Bond investments remain in focus for many advisors given the geopolitical and monetary policy uncertainties. The recent yield on the 10-year Treasury of 5.0% was at levels we have not seen since the Sopranos was on TV. Yet, the first nine months of 2023, fixed income ETFs gathered 42% share of the U.S. industry net inflows. This is more than double the market share for the $1.4 trillion asset class. According to recent VettaFi sentiment data, many advisors plan to boost exposure to bonds.

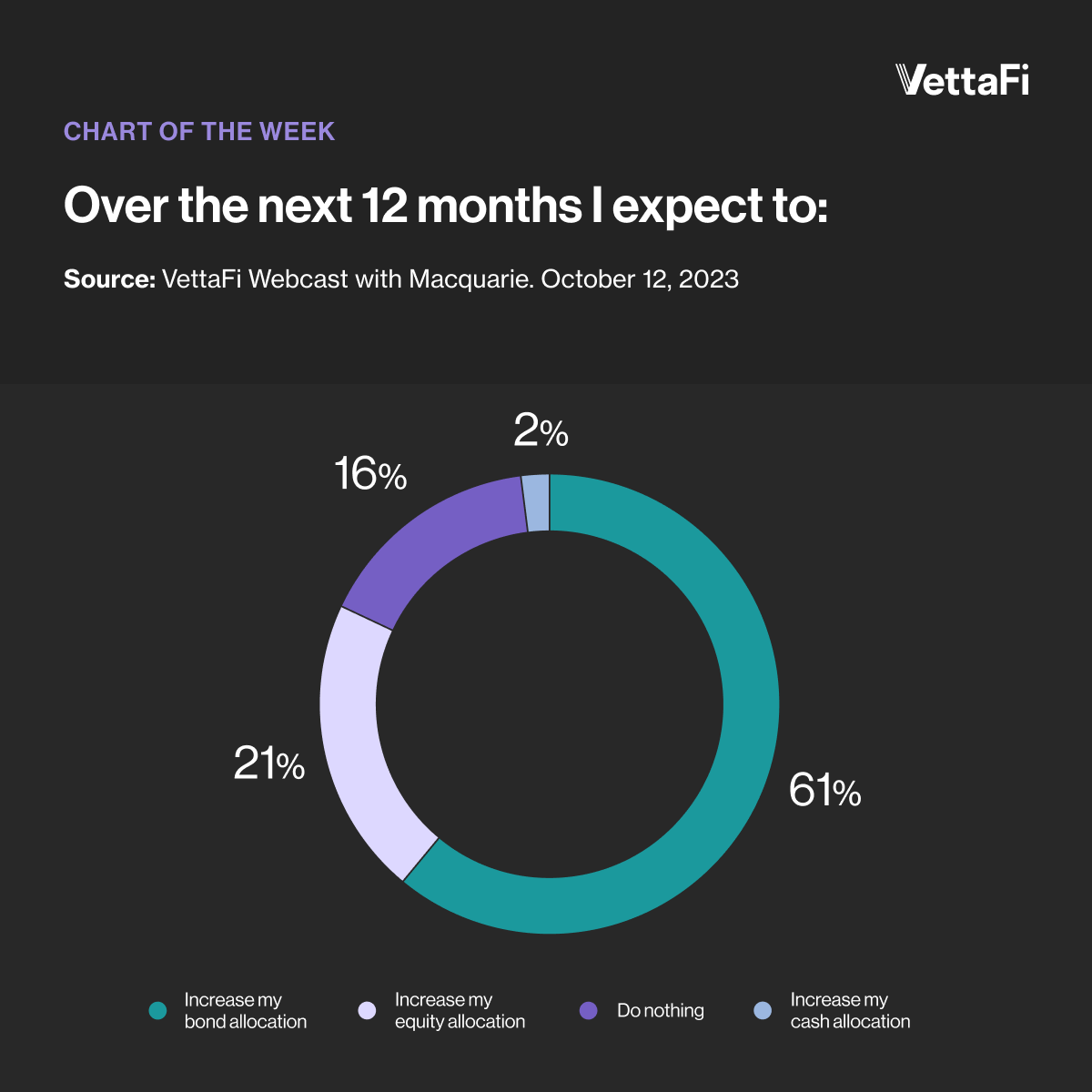

During a webcast with Macquarie in mid-October, VettaFi asked advisors about their expected moves over the next 12 months. The majority (61% of respondents) planned to increase their bond allocations, which compares to just 21% and 2%, respectfully, who plan to increase equity and cash allocations. The remainder plan to do nothing.

Many Advisors Plan to Increase Their Bond Allocation

The VettaFi Income Strategy Symposium

On Friday October 27, VettaFi is hosting an Income Strategy Symposium starting at 11am. We’re bringing industry experts from leading asset managers. We will talk about where advisors allocate their bond assets; whether taking on corporate credit risk leads to compensation; the risks and opportunities of municipal bonds and the growing popularity of active funds; and more. I’m moderating some of these sessions – my colleague Tom Lydon is hosting the others — and I wanted to offer a taste of what to expect.

At 11:20, I’ll be talking to Riverfront and T. Rowe Price about high yield. Year-to-date through October 18, taking on credit risk had been rewarding. The T. Rowe Price U.S. High Yield ETF (THYF) was up 3.9% compared to the 1.7% decline for the iShares Core Aggregate Bond ETF (AGG). Relative to its high yield benchmark, THYF was recently overweighted toward the more speculative-grade B- (33% of assets) and CCC- (11%) rated bonds. I’m interested to learn why.

The Riverfront Strategic Income ETF (RIGS) has a broader investment mandate than THYF. The active multi-sector ETF has the flexibility to invest in bonds of various maturities, credit ratings and currency denominations. Recently the fund had some high-quality US government bond exposure (20% of assets), but investors allocated most assets to corporate bonds. RIGS had a mix of investment and speculative grade bonds. I’m curious to understand management’s allocation decisions.

Talking Active Bond ETFs and More

At 12:05, I’ll be back talking about active fixed income funds with Capital Group and Vanguard. After decades offering fixed income mutual funds, Capital Group entered the ETF market in early 2022 with active strategies. However, a new suite began trading in late September. One of these, the Capital Group Core Bond ETF (CGCB), is likely to be highlighted during the Income Strategy Symposium. CGCB invests primarily in high-quality asset-backed, mortgage-backed, and investment-grade corporate bonds. The fund seeks to add value relative to an index-based strategy via security selection.

Vanguard’s fixed income ETF presence has largely been index-based, via Vanguard Total Bond Index ETF (BND) and peers. However, they have a strong active fixed income mutual fund franchise. For example, the Vanguard Core Bond (VCORX), is rated four stars by Morningstar. Vanguard plans to launch a pair of active fixed income ETFs in December. While we don’t expect to hear much about them during the Income Strategy Symposium, due to regulatory constraints, we anticipate Vanguard’s fixed income expert will showcase how an active approach can add value.

Over two-plus hours, there will be other sessions worthy of attending. Speakers from Amplify, Columbia Threadneedle, Fidelity, Goldman Sachs, KraneShares, Morgan Stanley NEOS, will provide a perspective on how there are more ETF tools income-minded advisors to consider. So register today.

For more news, information, and analysis, visit Vettafi | ETF Trends.