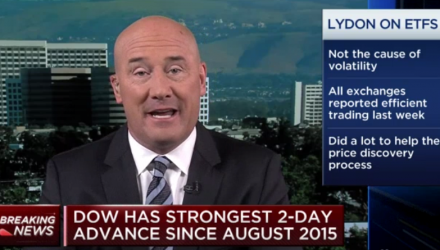

“They did what they were supposed to do,” he said. “The chink in the armor is when we are talking about the few volatility ETFs. That was a moment in time where the last hour of trading where a billion dollars came into the futures market and had to be settled between 4 pm and 4:15 pm (Eastern), where it exasperated a problem. That’s where we really need to focus, just on these volatility ETFs where you lost about 95% if in fact you bet volatility was going to come back to earth and decline, and you were right, unfortunately the tool didn’t do what you wanted it to do.”

The VIX, or so-called fear index, is a widely observed indicator for investor sentiment in the stock market and measures the expected or implied volatility of large-cap stock options traded on the S&P 500 index. ETPs that track VIX futures allow investors to profit during rising volatility or hedge against short-term turns.

Amid last Monday’s plunge in U.S. stocks, the VIX surged, and inverse volatility exchange traded notes and ETFs attracted $1 billion in the closing hours of trading. Buying VIX futures after the close of the market exacerbated pricing which had the reverse affect than investors intended.

In after-hours trading last Monday, XIV suffered catastrophic losses. The ETN’s market closing Monday was $99, but its closing indicative price as listed on the VelocityShares website was just $4.22.

Intraday drops of 80% or more trigger termination events with XIV.

For more ETF-related commentary from Tom Lydon and other industry experts, visit our video category.