We are focusing a lot of attention on fixed income at VettaFi in October. This week, we are hosting webcasts with AllianceBernstein and State Street Global Advisors. We also have an Income Strategy Symposium with 11 asset management partners. These 20-minute discussions will be taking place over two-plus hours. We believe interest in the asset category remains high, but that fixed income sentiment could be shifting.

What Does the Data Indicate to Us?

VettaFi and our clients can use a robust dataset, called Explorer, to understand what asset classes, categories, and areas of focus are resonating with our audience. This is helpful for spotting trends and helping asset managers understand what products are in focus.

In the screenshot below from Explorer using data since July, note the teal bars (corporate broad-based) in the middle of the chart. They became larger than the green bars (government-Treasuries) at the bottom of the chart.

Interest in U.S. Corporate Bonds Rising in Favor of Treasury Bonds

A Closer Look at Fixed Income Flows

Looking back over the past month, demand has been strongest for high-quality safe-haven ETFs. Ultra-short ETFs like the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) and iShares Short Treasury Bond ETF (SHV) were among the most popular according to VettaFi’s LOGICLY data. BIL and SHV added $4.0 billion and $1.9 billion of new money as of October 19, respectively. Meanwhile, the iShares 20+ Year Treasury ETF (TLT) matched its much-less-rate-sensitive sibling SHV in flows.

What also catches my attention is the demand for municipal bond ETFs and active ETFs. The iShares National Municipal Bond (MUB) and the Vanguard Tax-Exempt Bond ETF (VTEB) were among the largest fixed income ETF asset gatherers. Others included the PIMCO Short Maturity Active ETF (MINT) and the Fidelity Total Bond ETF (FBND).

VettaFi Income Symposium attendees are going to hear from Fidelity during the kick-off session. We will focus on where advisors were putting money to work in fixed income in 2023 and what’s ahead for 2024. A later session that day will involve active managers talking about the risks and opportunities in the municipal bond market.

Largest Fixed Income ETF Net Inflows in Past Month

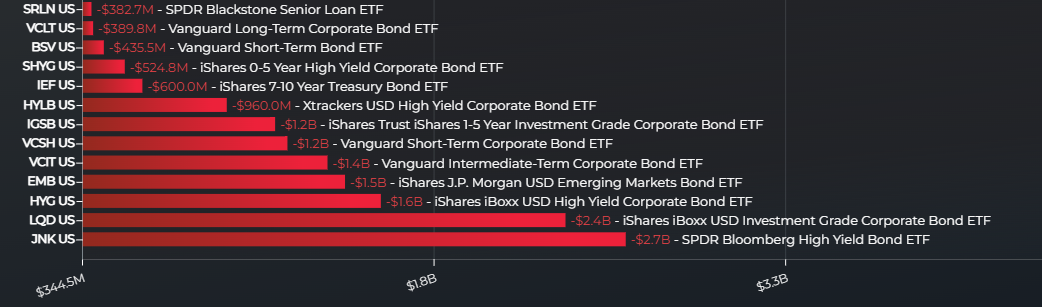

Investors Redeemed High Yield ETFs

In contrast, the SPDR Bloomberg High Yield Bond ETF (JNK) had the highest net outflows, with $2.7 billion redeemed in the past month. High-yield peers like the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and the Xtrackers USD High Yield Corporate Bond ETF (HYLB) also had sizable net outflows. Investors have been rewarded for taking on credit risk and not interest rate risk thus far in 2023. The three diversified high yield ETFs were up approximately 3% for the year, in contrast to the highly rate sensitive TLT that was down more than 11%. Meanwhile, the more targeted BondBloxx CCC-rated USD High Yield Corporate Bond ETF (XCCC) had a nearly 9% total return for the year.

Largest Fixed Income ETF Net Outflows in Past Month

Despite the recent flows data, based on VettaFi sentiment, investors are looking more closely to learn about corporate bonds heading into 2024. We hope you join VettaFi’s upcoming events to hear from the experts.

For more news, information, and strategy, visit ETF Trends.