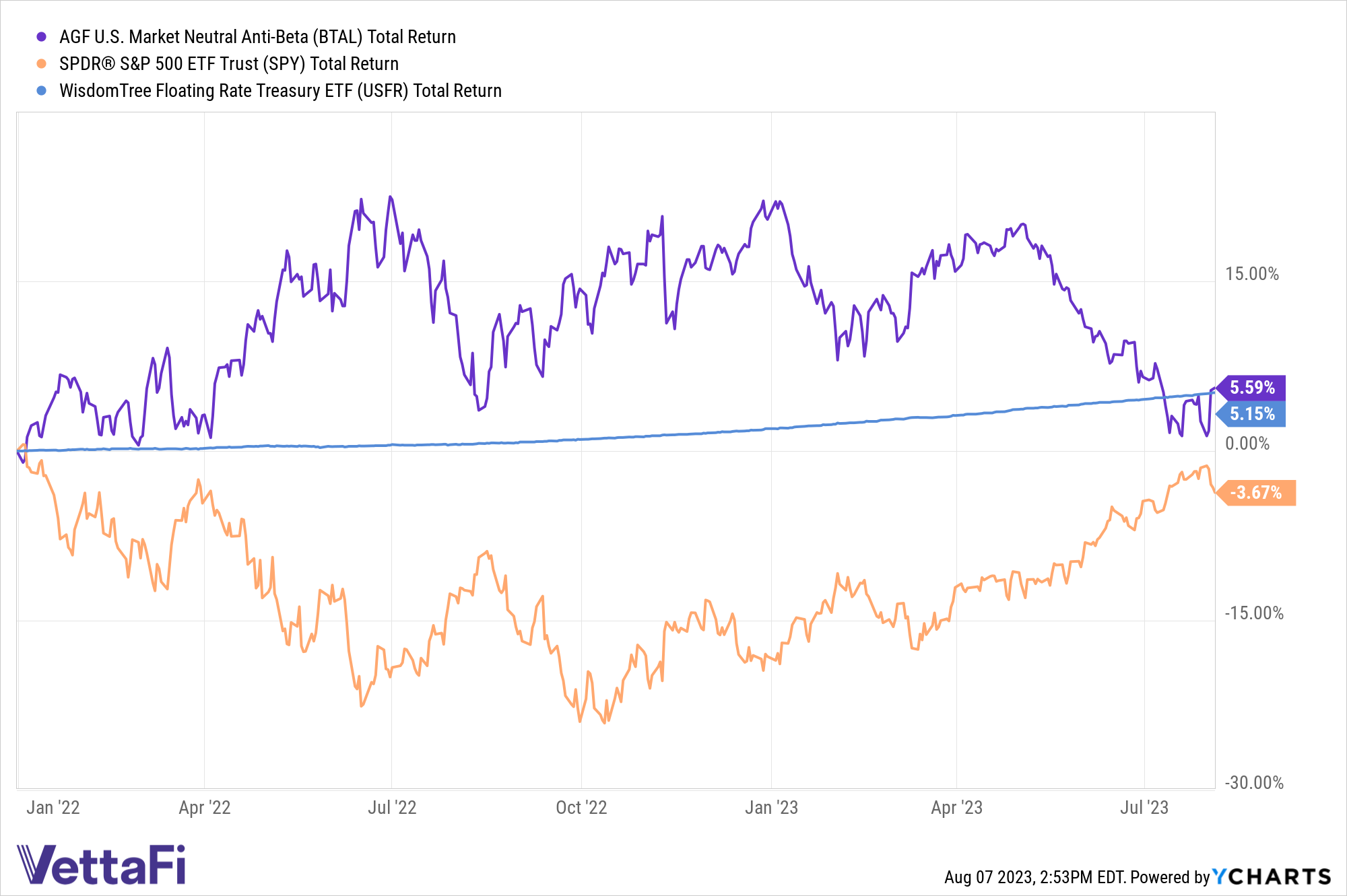

Finally, let’s talk about one problem that’s simpler to understand, but maybe even tougher to swallow – the fees. Say you had the forethought to own the AGF U.S. Market Neutral Anti-Beta ETF (BTAL) at the start of 2022 and held it until now. Yes, BTAL outperformed SPY pretty well, 5.6% to -3.7%. That’s meaningful.

However, BTAL charges an eye-popping 154 basis point (bps) fee. That’s nothing to scoff at. Sure, investors and advisors want performance first and foremost, even if that’s a full 145 bps more to pay compared to SPY. I’ll give you that.

That said, taking the same crystal ball approach, buying and holding the WisdomTree Floating Rate Treasury ETF (USFR) on January 1st would have produced nearly the same return that BTAL did, 5.2%, charging just 15 bps. As an alts ETF, BTAL whooped SPY – but that’s where your fixed income allocation stepped in. USFR’s slow and steady approach outdid BTAL even when BTAL could have profited from both last year’s stock market doldrums and this year’s recessionary rumors.

