Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides to debate controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Nick Peters-Golden and James Comtois debate whether this is truly the year active ETFs turned pretty.

Nick Peters-Golden, staff writer, VettaFi: Hi James! Active ETFs have made plenty of headlines this year, with the ETF ecosystem once again swooning at the prospect of meaningful outperformance by experienced managers. I thought it was about time we VettaFi writers took a closer look at active management. I think there’s a real story behind the “Year of Active” narrative that investors and advisors should be accounting for looking ahead to 2024.

Active ETFs: By the Numbers

Let’s take a closer look at the success active ETFs have had this year and the milestones they’ve hit. First off, let’s look at the number of overall ETF launches and the role of active ETFs therein.

ETF launches are on track to set a record this year, having last done so in 2021. As of October this year, 391 new ETFs had launched compared to just 311 at the same time in October 2021. So what’s driving that big jump in ETFs? Active exchange traded funds are. Nearly 75% of ETFs launched this year have been active.

That’s one of the biggest jumps we’ve seen in active ETF launches since they first burst onto the scene in 2008. We may be witnessing another era of active ETF growth and development that reflects the strong flows actives have seen this year, too.

Despite making up just about 6% of total net assets, active ETFs picked up almost one-third of inflows in September. That tracks with active ETFs representing about 6% of ETF AUM, too, picking up about 30% of flows to start 2023. Active strategies also saw 40 consecutive months of net inflows as of the end of July.

Much of that flow’s success is likely owed to concern about an up-and-down market narrative this year. Entering 2023, the fear was all about recession caused by earnings. That failed to materialize, but then the mini-bank crisis hit. Through it all, the Fed has continued its long slog to fight inflation with repeated rate hikes.

With markets finally realizing we really are in for higher-for-longer rates, actives have looked like a solid option to adapt and ride things out. And they’ve delivered, for the most part. Active outperformed passive in the first half of 2023. On the performance front, 57% of active ETFs outperformed their passive benchmarks or rivals to start the year. That’s much better than the 43% of active ETFs that did so in December 2022.

The Year of Active? Or of Dimensional and JEPI?

James Comtois, staff writer, VettaFi: Greetings, Nick! Always a pleasure. You aren’t kidding — it’s truly been the year for active ETFs. But I wonder if this particular active gold rush is actually fool’s gold.

First off, let’s take a look at those inflows. Of the $289 billion that has entered U.S.-listed ETFs year to date, 22% went into active products. That’s nothing to sneeze at.

But dig a little deeper, and you’ll find that most of that money has gone to only a couple of issuers; specifically, Dimensional and J.P. Morgan. So that means it’s not so much active’s year as it is, well, Dimensional’s and J.P. Morgan’s.

See more: “2023’s Overactive Active ETF Flows Are Mostly a Mirage”

In fact, if you take Dimensional’s funds plus the JPMorgan Equity Premium Income ETF (JEPI) and the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) out of the picture, the remaining 887 active ETFs have only brought in $27.2 billion YTD. That’s 9% of the total year-to-date flows for all ETFs. So, not so impressive.

Sure, a cursory glance makes it appear that active ETFs are enjoying a surge in popularity. However, a closer look suggests this to be another example of the biggest brands taking up all the money.

Peters-Golden: Well, when I hear how just a few active ETFs have lifted the whole category so significantly, that gets me excited about the potential of other active ETFs to follow suit. However, we can see from the performance data I mentioned above that the strength in active is more distributed than the flows alone suggest. At the same time, active ETFs “outgrew” their passive rivals, too. Based on organic growth, active ETFs saw a 14% organic growth rate in the first half of 2023 compared to 3% for passive.

We’ve been focusing too much, perhaps, on backward-looking factors alone. Let’s take a look at allocators’ response to actives and their plans moving ahead.

Institutional investors- some of the biggest players in the investing landscape- are one group planning to increase their allocations to active. A PwC survey titled “ETF 2027: A world of new possibilities” found that almost a quarter of institutional investors planned to invest more in active in the next 12 to 24 months. Among Asian institutional investors, active ETF diversification and liquidity benefits have been a big part of the draw.

