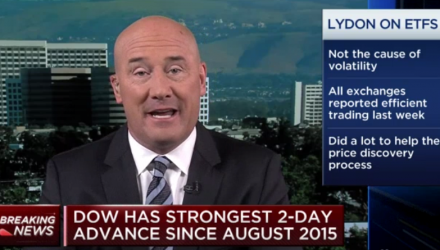

ETF Trends publisher Tom Lydon appeared on CNBC’s ‘Closing Bell’ on Monday afternoon to discuss if ETFs are affecting the recent market volatility and how are they holding up.

Lydon told host Megan Kelly that ETFs experienced a record $376 billion in flows in 2018, adding that momentum continued with another $78 billion of flows in January.

“There may have been about $25 billion that came out in the last week,” Lydon said. “That’s kind of a blip on the radar; not really that much.”

Despite the volatility in the markets, Lydon said ETFs continued to trade exactly how they were supposed to.

“There were no halts on exchanges, there was real tight trading and even all the inverse/leveraged ETFs, where people tried to throw stones at them, again, they did exactly what they were supposed to do,” he said. “The fundamentals are there.”

When Kelly quizzed Lydon whether inverse and leveraged ETFs should be banned or have better disclosures, Lydon responded that the majority are either equity-based or fixed-income based.