After a relatively tepid year in 2020 due to the start of the pandemic, some shoppers are ready to come back this holiday season, giving ETF traders an opportunity to play the Direxion Daily Retail Bull 3X ETF (RETL).

According to a Retail Dive article: “Echoing other reports of increased consumer spending, a new survey from JLL found that respondents plan to spend an average of $870 per person on holiday expenses this year, a 25.4% increase from last year.” The majority of those consumers plan to continue using online retail as an avenue to make their gift purchases.

“The survey also found that 60.1% of survey respondents plan to buy their goods online from an online-only retailer,” the article added. “Meanwhile, 58% of respondents plan to shop in stores, and 52.6% of respondents want to buy their goods online and have them shipped directly to their homes.”

Where exactly are the retailers heading? The JLL survey pinpointed five big retailers: Amazon, Walmart, Target, Macy’s, and Kohl’s.

It’s not just online retail that’s set to experience an influx of consumers this year. With vaccine mandates being enforced and more consumers protecting themselves during the ongoing pandemic, they’re expected to return to brick and mortar stores as well.

“Consumers are eager to return to in-person shopping this holiday season—immersing themselves in the holiday spirit to dining after a long day of shopping. It’s a full holiday experience that many shoppers look forward to,” said Greg Maloney, president of JLL Retail. “And, it’s refreshing to see that in-person dining and enclosed malls are at the top of consumers’ destination lists.”

Big Returns for Retail

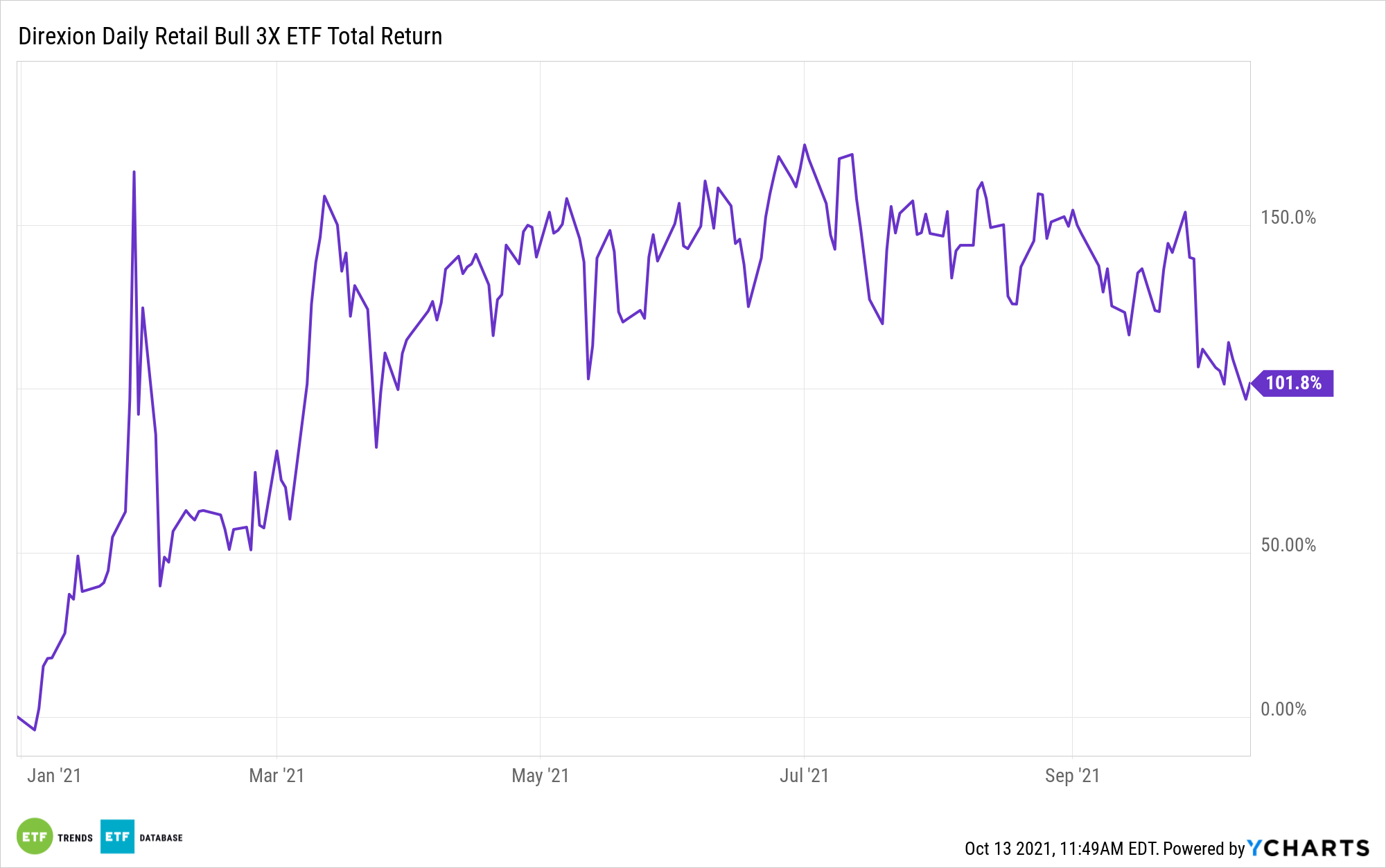

Traders who have been keen to ride the wave of RETL this year have been handsomely rewarded. According to Morningstar performance numbers, the ETF is up just over 100%.

RETL seeks daily investment results of 300% of the daily performance of the S&P Retail Select Industry Index. With its triple leverage, RETL gives investors the ability to:

- Magnify short-term perspective with daily 3X leverage.

- Go where there’s opportunity, with bull and bear funds for both sides of the trade.

- Stay agile, with liquidity to trade through rapidly changing markets.

For more news, information, and strategy, visit the Leveraged & Inverse Channel.