Of course, it’s not just the big institutional investors looking to add to their active exposure. The Global ETF Survey by Trackinsight found that a majority of respondents planned to increase their active ETF allocation in the next two to three years. Even more are interested in thematic ETFs, of which a not insignificant portion are active strategies.

Among advisors, too, active strategies are getting noticed. Fee-conscious advisors are turning away from mutual funds, which may contribute to a finding in a report by Escalent. That report noted that 48% of ETF users planned to increase their active ETF adoption in the next year.

Across the allocator landscape, active ETFs are gaining steam. Active ETFs may even become the ETF type of choice for Gen Z clients. So it’s not only the stats from our wonderful ETF Database and elsewhere that show them having a strong 2023. Looking ahead, allocators may continue to boost active ETF flows and usage, too.

Not Worth the Higher Price

Comtois: I won’t deny that active funds are gaining momentum, or that they’ll continue to gain flows. But again, I (don’t) wonder where the bulk of those flows will continue to go.

The thing is, how is Dimensional crushing the competition? Because they’re cheaper. That brings me to my next point: Active ETFs are more expensive than their passive counterparts.

Active ETFs charge more than index funds because they cost more to manage. That makes sense. The active nature of the funds means that they require research analysts, portfolio managers, and increased trading frequency.

And this, in turn, often eats up whatever alpha these active funds may gain. When accounting for these costs, they often fall short of outperforming the index. Consequently, passive investing has often delivered superior results, primarily due to its more cost-effective fee structure.

