Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, James Comtois and Elle Caruso debate the pros and cons of investing in high yield fixed income ETFs.

James Comtois, staff writer, VettaFi: Greetings, Elle! Interest rates are high, and the debt ceiling nonsense is behind us (for now). So, I’m feeling a little more risk-on with my investments these days. That’s why I’m thinking now’s the right time to target some high yield fixed income.

We’ve heard the battle cry: Bonds are back because yields are back. That’s certainly the case with high yield bonds. Rates are high. Like, real high. High yield bond yields are currently yielding over 8%. That’s double where they were at the start of 2022.

At these higher yielding levels, high yield fixed income gives investor portfolios a much-needed cushion. It also offers the potential for attractive total return performance, even if spreads were to widen from here.

So, what say you, Elle? Care to join me in buying some high yield bond ETFs to diversify our portfolios? Perhaps some shares of the SPDR Bloomberg High Yield Bond ETF (JNK)? Or have I completely forgotten how this column works, and you’re about to tell me to slow my roll?

Only Attractive on Paper?

Elle Caruso, staff writer, VettaFi: Hello, James! While I agree that high yield bonds look attractive on paper, I will argue that the risk/return fundamentals aren’t nearly as attractive as some other fixed income opportunities.

The debt ceiling debacle may have been solved, but there are still many other uncertainties that have weighed on U.S. markets. Inflation has eased slightly but remains stubbornly high, the market isn’t certain about the trajectory of interest rates, and many investors still fear that a recession is coming in the second half of the year.

If there is a recession, investors are better positioned staying investment-grade and keeping high yield exposure low. We all know that when a recession hits, the companies issuing high yield bonds are going to be among the first to go.

In fact, there are points on the yield curve where investors can manage risk and control duration, but also lock in a nice yield and return over the coming years.

In the current environment, investors can lock in an attractive 6% yield for a couple of years with just two to three years of duration risk by staying investment-grade. The Invesco Variable Rate Investment Grade ETF (VRIG) has a 30-day SEC unsubsidized yield of 6.0% as of June 12.

Not Actually That Risky

Comtois: I totally understand the apprehension. I mean, they’re called “junk bonds,” after all. But despite all the talk about them being riskier assets, they’re not really that risky.

Historically, the risk of defaults is low, and the fundamentals of the asset class are quite strong. Thanks in part to the Federal Reserve aggressively raising interest rates, fundamentals started 2023 from a position of strength.

That’s what makes this cycle different. We’re neither starting from a riskier fundamental backdrop, nor from clear excesses in the high yield market.

In fact, the quality of the high yield market is the highest it’s been in more than a decade. Bonds rated double-B currently make up 52% of the market. And in the event of a possible recession, high yield may be more resilient than skeptics think. According to Oaktree, the high yield market “appears to be better positioned to weather an economic downturn than in the past.”

The great thing about high yield bond ETFs is that they let you not only customize your exposure, but also customize your risk. BondBloxx has seven industry sector-specific high yield bond ETFs that offer precise, index-based exposure to the high yield asset class.

The fixed income specialist also has three ratings-specific high yield bond ETFs. This includes the BondBloxx BB-Rated USD High Yield Corporate Bond ETF (XBB), which seeks to invest in bonds rated BB1 through BB3, and the BondBloxx CCC-Rated USD High Yield Corporate Bond ETF (XCCC), which seeks to invest in bonds rated CCC1 through CCC3. These funds can serve as good entry points into high yield, depending on an investor’s risk tolerance and what they expect for the U.S. economy.

Simply Not Worth It

Caruso: You bring up some great points on the risk profile of high yield bonds, James. I’ve talked a lot about recessionary risks, but staying investment-grade is favorable in an inflationary environment too.

If there isn’t a recession, if the economy hangs in there and interest rates stay higher for longer, the yields of floating-rate exposure at the front of the curve will hold up. The higher risk of high yield bonds simply doesn’t seem worth it when investment-grade is yielding more and is safer.

For example, I just can’t understand why high yield bonds look attractive when the Invesco AAA CLO Floating Rate Note ETF (ICLO) allows investors to stay AAA and floating-rate, but still pick up over 70 basis points over Treasuries. The 30-day SEC unsubsidized yield of ICLO is 6.6% as of June 12.

Better Than (Other) Bonds, Safer Than Stocks

Comtois: Investment-grade is obviously the safer, and seemingly more reliable bet. But T. Rowe Price has noted that high yield bonds have outperformed nearly all other major forms of fixed income over the long term. For the 10 years ended August 31, high yield bonds generated a cumulative total return of 74%. Meanwhile, U.S. Treasuries returned 19%, and investment‑grade corporates yielded 43% for the same period.

This actually leads to another reason why I’m bullish on high yield: believe it or not, they’re safer than equities. The volatility of high yield returns is significantly lower than the volatility experienced by equities. High yield’s significant coupon income component provides a cushion for price declines. Stocks don’t offer this same level of cushion with their dividends.

Plus, if a company fails, bondholders get paid out before stockholders during the liquidation process. So, even if a company defaults, bondholders have a better chance of getting some money back than stockholders. And again, even this risk is significantly mitigated when investing in a basket of high yield corporate debt issuers through an ETF.

