Markets kicked off the week gaining on the momentum of last week’s strong performance. One stock in particular saw some major gains. Last week marked the S&P 500’s and Nasdaq Composite’s best week thus far since November 2022. The recent monthly jobs report also helped boost stocks.

RBC Capital Markets’ head of U.S. equity strategy Lori Calvasina is quoted in CNBC as writing: “The stock market has had a strong start to November.” She added: “the move seems deserved in light of what we’re seeing in most, though admittedly not all, of our sentiment indicators.”

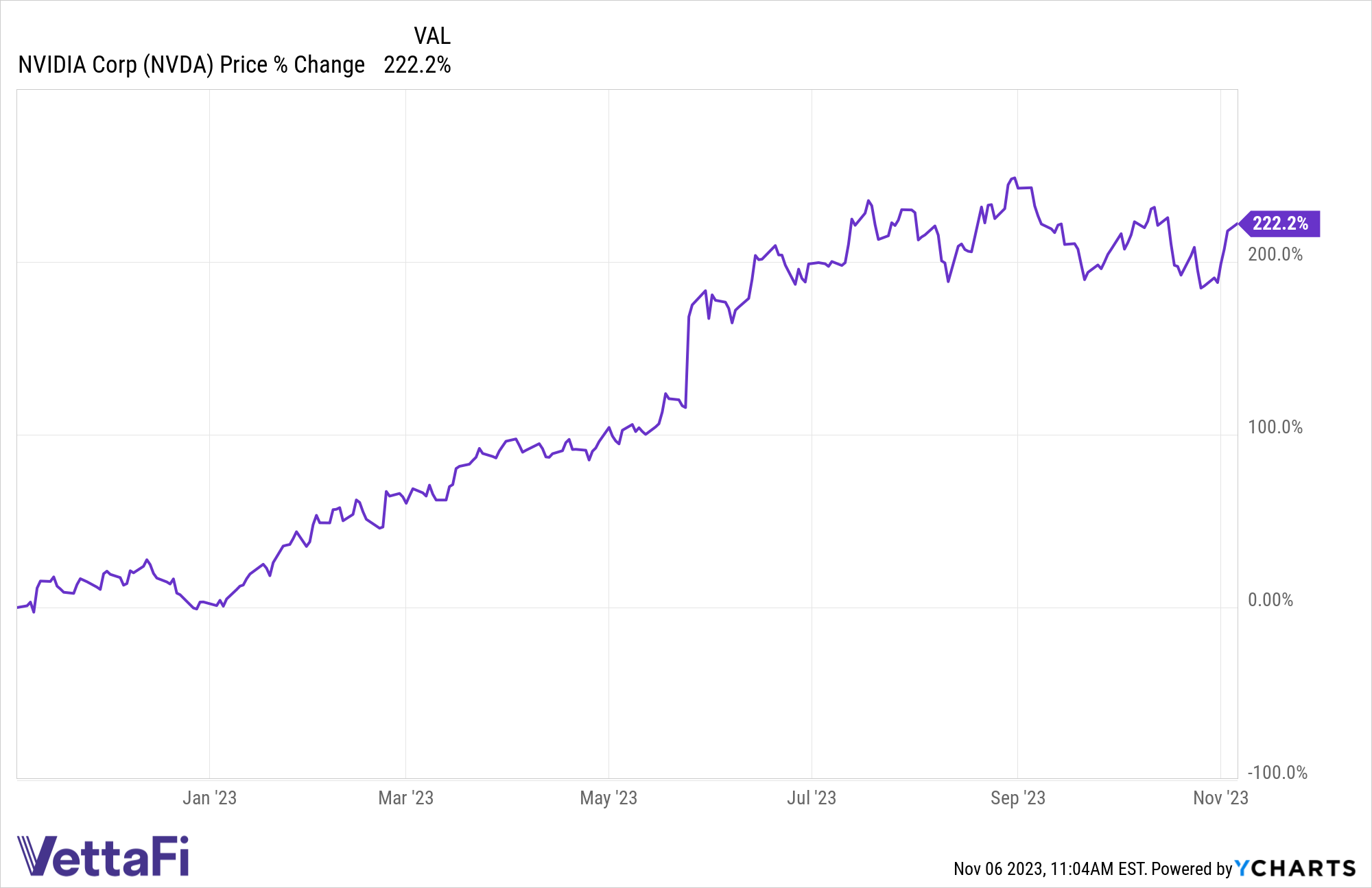

Per CNBC, NVIDIA Corp. (NVDA) stock rose more than 1% Monday morning after Bank of America expressed bullishness over the company in advance of its earnings report. The chipmaker has also greatly benefited from the surge of interest in artificial intelligence (AI) technology. NVIDIA’s share price has risen more than 222% over the past year.

See more: “Invesco’s Quality ETFs Attract Significant Flows”

Investing in Market Momentum

For investors looking to benefit from some of this market momentum, the Invesco S&P 500 Momentum ETF (SPMO) may be what they’re looking for. The fund generally will invest at least 90% of its total assets in the securities that comprise the S&P 500 Momentum Index. The Index tracks the performance of stocks in the S&P 500 with a high “momentum score.”

SPMO’s underlying index includes the top 100 stocks in the S&P 500 based on 12-month prior risk-adjusted performance. The index weighting is inversely proportional to the trailing volatility of each component, subject to single stock and sector constraints, per S&P Dow Jones Indices.

The ETF and its index are reconstituted and rebalanced twice a year on the third Fridays of March and September. Constituents are weighted by their market capitalization and their momentum score.

NVDA is currently the top holding in SPMO, with a weighting of 8.46% as of November 3.

And SPMO is relatively inexpensive, as the ETF charges just 13 basis points.

For more news, information, and analysis, visit the Innovative ETFs Channel.