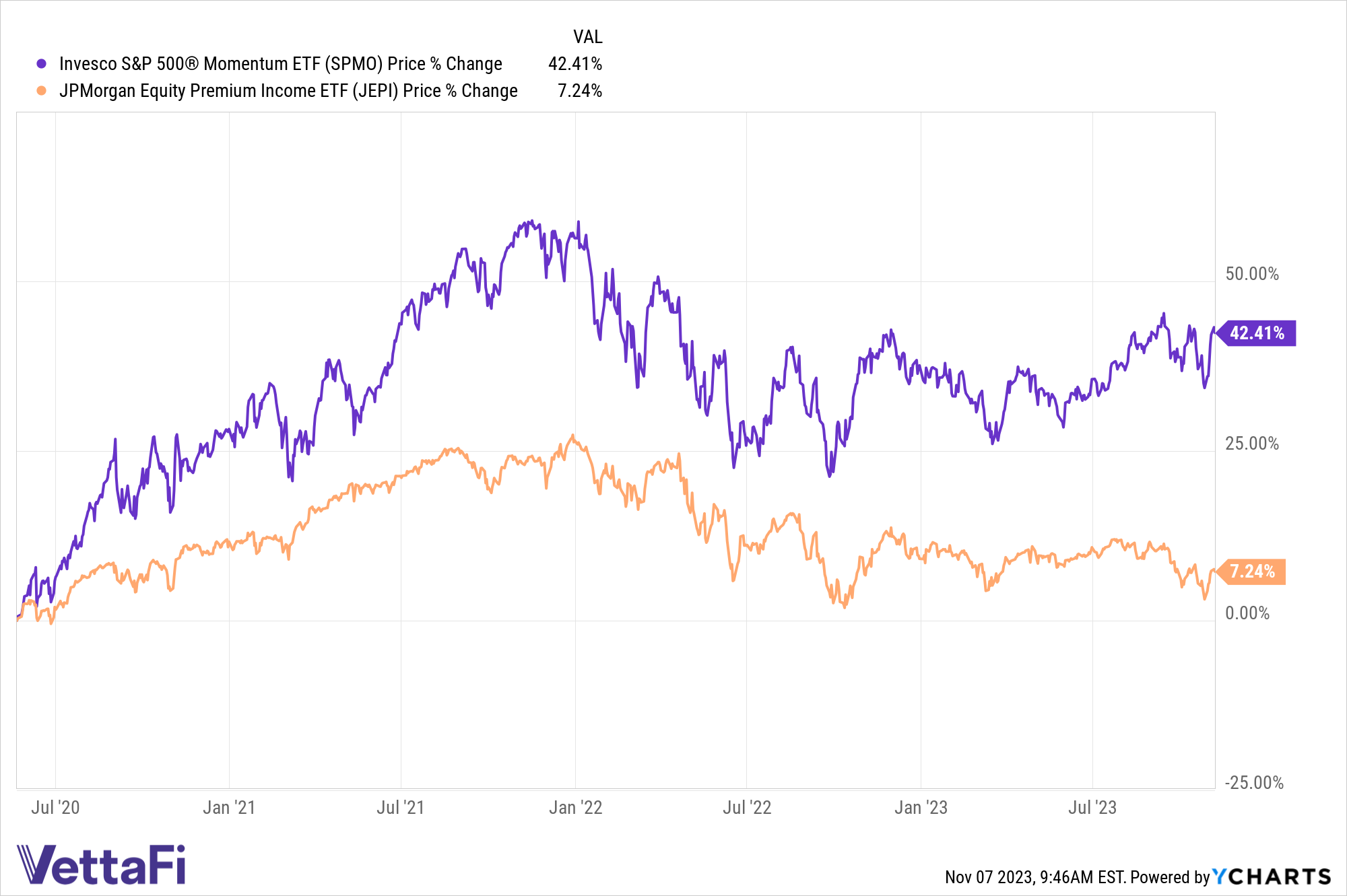

So, rather than buy into an active ETF that charges 1.35%, why not invest in a passive fund? Consider the Invesco S&P 500 Momentum ETF (SPMO), which invests in the top 100 stocks in the S&P 500 based on 12-month prior risk-adjusted performance.

Incidentally, SPMO has been absolutely crushing JEPI performance-wise since the JPMorgan fund’s inception. (I’ll get a little more into active ETFs’ performance issues later).

And SPMO charges just 13 basis points. Way more bang for your buck, I say.

See more: “Invest in the Market’s Momentum – and NVIDIA’s – With SPMO”

Peters-Golden: We’ve talked a lot about actives in 2023, but I want to look at the case for investing in them now for our readers. Actively managed ETFs offer all kinds of benefits that could boost investor portfolios through the end of 2023 and into 2024. We tend to think of active ETFs as either bond or equity strategies that can invest with some more freedom than their passive counterparts. Active strategies are much more than that, however.

Different Flavors of Active ETFs

Active ETFs host all kinds of thematic strategies focused on either asset-based themes or whole investment styles like total return, hedged, or buffer ETFs. They likely do so because of the inherent flexibility in the active setup, as compared to less flexible indexed strategies. In fairness, however, the passive ETF space may be oversaturated, too, but that just adds to the excitement around active ETFs.

We often think about active strategies only as defensively-minded, risk-conscious funds. They can adapt quickly, even intraday, to challenging environments or quick turns in the market. They also, of course, lean on those experienced managers who know each sector and how they respond to a changing market environment. We can, however, forget about their potential to outperform staid, passive indexes.

An actively managed U.S. equity ETF can outperform a passively managed ETF like the SPDR S&P 500 ETF Trust (SPY). With the freedom to move fluidly across subsectors, the active ETF can weigh successful areas more than struggling areas but then swap as needed. Active ETFs also can mitigate taxes via an overall tax loss harvesting approach. By moving out of loss-heavy securities and reinvesting in similar firms, they can boost a portfolio’s overall tax outlook.

Overall, active strategies deserve a place in investor portfolios entering 2024. We still don’t know what the picture really looks like going forward, but if we do see a recession develop, or even just the higher-for-longer regime we’ve been discussing at length, active ETFs could make a great addition.

They Just Don’t Deliver

Comtois: Sure, I’ll absolutely concede that it wouldn’t hurt to have some active management in one’s portfolio. A diversified portfolio is a good portfolio, after all. The question is, how much? I’m thinking, not much. Here’s why: Despite the higher fees, active ETFs don’t deliver.

When Morningstar analyzed 3,000 active funds, it found that less than half (43%) survived and outperformed their average passive peers in 2022. Or, as Morningstar’s Bryan Armour put it: “When viewed as a whole, active funds had less than a coin flip’s chance of surviving and outperforming their average passive peer in 2022.”