Don’t Break Up With Commodities — Break Out

Gordon: One of the biggest conundrums when it comes to commodity investing is their cyclical nature. It can be difficult to predict when oil will unexpectedly cycle on or off. Take this summer with crude oil price spikes of 21% in the last six weeks. There is a lot to be said about trying to time commodity exposure, as you noted.

There are new opportunities in commodities if you’re hesitant about including more cyclical exposures. One subset of metals is set to break out of their historical cyclical rotation. Instead, they are pivoting to exponential demand increases in the next 30 years. The global demand shift is set to create what some have termed a “super cycle”.

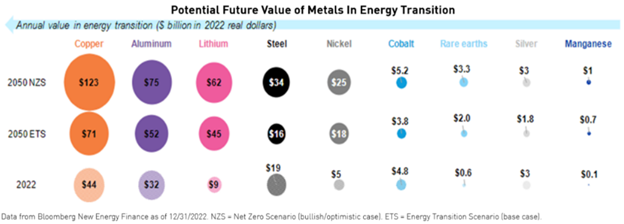

Electrification metals necessary for the energy transition are forecast for significant demand increases in the next decade and beyond. These include metals with use cases in batteries, electric vehicles, wires, and more. Bloomberg New Energy Finance estimates $10 trillion in metals will be necessary to meet Paris Agreement goals.

Image source: BloombergNEF

Limited Supply & Negative Correlations

Alongside enormous demand increases for transition metals is the reality that supply cannot logistically keep up. I wrote about the looming copper shortage recently, but it’s a systemic issue in metals worldwide. It also creates significant price opportunities for investors, given the longer-term supply and demand imbalance forecasted.

What’s more, these electrification metals had negative correlations to the S&P 500 over the last five years. A basket of metals such as those that make up the Kraneshares Electrification Metals Strategy ETF (KMET) generated a correlation of -0.30 to the S&P 500 between February 28, 2018 and February 28, 2023. The basket includes lithium, copper, nickel, aluminum, zinc, and cobalt futures.

KMET has a management fee of 0.80%. While this is steeper than some funds, given the outlook for metal prices it seems a marginal price to pay for exposure. An alternative fund within the space is the Invesco Electric Vehicle Metals Commodity Strategy No K-1 ETF (EVMT) with a management fee of 0.59%.

Transition metals offer all the benefits of alternatives as strong portfolio diversifiers. They also offer a rather unique opportunity within commodities, given the impending “super cycle” of the next three decades.

Go Abroad, Young Investor

Peters-Golden: So far, our discussion has focused on the 50/30/20 portfolio compared to the standard 60/40 and focused entirely on the U.S. market. Given how well the U.S. stock market has done and of course, how relevant it remains for U.S. investors, that makes sense. However, we haven’t even considered another way to diversify away from the U.S. stock market – looking abroad.

Yes, factors like the U.S. dollar and economy will still impact foreign markets, but for the most part, you’re not getting equities uncorrelated from U.S. equities. The reason why U.S. investors have hesitated when considering foreign equities is that U.S. stocks have outperformed international stocks in eight of the last ten years.

Historically, international stocks have outperformed when U.S. returns dipped below 4%. Based on that, international stocks deserve a place in the conversation as a diversifier. Investors have already been looking abroad more this year given how expensive U.S. equities are. The Fed, having put an end to the monetary regime that’s defined U.S. markets for more than a decade, has also helped to reinvigorate the case for international diversification.

Now it is true that international diversification proves its worth in much longer time frames than just a one-year blip. However, if we’re talking about the pros and cons of switching away from a 60/40 to a 50/30/20 portfolio, international diversification strongly boosts the case for the former. The ease, lower cost and liquidity available in international equities that can still diversify renders the alts case nearly moot.

How Will You Weigh in on Alts?

Gordon: Nick, you’ve given some really good reasons on why advisors and investors need to be educated on some of the pitfalls of alts investing. I’m not a rose-colored glasses type of person, and like any investing strategy, alts carry their own risks. I genuinely believe the benefits can outweigh the risks though and that they deserve an increasing portion of any modern portfolio.

We’re in an environment without a Fed put in markets anymore and globalization appears to be fraying at the seams. Market volatility and the potential for unexpected risk seem higher than it has been in the last decade. Alts could prove to be a portfolio ballast should markets once again turn for the worse.

Peters-Golden: I appreciate your insight on this one, Karrie. I can see the case for them, of course. You did a great job outlining how alts are a diverse category with all kinds of strategies therein. As ever, thanks for chatting with me!

For more news, information, and analysis, visit the Managed Futures Channel.