Last year, the market consensus was that there would be a recession in the second half of 2023. Instead, economic indicators have consistently outperformed market expectations.

“Nominal GDP consistently outperformed market expectations,” said JoAnne Bianco, a partner at BondBloxx Investment Management. “The U.S. economy demonstrated remarkable resilience throughout the year.”

And not only did a recession not hit in 2023, Bianco also doesn’t expect one to occur in 2024.

“We’re not forecasting a recession at any time during the year,” she said during a VettaFi-hosted webcast. “We think the U.S. economy will continue to demonstrate a lot of resilience despite today’s higher interest rate environment.”

See more: “Fixed Income Outperformed in 2023, But Not All Outperformance Was Equal”

U.S. High Yield Way Up After Being Down

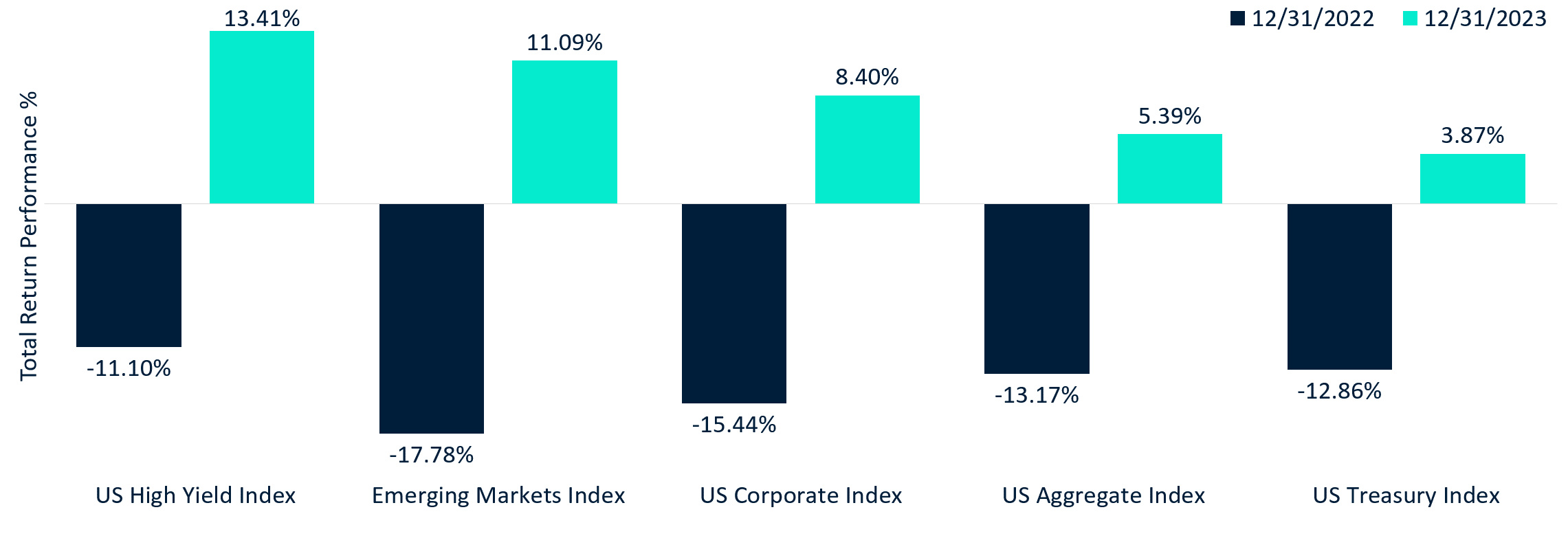

As a result of this resilient economy, fixed income saw a nice rebound across all sectors last year. Of course, this is after most bond sectors saw negative returns in 2022.

So, with the Fed either at or near the end of its rate hiking cycle, the BondBloxx partner argued that “fixed income investments will present a myriad of opportunities this year.”

In particular, U.S. high yield was up more than 13% for the year, after being down over 11% the year before. (Bianco did note, however, that of the sectors, high yield was the least negative in 2022.) Emerging markets sovereign debt was the second-best performer last year (returning more than11%). This is after EM debt experienced the worst performance in fixed income in 2022.

Fixed Income Returns in 2023 vs. 2022

Source: BondBloxx via ICE Data Services, J.P. Morgan, and Bloomberg.

In Bianco’s view, investors were under-allocated to high yield in 2023. But it’s an asset class with attractive characteristics for investors. So, investors would be “well served by looking beyond broad-based benchmarks in fixed income. Therefore, they “should invest in more precise exposures.”

Choosing Your Entry Points Carefully With BondBloxx ETFs

BondBloxx offers a suite of seven sector-specific high yield bond funds. Among them are the BondBloxx USD High Yield Bond Energy Sector ETF (XHYE), the BondBloxx US High Yield Consumer Cyclicals Sector ETF (XHYC), and the BondBloxx USD High Yield Bond Industrial Sector ETF (XHYI).

And for investors who want to target EM sovereign debt, BondBloxx offers the BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF (XEMD). This fund targets short- to intermediate-term U.S.-dollar-denominated EM bonds, excluding bonds with maturities longer than 10 years.

BondBloxx is a fixed income manager with more than $2.6 billion in assets. VettaFi’s Head of Research Todd Rosenbluth called BondBloxx “one of the more innovative providers of fixed income ETFs.”

For more news, information, and analysis, visit the Institutional Income Strategies Channel.