High yield bond spreads have widened in recent weeks. For the week of October 14, spreads for high yield fixed income widened by 13 basis points, according to a weekly update on the U.S. credit markets from BondBloxx Investment Management.

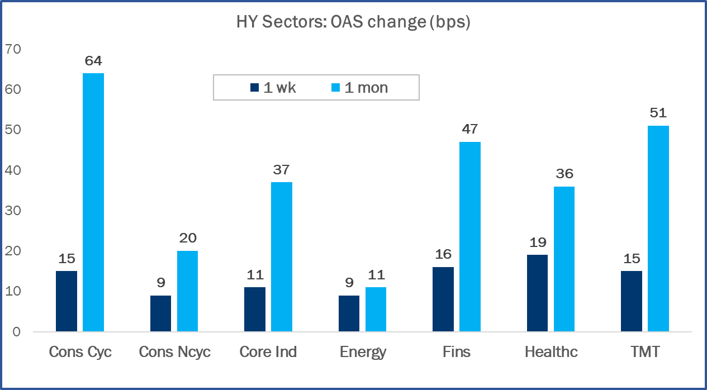

Last week, the healthcare industry experienced the most spread widening (by 19 bps), while consumer cyclicals experienced the largest widening over the past month (64 bps).

Data as of October 14, 2022

Sources: Ice Data Services; JP Morgan; IHS Markit; Bloomberg; TRACE, BondBloxx

High yield bonds are living up to their name this year. With yields now at an average of 9.3% — up from 4.4% at the start of the year, according to the ICE BofA US High Yield Index — the $1.5 trillion sector is looking increasingly appealing.

Launched in October of 2021 to provide precision ETF exposure for fixed income investors, BondBloxx was co-founded by ETF industry leaders Leland Clemons, Joanna Gallegos, Tony Kelly, Mark Miller, Brian O’Donnell, and Elya Schwartzman. The team has collectively built and launched over 350 ETFs at firms including BlackRock, JPMorgan, State Street, Northern Trust, and HSBC.

“Our conversations with investors have reinforced what we already knew – there is significant demand for more targeted fixed income products,” Kelly said. “Our initial product suites aim to create a full toolkit for high-yield investors looking to implement their specific views on the market, and we anticipate extending this approach to other fixed income asset classes.”

Since February, BondBloxx has launched 19 high-yield products, including eight target-duration U.S. Treasury ETFs, seven industry sector-specific high-yield bond ETFs, three ratings-specific high-yield bond ETFs, and one short-duration emerging market bond ETF.

“BondBloxx has continued to launch innovative products since its founding and has expanded the ETF universe with targeted products where there is white space,” said Todd Rosenbluth, head of research at VettaFi. “Their broad range of fixed income funds makes them a firm to watch as the asset category grows.”

For more news, information, and strategy, visit the Institutional Income Strategies Channel.