Recession or no recession, demand for utilities will continue, making them a prime option in times of economic uncertainty such as now. Traders can also play the steadiness of the utilities sector with leveraged exchange traded funds (ETFs) from Direxion Investments.

Trading utilities can also provide a hedge against a volatile stock market, which investors know well after a rocky first half of 2022. When recession fears strike, a steady utility sector can help during risk mitigation, given its ability to help mute stock market downturns.

Quite simply, no matter what the stock market is doing, the lights need to stay on.

“Utilities provide services to nearly every home and business in the United States, supplying them with electricity, natural gas and water,” Forbes Advisor noted. “These heavily regulated companies are among the largest and most stable equity investments available in the stock market.”

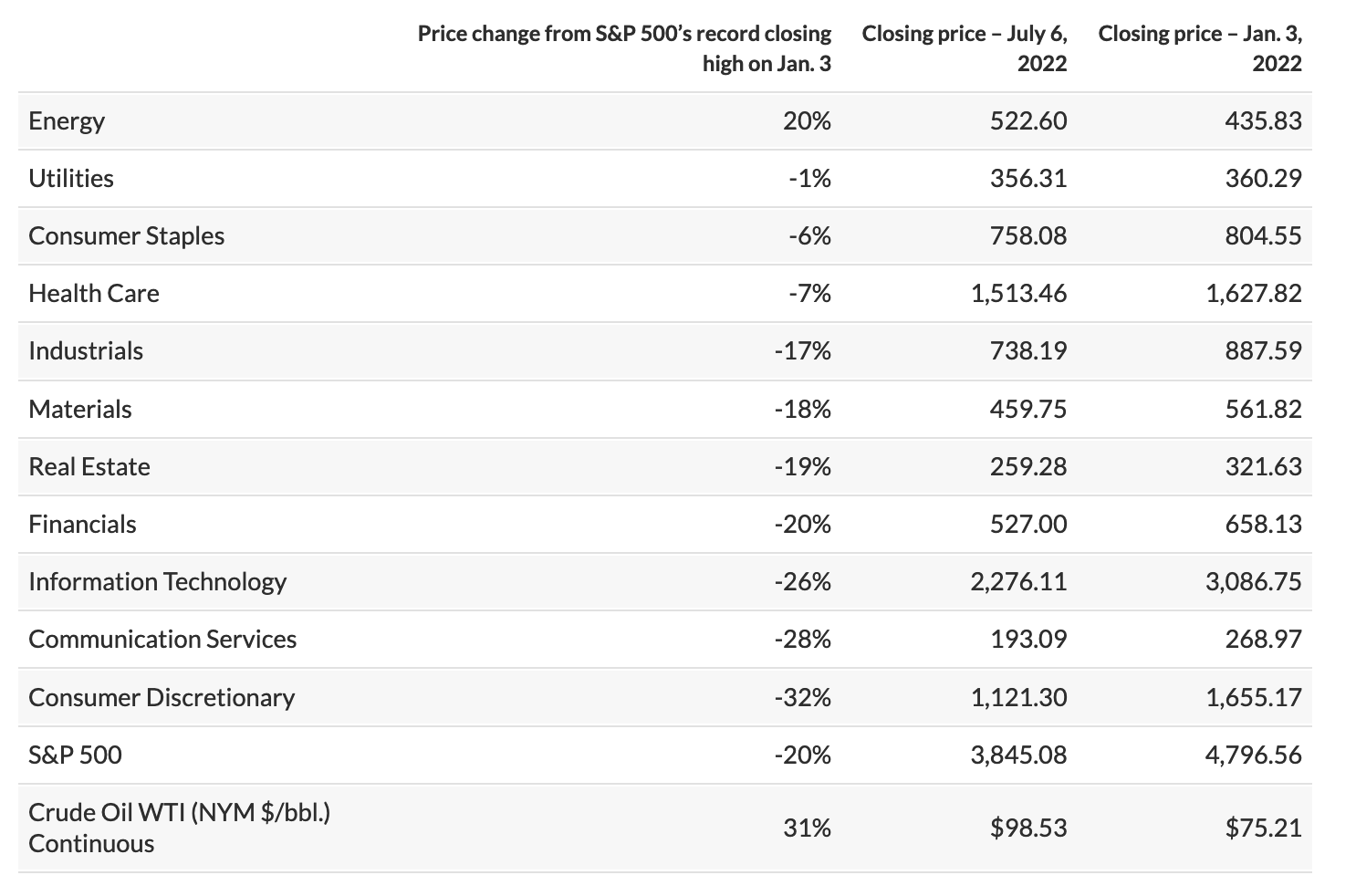

The sector has also proven its mettle, according to a MarketWatch article. Aside from energy, which has fared the best so far this year, utilities came in second.

