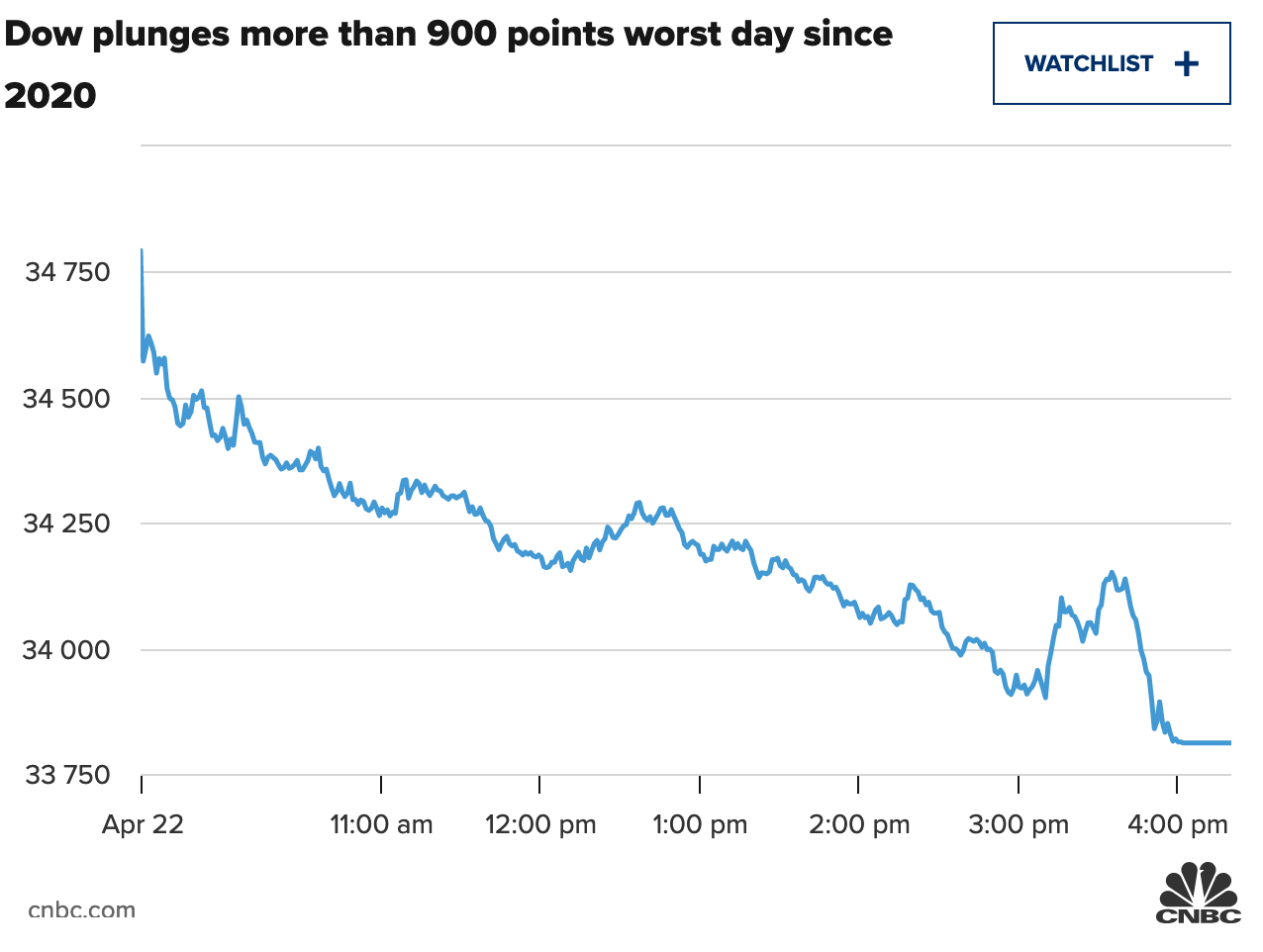

Last Friday’s trading session was a reminder that investors are standing on shaky ground when it comes to the markets. The Dow Jones Industrial Average fell by 900 points, marking its worst day since the height of the pandemic in 2020.

The S&P 500 fell by almost 3% as sell-offs continued, thanks to inflation fears and the prospect of rising interest rates as the U.S. Federal Reserve continues to tighten its monetary policy. Lower corporate earnings and not-so-optimistic guidance also dragged the markets down.

“Investors appear to be moving away from the TINA ‘there is no alternative’ narrative as of late when it comes to equities,” said Brian Price, head of investment management for Commonwealth Financial Network. ″This is the second straight week of significant outflows from equity mutual funds and days like today are unlikely to change the sentiment moving forward.”

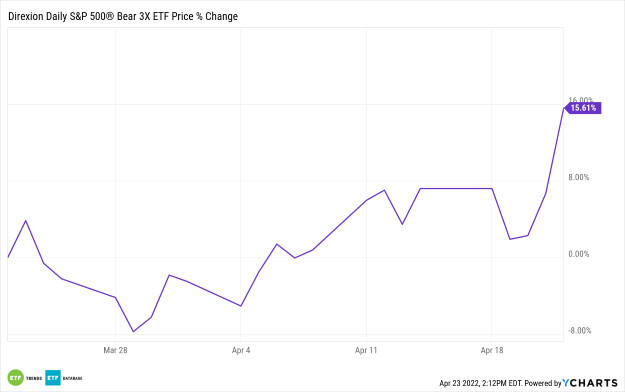

One play that has fared much better over the last 30 days was going short the S&P 500 via the Direxion Daily S&P 500 Bear 3X ETF (SPXS). SPXS, which seeks daily investment results equal to 300% of the inverse of the daily performance of the S&P 500 Index, is up almost 16% within the past month.

If Bullishness Prevails

However, not all is lost for the bulls. The markets are always sensitive to any sliver of positive news after a heavy sell-off, which can allow bulls to capitalize on an impending rally.

“Of course, the market can rally back ferociously this week if we get some good news, although that might take more than earnings beating expectations,” a Schaeffer’s Investment Research article says. “Per Refinitiv Eikon data, 77.8% of companies have beat earnings thus far, while selling pressure has increased. Macro factors are clearly driving this market, and we likely need to see some positive notes on that front.”

That said, when the S&P 500 rises, traders can play to the upside with the Direxion Daily S&P 500® Bull 3X Shares ETF (SPXL). Both SPXL and SPXS offer thrice the leverage, so only seasoned traders should use these products.

For more news, information, and strategy, visit the Leveraged & Inverse Channel.