Maybe Skip High Yield Altogether and Try Bank Loans

Caruso: It is true that fixed income is largely seen as safer than equities; however, investors can mitigate risk further by skipping out on high yield altogether. Investors who really want to squeeze as much yield as possible might look to bank loans instead of high yield bonds. Bank loans offer a more conservative way to access a high yield.

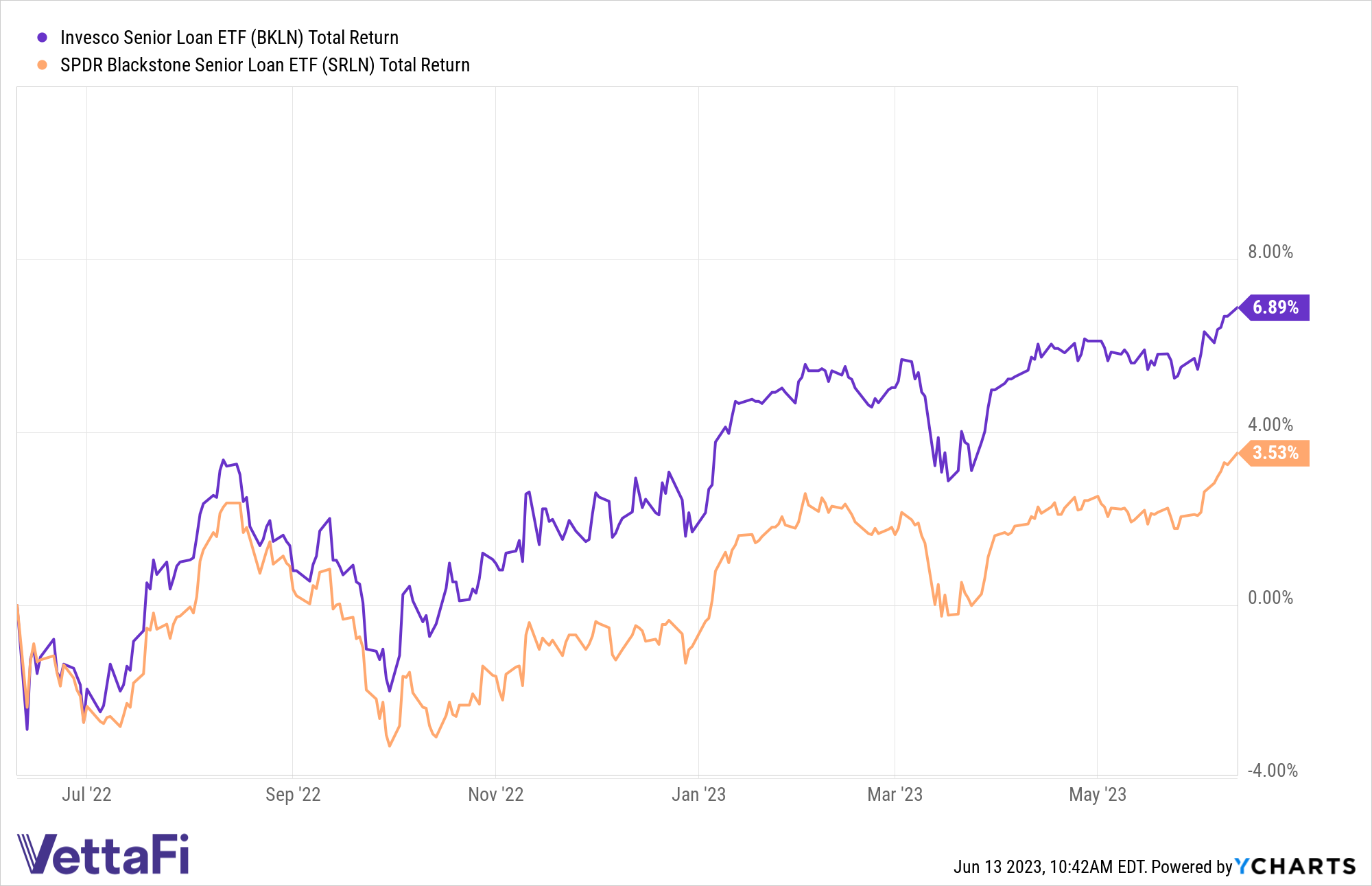

The Invesco Senior Loan ETF’s (BKLN) had a 30-day SEC unsubsidized yield of 8.7% as of June 12. I like BKLN, as it tends to be more defensive than its active peers in the bank loan ETF category. It offers a high yield, but it takes a more conservative, low-duration, higher-quality approach.

BKLN has also outperformed over the past year, which is notable as the lack of Fed support has caused the market to be more challenged. BKLN has outpaced the SPDR Blackstone Senior Loan ETF (SRLN) by over 350 basis points over a one-year period.

Comtois: Very fair point, Elle. Heck, I’m not at all averse to putting investment-grade corporate bonds or bank loans in a portfolio. I’m all about diversifying!

While I do acknowledge the risks involved, I think high yield fixed income ETFs are a good diversifier for an investor’s portfolio. The yields are high, the risks are (relatively speaking) low, and when it comes to volatility, they’re less volatile than volatile stocks.

Until next time, Elle!

For more news, information, and analysis, visit the Institutional Income Strategies Channel.