I love ETF milestones, whether they are global bond ETF assets hitting a key level or a widely held ETF reaching a round number anniversary. So when I learned another was just reached, I got excited. The New York Stock Exchange (NYSE) has 2,000 ETF listings.

The NYSE traces its origins to the Buttonwood Agreement signed by 24 stockbrokers in May 1792. It was a response to the first financial panic in the young nation. It set rules for how people could trade stocks and established set commissions. According to the NYSE, the Agreement aimed to promote public confidence in the markets and to ensure that deals were conducted between trusted parties.

Since then, a lot has changed. These changes include technological advancements to support efficient trading of stocks and the growth of the ETF industry.

“The NYSE’s 2,000 ETF listings underscore the industry’s strong growth as well as the wide interest and acceptance ETFs have achieved in just three short decades,” explained Douglas Yones, head of exchange traded products at the NYSE. “We look forward to continuing to work with asset managers to bring new investment strategies wrapped in an ETF to the NYSE markets. We remain focused on advancing important innovations such as the semi-transparent active ETF industry.”

See more: ETF 360 with PIMCO

In August alone, we have seen the following ETFs begin trading on the NYSE:

- The AllianzIM U.S. Large Cap Buffer10 Aug ETF (AUGT)

- The First Trust Intermediate Duration Investment Grade Corporate Bond ETF (FIIG)

- The YieldMax™ NFLX Option Income Strategy ETF (NFLY)

A defined outcome ETF, an actively managed bond ETF, and an ETF that provides enhanced income tied to a single stock — this is a far different ETF industry than the one that started with the SPDR S&P 500 ETF (SPY) more than 30 years ago.

VettaFi at the NYSE

For many investors, the most familiar image of the NYSE is the bell signaling the opening or closing of trading. I’ve even had the pleasure of being on the podium a couple of times, but just being on the floor remains a thrill.

A bell was first used at the Exchange in the 1870s with the advent of continuous trading. But it was different than today. It was actually a Chinese gong. When the current NYSE building opened in 1903, a brass bell replaced the gong. This bell was electrically operated and large enough to resonate throughout the voluminous main trading floor.

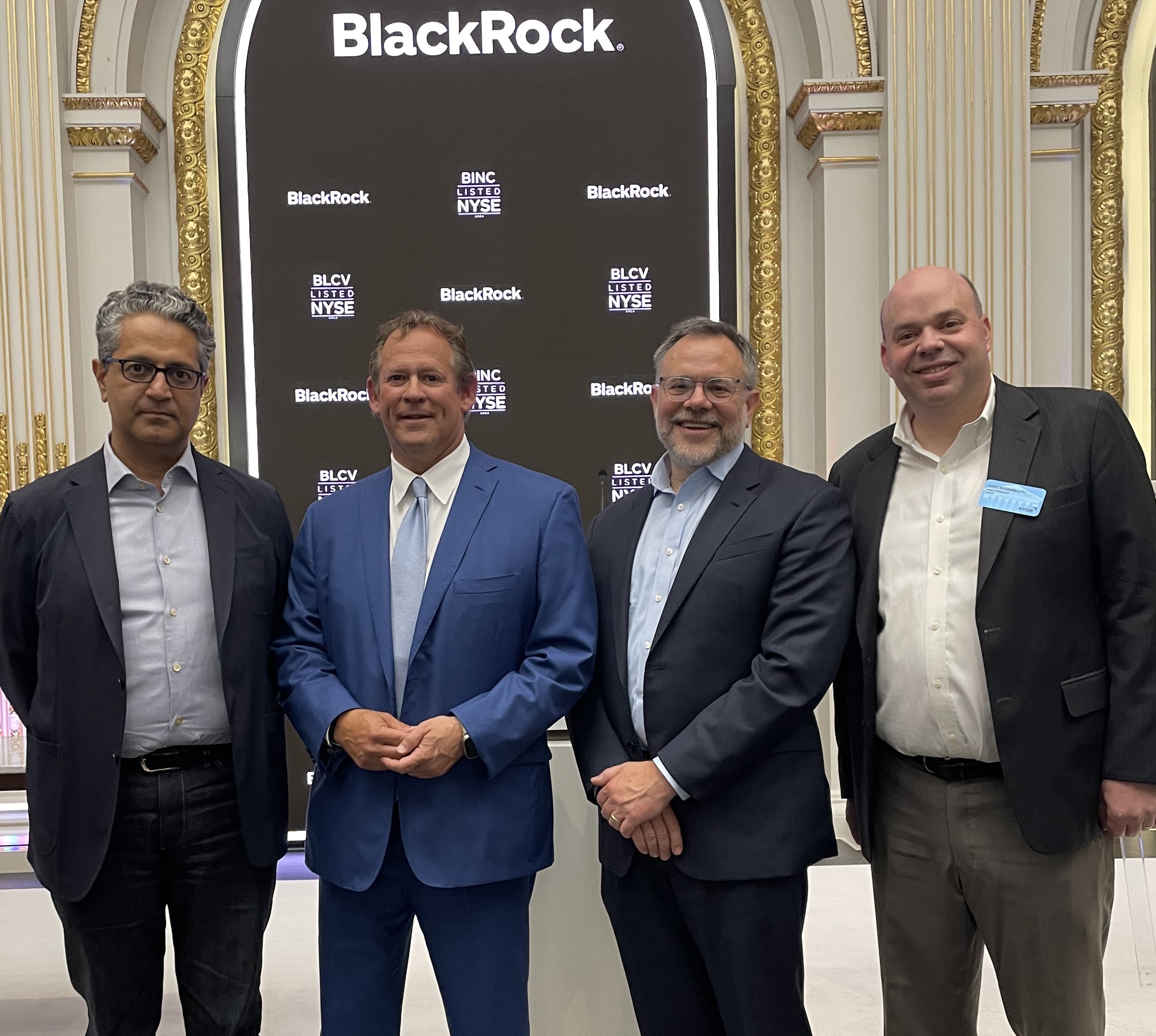

In 2023, VettaFi was honored to be able to join asset managers like American Century, BlackRock, Invesco, PIMCO, and Vanguard to celebrate their ETFs’ NYSE listings. Being on the floor for the opening or closing bell ceremony with them was indeed special.

These events help to bring the ETF ecosystem together. They also allow asset managers a chance to engage with their partners at a historic site. Congratulations to Douglas and the whole NYSE ETF team.

For more news, information, and analysis, visit VettaFi | ETF Trends.