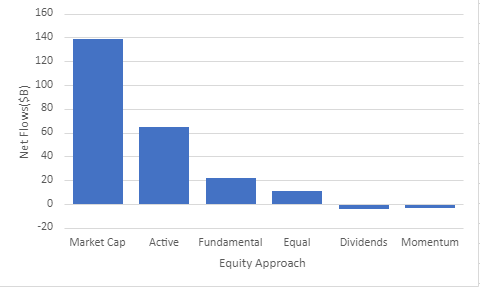

Approximately $140 billion of net inflows went into market-cap-weighted equity index ETFs in the first nine months of 2023. The Vanguard S&P 500 ETF (VOO) is an example of such a popular ETF. An additional $65 billion flowed into actively managed equity ETFs like the JPMorgan Equity Premium Income ETF (JEPI). However, $22 billion moved into fundamentally weighted equity index ETFs, while dividend and momentum ETFs had outflows. This is sizable and warrants some added attention.

Fundamentally Weighted Equity ETFs Gaining Ground in First Nine Months of 2023

Fundamentally weighted index ETFs take a company’s financial profile into account, in a similar way that an active manager would. However, the fundamentally weighted funds follow index guidelines rather than allowing for management discretion that could work in favor or against the selection process.

In 2023, the two most popular fundamentally weighted ETFs were the iShares MSCI Quality Factor ETF (QUAL) and the Pacer US Cash Cows ETF (COWZ). QUAL and COWZ added $9.5 billion and $4.1 billion, respectively. These two ETFs have benefited as investors sought relative stability via the equity markets. However, they are built differently than one another as well as new entrants.

What’s Inside Fundamentally Weighted ETFs

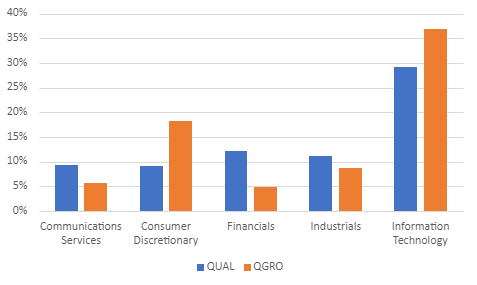

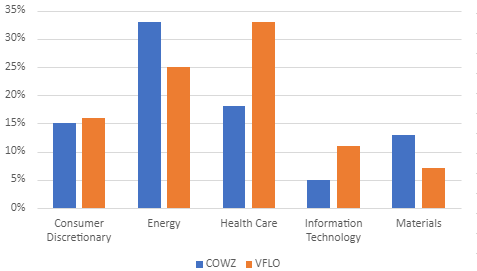

QUAL owns shares of companies with high return on equity, stable year-over-year earnings growth, and low financial leverage traits. Eli Lilly, Nike, Nvidia, and Visa are examples of QUAL holdings. COWZ owns companies with high free cash flow relative to its value (free cash flow yield). These include Altria, CVS Health, McKesson, and Valero Energy. Both ETFs are rebalanced on a planned schedule during the year unlike market-cap-weighted ETFs.

QUAL rebalances semiannually and takes a sector-neutral approach. As such, it has a relatively high stake in information technology (29% of assets) and relatively low exposure to energy (5%).

In contrast, COWZ is rebalanced quarterly and has no sector constraints. COWZ has 33% invested in energy stocks, but just 5% in information technology.

There are also newer and less known fundamentally weighted index ETFs that incorporate some similar metrics as QUAL and COWZ but add in some growth attributes. They are the American Century U.S. Quality Growth ETF (QGRO) and the Victory Free Cash Flow ETF (VFLO). Both ETFs track indexes tied to VettaFi.

Quality Is in the Eye of the Beholder (% of Assets)

QGRO’s quality attributes incorporate profitability, earnings quality, and leverage. However, the tracking index, which is reconstituted quarterly, also uses capital expenditures, earnings estimate revisions, and price momentum metrics. This adds a growth twist to what is used for QUAL and shifts the sector exposure. Relative to QUAL, QGRO has more exposure to information technology (37% of assets vs. 29%) and consumer discretionary (18% vs. 9%) and less in financials (5% vs. 12%). Autodesk, Synopsys, and TJX Companies are examples of top holdings.

Free Cash Flow Focused ETFs Are Different (% of Assets)

Like COWZ, VFLO focuses on companies with high free cash flow yield, but its index removes companies on a quarterly basis because of weak growth prospects. This growth filter results in a different portfolio than COWZ. Exposure is greater for VFLO in healthcare (33% of assets vs. 18%) and lower in energy (25% vs. 33%). Abbvie, Bristol-Myers Squibb, and Cigna are some top holdings.

Even when fundamentals matter to ETF investors, it matters what metrics are being used to construct the index. We are big believers in looking inside to know what you own and why.

For more news, information, and analysis, visit VettaFi | ETF Trends.