The global transition to net-zero emissions will require enormous amounts of investment, regulatory support, and raw material. In electrification metals, the demand ramp-up is particularly significant but can current supply capabilities keep up? In copper, that answer looks to be a resounding no.

The additional usage of copper in renewable energy and emissions reductions creates a 17% demand increase by 2030 just for electrification purposes, Aditi Rai, analyst at Goldman Sachs, told Mining.com. In a true net-zero scenario, that demand increases to 54% by 2030, in addition to already forecast increases in general demand.

McKinsey currently forecasts that production will need to increase 45% by 2031. It’s the “equivalent to doubling production from the top four copper-producing countries,” they wrote in a recent article on the necessity of regulatory efficiency in the net-zero transition. McKinsey also forecasts a copper supply gap of 6.5 million tons by 2031.

Ramping Demand Runs Headlong Into Supply Deficits

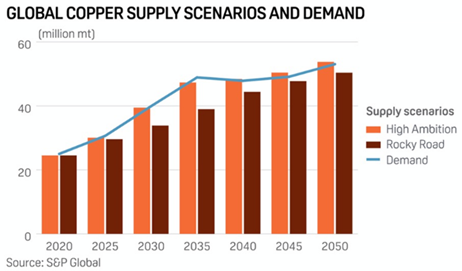

The S&P Global forecasts a more aggressive ramp-up in demand, doubling by 2035 from 25 million metric tons in 2022 to 50 million metric tons.

“The world has never produced so much copper in such a short timeframe as would be required,” said Daniel Yergin, vice chairman of S&P Global in the press release last year. “On current trends, the doubling of global copper demand by 2035 would result in significant shortfalls.”

Image source: S&P Global

Current production capabilities (the Rocky Road scenario) would result in a supply deficit of 10 million metric tons by 2035, according to S&P forecasts.

The issue is one of increasing output through new mines. Two new major copper mines are coming online (Quellaveca in Peru as well as Kamoa-Kakula in the DRC ) and two transitioning to sulfide ores from oxide ones (Quebrada Blanca II and Spence-SGO in Chile) reported Reuters.

New mines take on average 16 years to go from planning to fully operational. As of now, there are no new major mines planned beyond the ones coming online.

“There is a looming supply crunch coming in the copper market: You have probably heard by now that the energy transition will require a lot of copper,” wrote Sam Crittenden, analyst at RBC Dominion Securities, and reported by Mining.com. “An additional 1 percent per year on our estimates which doesn’t sound like much but would be the equivalent of one large-scale copper mine coming online every year.”

What’s more, analysts and mining companies are already flagging continued deficits this year. The International Copper Study Group currently projects a 114,000-ton deficit this year, reported Reuters. It comes on the heels of last year’s 431,000-ton deficit as supply disruptions and geopolitical instability reduce output.

Position for the Copper Supply-Demand Imbalance With KMET

Advisors and investors looking to gain exposure to copper ahead of price recovery and gains should consider the KraneShares Electrification Metals ETF (KMET). KMET offers targeted exposure to the metals necessary for electrification, such as copper. The fund offers exposure to growing metal demand from the clean energy transition via the futures market.

The fund seeks to track the Bloomberg Electrification Metals Index. KMET carries futures contracts on copper, nickel, zinc, aluminum, cobalt, and lithium. These metals are all core components for batteries, electric vehicles, and the renewable energy infrastructure needed to meet 2050 net-zero goals.

KMET’s largest allocations currently include copper futures at 27.03% and a 24.74% allocation to nickel futures. The fund has an expense ratio of 0.79%.

For more news, information, and analysis, visit the Climate Insights Channel.