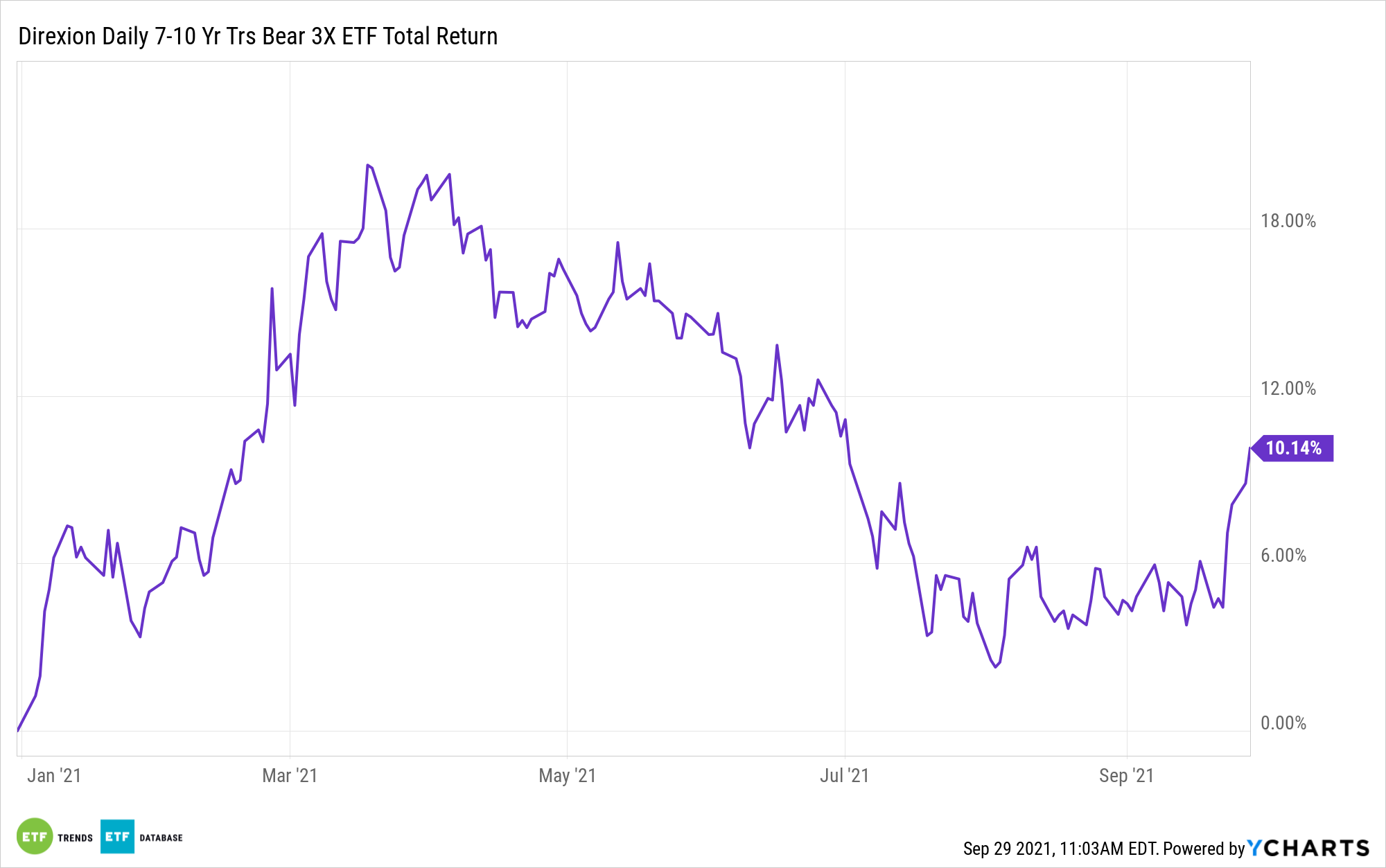

Rising yields are roiling the stock market indexes with heavy volatility, but traders can counter the move with the Direxion Daily 7-10 Year Treasury Bear 3X Shares (TYO).

According to a CNBC report, more volatility could be ahead for the stock market. Big tech in particular took the brunt of the blow with the Nasdaq Composite Index falling close to 3%, while the Dow Jones Industrial Average lost over 500 points in Tuesday’s trading session.

“A sharp jump in interest rates over the last several sessions stung the market, particularly the growth names,” the report said. “At its high Tuesday, the yield on the benchmark 10-year Treasury had climbed to 1.56%, about a quarter-percentage point move since the Federal Reserve meeting last Wednesday.”

“The S&P 500 ended the session down 2%, and the Nasdaq was off by 2.8% because of the large concentration of tech names in the index,” the report added. “Ten of the 11 S&P 500 sectors were down, with tech losing 2.9%. Energy was the only advancer, gaining 0.4%.”

Since bond prices and bond yields move inversely to one another, this sets up a play for TYO. It provides a hedging option against a trader’s existing positions in equities should they experience more weakness.

TYO seeks daily investment results, before fees and expenses, of 300% of the inverse (or opposite) of the daily performance of the ICE U.S. Treasury 7-10 Year Bond Index. The index is a market value weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less than or equal to 10 years.

Playing Large-Cap Weakness

The rise in bond yields opens the doors for large-cap weakness. In particular, this sets up potential trades in the Direxion Daily Technology Bear 3X ETF (TECS) and the Direxion Daily S&P 500 Bear 3X ETF (SPXS).

“We’re seeing a gap down decline that is being driven by the mega caps broadly, which are down anywhere from 2% to 5% at this time,” said Fairlead Strategies founder Katie Stockton.

“Keep an eye on the momentum behind them,” said Stockton. “Just their sheer footprint alone creates an issue. When they do this, it affects sentiment. People relied on Google and Microsoft to never go down. Now, they’re getting a reality check.”

For more news and information, visit the Leveraged & Inverse Channel.