While Treasury inflation-protected securities (TIPS) can help provide a degree of safety in a market environment like now where rates are rising, they aren’t completely immune to the woes in the bond market.

Bonds have been following stocks downward as inflation fears have continued to permeate throughout the capital markets. While the selling pressure has somewhat subsided in the last few trading sessions, bond bears could still find opportunities should a hawkish Federal Reserve continue to push rates higher as expected through 2022.

Last week’s inflation report “did show that overall, year-over-year inflation slowed a bit to 8.3% in April from 8.5% in March,” as reported by the Wall Street Journal. “That marked a much-anticipated turn, as prices are no longer compared with deeply depressed levels from earlier in the Covid-19 pandemic.”

“Bond investors, though, were more concerned about the monthly pace of price increases, which they consider a better gauge of where inflation is headed,” WSJ added. “Stripping out food and energy prices similarly takes out some of the noise in the data, providing a better sense of underlying inflation pressures.”

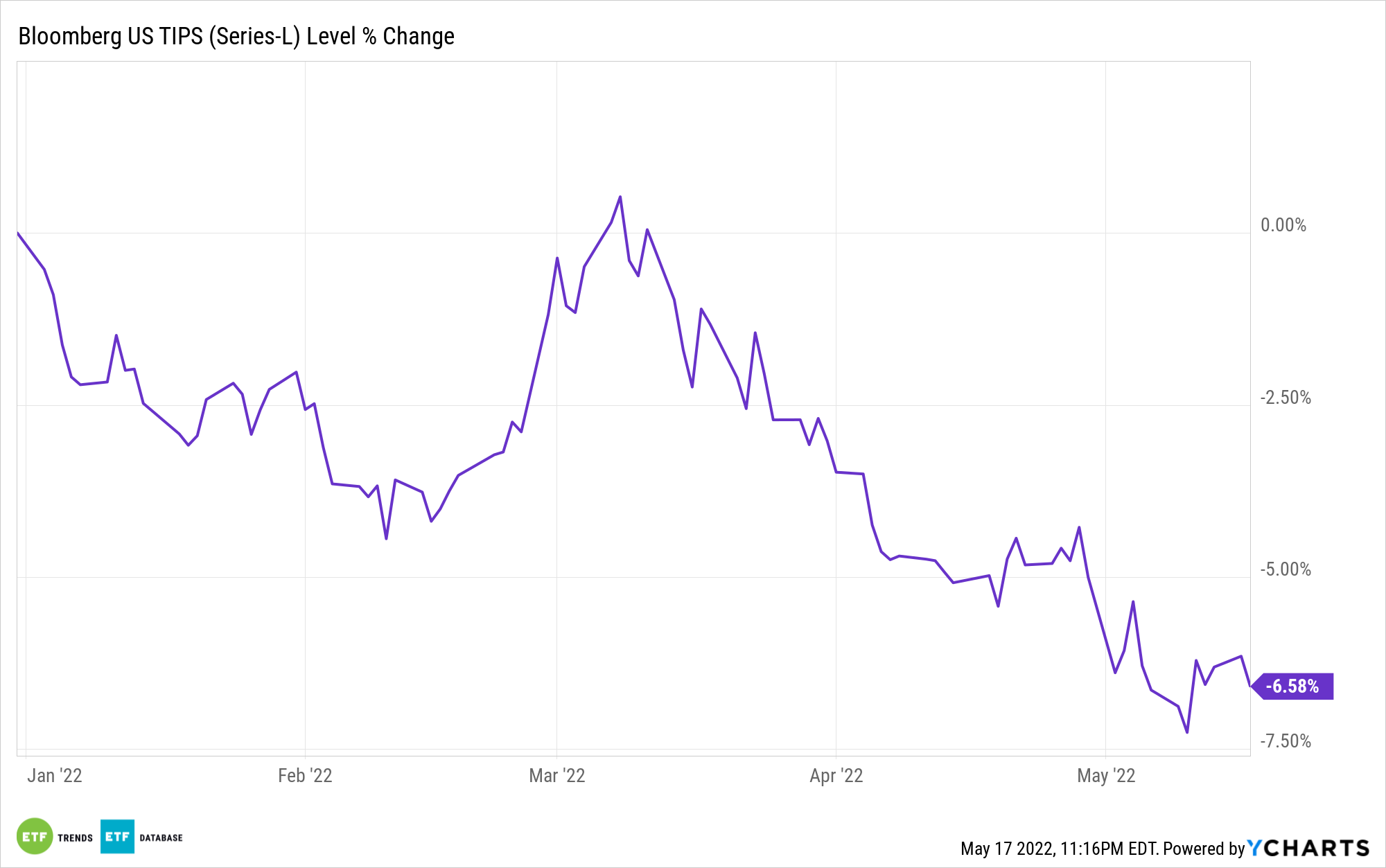

In the meantime, according to the Bloomberg US TIPS (Series-L) Index, TIPS have been heading lower like the rest of the bond markets in the first quarter and spilling over into the second quarter. The index itself is down about 7% for the year.

2 Options for Weakness or Strength in TIPS

Direxion Investments has a couple of options play either strength or weakness in TIPS. Both ETFs are just part of a suite of leveraged ETF products that Direxion offers to play both sides of the trade.

For traders erring on the side of bullishness, there’s the Direxion Daily TIPS Bull 2X Shares (TIPL), and for bearishness, there’s the Direxion Daily TIPS Bear 2X Shares (TIPD). Both ETFs seek to achieve 200%, or 200% of the inverse, of the daily performance of the Solactive TIPS ETF Index, which provides exposure to inflation-protected U.S Treasury bonds, commonly known as “TIPS,” according to a statement from the firm.

For more news, information, and strategy, visit the Leveraged & Inverse Channel.