Institutional investors are becoming increasingly interested in emerging markets debt. Considering EM debt yields are at their highest level in 10 years, that’s not surprising.

As the Federal Reserve eases up on its pace of rate hikes, investor confidence in EM debt is growing. A report from Institutional Investor said that “emerging markets are gaining ground offering investors higher credit yields and stronger growth potential.”

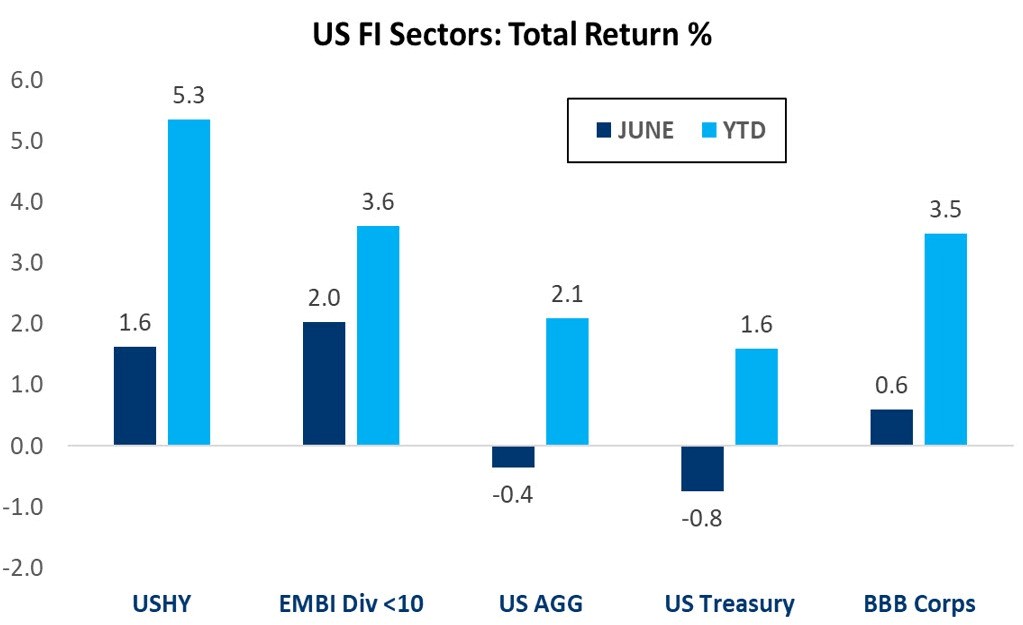

According to BondBloxx Investment Management, the asset class delivered its best performance since January. The fixed income specialist reported that EM debt returned 2% for June and 3.6% year-to-date.

See more: “Strong Growth and Higher Yield Make Emerging Markets Debt Attractive”

Sources: ICE Data Services, JP Morgan, Bloomberg | Data as of 6/30/2023

Manage Duration Exposure With XEMD

The BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF (XEMD) targets short- to intermediate-term U.S. dollar-denominated, EM bonds. It excludes bonds with maturities longer than 10 years. The fund tracks the J.P. Morgan EMBI Global Diversified Liquid 1-10 Year Maturity Index.

XEMD’s index was built without making significant country or sector deviations from the full index. The index is also shorter in duration than other broad market emerging market bond benchmarks. This results in potential relative performance advantages during a rising rate environment.

“XEMD is designed to give fixed income investors the ability to better manage their duration exposure when investing in emerging markets debt,” said JoAnne Bianco, client portfolio manager at BondBloxx.

XEMD is one of 19 fixed income ETFs that BondBloxx has launched since February 2022, which also include seven industry sector-specific high-yield bond ETFs, three ratings-specific high-yield bond ETFs, and eight target-duration U.S. Treasury ETFs.

BondBloxx was launched in October 2021 to provide precision ETF exposure for fixed income investors. It was founded by ETF industry leaders Leland Clemons, Joanna Gallegos, Tony Kelly, Mark Miller, Brian O’Donnell, and Elya Schwartzman. The team has collectively launched over 350 ETFs at firms including BlackRock, JPMorgan, State Street, Northern Trust, and HSBC.

For more news, information, and analysis, visit the Institutional Income Strategies Channel.