Even after high demand in 2023, quality-focused investments are popular again in 2024. Indeed, during the VettaFi Equity Symposium last week, advisors told us that the quality factor was highly appealing in the current environment.

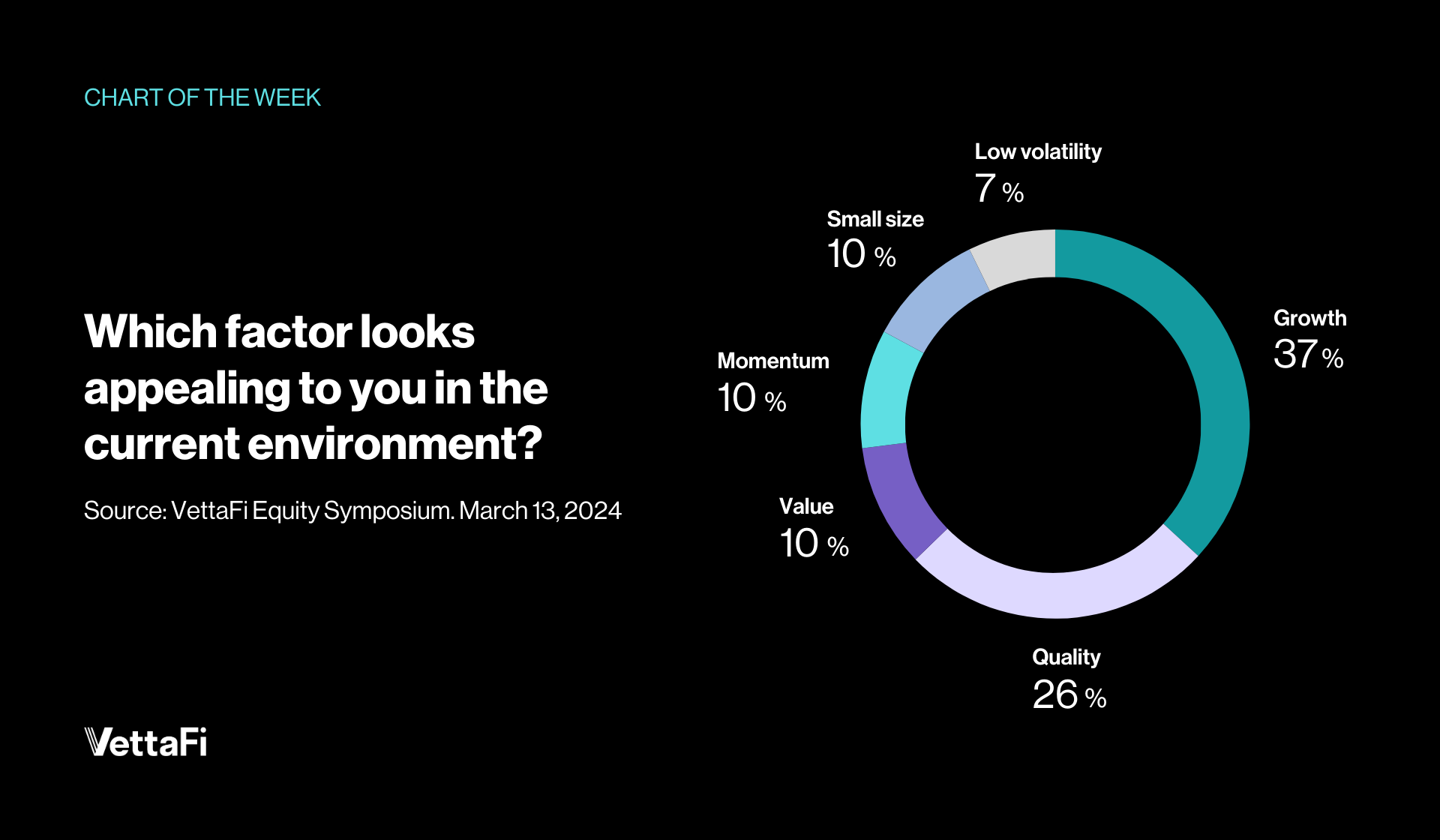

While the strong performing growth factor garnered the highest percentage of poll responses (37%), quality came in second (26%). These two were easily ahead of value (10.3%), momentum (9.9%), small size (9.9%), and low volatility (7.3%).

Top Quality ETF Traded Heavily Last Week

This data was pulled together on Wednesday last week. However, on Thursday, the largest quality ETF had unusually strong volume. The iShares MSCI USA Quality Factor ETF (QUAL) had $39 billion in assets on March 13 and traded on average 1.1 million shares daily. On March 14, the fund traded a relatively high 18 million shares.

We believe investors often turn to ETFs like QUAL to add equity exposure but in a modest risk-conscious manner. This is often around events like the end of strong earnings season or ahead of a key Federal Reserve meeting. The last time in 2024 that QUAL traded so heavily was on January 25, when the fund traded 19 million shares.

We believe QUAL incurred net redemptions in 2024 through March 13 due in part to a BlackRock model allocation change. However, we think BlackRock just added back exposure to QUAL to support advisors that work with third-party platforms like Envestnet. QUAL recently had 31% in information technology, 12% in financials, and 12% in healthcare stocks.

The second largest quality ETF is the Invesco S&P 500 Quality ETF (SPHQ), which manages $8.5 billion in assets. While SPHQ did not see a volume spike last week, the ETF already gathered $1 billion year-to-date through March 13. SPHQ recently had 35% of assets in information technology, 14% in healthcare and 11% in industrials.

Lesser-Known Quality ETF Alternatives

Given the persistent advisor interest in quality ETFs we want to highlight a couple of lesser known but strong funds. One such ETF is the American Century US Quality Growth ETF (QGRO), which combines quality and growth factors. At the Exchange conference in February, we had a chance to speak about that fund, which ties the two popular factors from our advisor poll together. QGRO recently managed $900 million in assets.

“We look for companies that have stronger balance sheets, more stable earnings growth, better management quality, and lower leverage,” explained Rene Casis, portfolio manager for American Century. “From there, we look for a diversified set of growth companies.”

Recent holdings included Booking Holdings, Nvidia, ServiceNow, and TJX Companies. At the sector level, information technology (38% of assets), consumer discretionary (20%), and industrials (12%) were the largest.

Another compelling fund is the Fidelity Quality Factor ETF (FQAL). The fund prioritizes companies with higher profitability, stable cash flows and good balance sheets. Those include Berkshire Hathaway, Broadcom, Eli Lilly, Home Depot, and Microsoft. Fidelity’s factor ETFs take a sector-neutral approach, so information technology (29%), financials (13%), healthcare (12%) were the largest. FQAL manages approximately $750 million in assets.

For more news, information, and strategy, visit the Innovative ETFs Channel.