“The energy sector has fared best, aided by the 31% increase in oil prices. However, it hit its own bear market in the past month amid recession fears and a pullback in crude,” the article said. “But the utilities sector has shined again, while featuring a weighted estimated annual dividend yield of 3.13%, based on consensus estimates among analysts polled by FactSet.”

Steady as Utilities Go

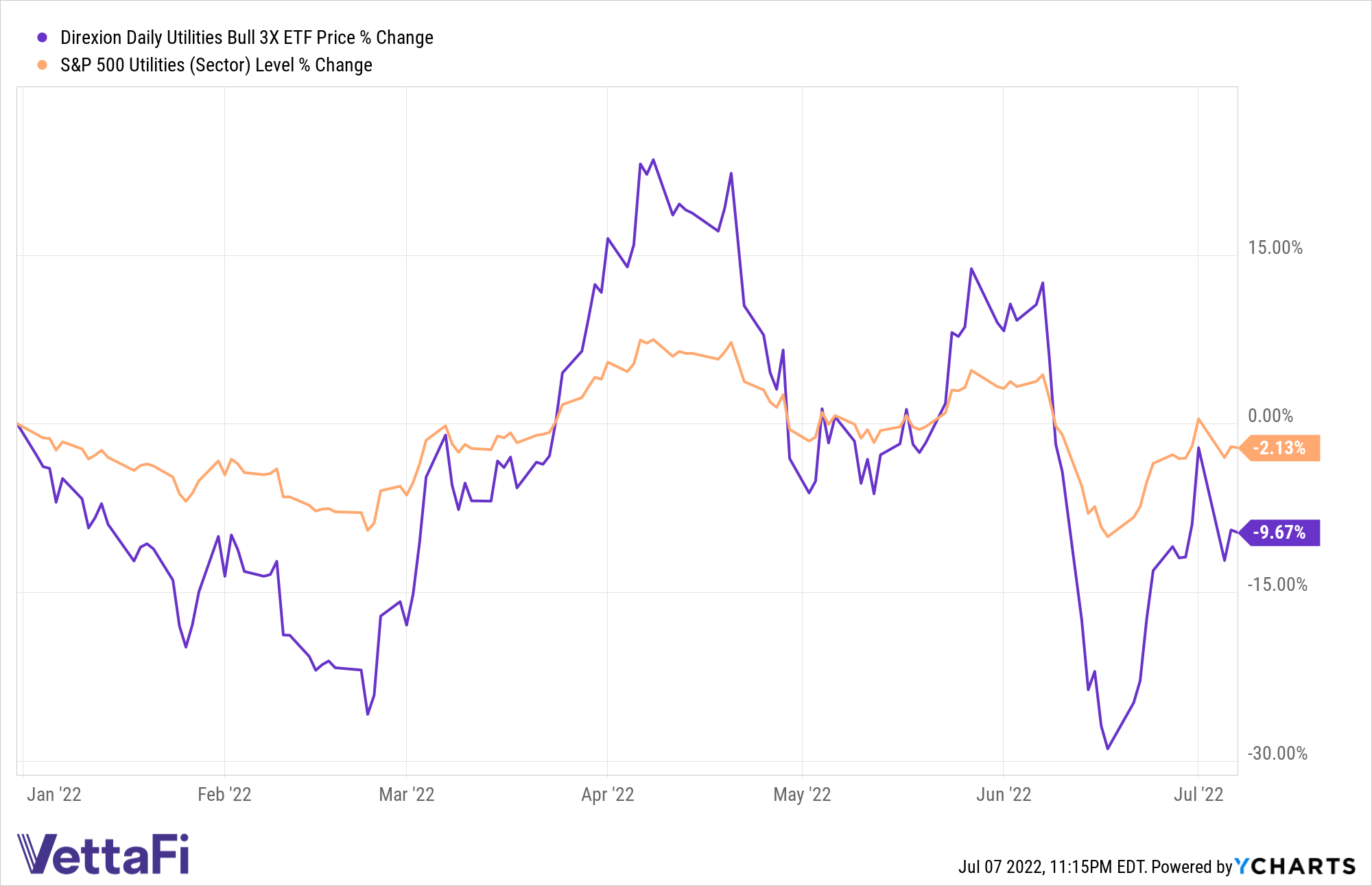

The S&P 500 is down roughly 20% so far this year. However, the utilities sector has been proving its resilience, especially when looking at the S&P 500 Utilities index, which is down only 2% comparably.

In times of upside, traders can get utilities exposure while amplifying their gains with triple leverage using the Direxion Daily Utilities Bull 3X Shares (UTSL). The fund seeks daily investment results equal to 300% of the daily performance of the Utilities Select Sector Index.

For more news, information, and strategy, visit the Leveraged & Inverse Channel.