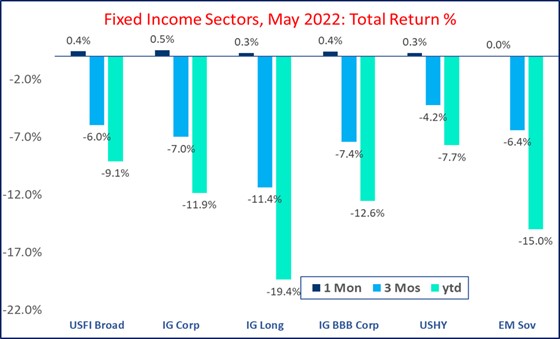

Returns for U.S. high yield fixed income is leading most fixed income sectors so far this year. High yield returned -7.7% year-to-date as of May 31, according to BondBloxx Investment Management co-founder and CIO Elya Schwartzman in a monthly update on the U.S. credit markets.

Meanwhile, interest rates battered higher-rated and longer-maturity sectors, with investment-grade bonds returning -12% and broad IG fixed income down over 9% during the same period. For May, high yield debt lagged but still recorded positive returns for the month at 0.3%.

Source: Ice Data Services, JP Morgan, Bloomberg, BondBloxx

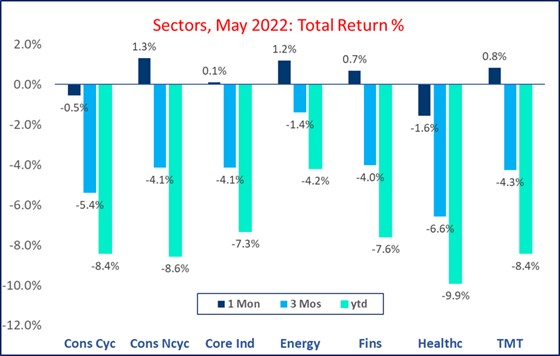

Within U.S. high yield, energy and consumer non-cyclicals were strong performers in May, returning 1.2% and 1.3% in May, respectively. Schwartzman attributed the positive returns to oil prices bucking any softening economic trends and continuing debt tenders by industry behemoth Occidental Petroleum.

At the other end of the spectrum, credit concerns among several issuers drove the U.S. high yield healthcare sector down to -1.6% in May.

The range of performance in May was 2.9% between the best and worst-performing sectors. For the year-to-date period, there’s been a spread of nearly 6% between the best and worst-performing sectors, as the volatile market has amplified dispersion.

Source: Ice Data Services, JP Morgan, Bloomberg, BondBloxx

Lower treasury yields in May helped drive the BB sector to a positive 1.5% return, leading the high yield ratings buckets, and even reporting a spread tightening of 10 bps. While CCC corporates experienced a sharp reversal in the last half of May, returns were still -2.9% for the month as spreads widened 100 bps in this bucket.

Schwartzman co-founded BondBloxx along with ETF industry leaders Leland Clemons, Joanna Gallegos, Mark Miller, Brian O’Donnell, and Tony Kelly. The team has collectively built and launched over 350 ETFs at firms including BlackRock, JPMorgan, State Street, Northern Trust, and HSBC.

According to the issuer, more institutional investors are acknowledging the role that fixed-income ETFs can play in their portfolios, even during times of volatility. They can offer short-term liquidity alongside a more efficient way to keep portfolios in balance. Sector ETFs enable intentional tactical tilts to be added to their portfolios. They can also enhance price discovery, even when transparency is low or the underlying securities are not trading.

“One of our goals at BondBloxx is to provide market awareness of the variation of returns within the credit markets,” said Schwartzman. “An important yet unappreciated source of outperformance for investors is the dispersion of returns within the broader bond market categories, especially during times of market dislocation.”

Last month, BondBloxx launched three new ETFs that track ratings-specific sub-indexes of the ICE BofA US Cash Pay High Yield Constrained Index. These three new products join the suite of seven sector-specific high yield ETFs that the high yield fixed income ETF issuer launched earlier this year.

For more news, information, and strategy, visit the Institutional Income Strategies Channel.