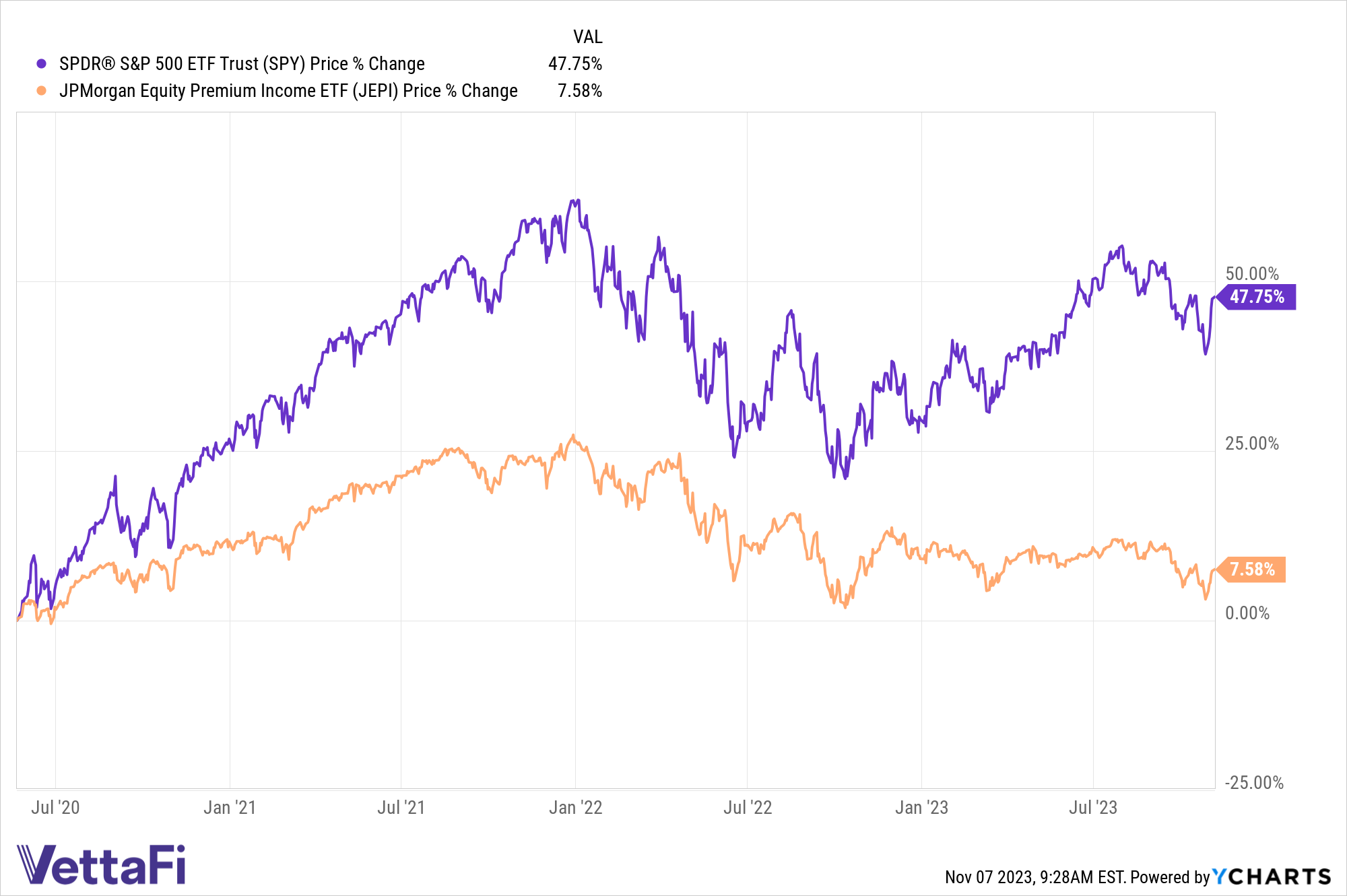

And check out how SPY squares off against the most popular active ETF out there right now, JEPI.

I mean… do I really need to say anything else? (Apart from “Yikes on bikes,” as our colleague Karrie Gordon would say.) You’re better off parking your money in the S&P 500 at any given time.

So, I’m not convinced there’s much “there there” with active funds. The oasis appears to be a mirage created by only a couple of big names; they cost too much and don’t consistently deliver extra value for that extra price.

Anyway, it’s a pleasure as always, Nick, even though we can never seem to agree on anything in this space (I wonder if that’s by design). Until next time!

For more news, information, and analysis, visit the Innovative ETFs Channel.