Bull vs. Bear is a weekly feature where members of the VettaFi writers’ room take opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Elle Caruso and Karrie Gordon discuss the likelihood of continued strong returns for semiconductor ETFs.

Elle Caruso, staff writer, VettaFi: Hi, Karrie! Semiconductor ETFs are dominating the top spots on VettaFi’s list of 100 Highest Non-Leveraged 5 Year ETF Returns. The VanEck Semiconductor ETF (SMH), the SPDR S&P Semiconductor ETF (XSD), the iShares Semiconductor ETF (SOXX), and the Invesco Dynamic Semiconductors ETF (PSI) are four of the five top-performing ETFs, each boasting five-year returns above 20% annualized.

These returns are attractive, but many investors are worried it’s too late to invest in semiconductor ETFs now. Personally, however, I think it’s a great time as there are many tailwinds for the space.

Karrie Gordon, staff writer, VettaFi: Elle, I’m thrilled to talk about something I find extremely fascinating, and not just for the opportunities semiconductors provide for society as a whole. Talking semiconductors is a great lens for looking at several big market and economic trends this year. This includes the ongoing role of deglobalization, the dangers of overvaluations and concentration risk, and the risks tied to thematic investing.

Semiconductors’ Role in the Booming AI Industry

Caruso: In 2023, we can’t talk about semiconductor ETF without delving into AI. AI is being referred to as the biggest margin tailwind and productivity increases ever seen in the economy.

The improvement in AI is different than prior tech investment cycles due to its reliance on existing infrastructure. AI can move at an extremely fast pace as it’s a purely digital innovation.

There is an ecosystem of companies that enable us to be at this moment in history where AI is becoming very real and tangible in everyday lives – and chip makers are integral participants.

One integral player is ASML Holding (ASML), the largest supplier of the semiconductor industry and the sole supplier of the machines required to manufacture the most advanced chips. ASML enables semiconductors to have the computing power they currently do, which is comparable to a human brain. ASML is the only company in the world that does what they do – it’s a natural monopoly. Other companies have tried, but none have been able to succeed.

However, ASML is just one player in the ecosystem. To be successful, it needs the companies that use its equipment: Taiwan Semiconductor Manufacturing Co (TSM) and Samsung Electronics (005930:KRX).

The semiconductor industry has become so complex and advanced that to do the things it’s doing at scale, it needs these 10 to 20 global companies that operate as an ecosystem.

Also included in the ecosystem are familiar names such as NVIDIA (NDVA) and Advanced Micro Devices (AMD), both of which make GPUs. Many other players in the semiconductor ecosystem also have natural monopolies in their own space.

Geopolitical Risk is Significant for Semiconductor Investors and ETFs

Gordon: Looking at semiconductors, both on an industry and an investing level, let’s talk about one of the biggest changes happening on a macro level: the decoupling from globalization.

It’s no secret that tensions between the U.S. and China have been elevated in recent years. Those tensions appear to be escalating despite a recent renewal of lines of communication between top officials of both countries. Export bans of specific U.S. semiconductor chips and materials to China last year resulted in China restricting the export of two primary metals necessary for semiconductor production this year to specific (read U.S. and allies) companies.

The latest in the volley of restrictions is President Biden’s Executive Order last week. The EO bans new U.S. investment into high-tech Chinese companies. It will take 45 days to see what that ban entails and what it means for investors. There is speculation the EO aims primarily at the private sector, but it’s just the latest to highlight the enhanced geopolitical risk semiconductor investing entails currently. The PHLX Semiconductor Sector Index (SOX), which underlies the Invesco PHLX Semiconductor ETF (SOXQ) and measures the 30 biggest U.S. companies within the semiconductor industry, dropped 6.01% last week (08/07/2023-08/11/2023) on the heels of the EO announcement.

The U.S. Competes at a Disadvantage Near-Term

The current back and forth on bans between the two countries is particularly pronounced given the supply chain disruptions of the last several years. In a world where globalization breaks down as countries retreat to onshoring industries like semiconductors, bans like the metal restrictions only create more supply chain fragility during transitionary periods.

China’s control of many critical metals for semiconductor production puts the U.S. at a distinct disadvantage in the mid-term. While U.S. efforts continue to ramp up to onshore semiconductor supply chains and manufacturing, that takes time. We’re talking three to five years, to be exact, to build out new semiconductor fabs, but that still doesn’t solve the issue of raw materials. 60% of germanium and 80% of gallium, both two critical minerals for semiconductor manufacturing, currently come from China.

There may be opportunity in semiconductors but it’s enmeshed in an enormous amount of risk, particularly geopolitical risk.

CHIPS Act Positions Sector for Continued Growth

Caruso: Another tailwind for semiconductor ETFs is the increasing regulatory support for semiconductors in the U.S. Semiconductors are imperative to the U.S. economy, national security, and technology leadership.

Last year, congress passed the CHIPS Act of 2022 as a solution to the U.S.’s supply chain vulnerabilities. Additionally, the act was a way to bolster U.S. competitiveness in an industry considered essential to national and economic security. The act includes semiconductor manufacturing grants, research investments, and an investment tax credit to incentivize semiconductor manufacturing in the U.S.

Since the CHIPS Act was enacted last August, several projects have been announced to increase U.S. manufacturing capacity. Highlights include Micron Technology (MU) building a 1,400-care memory fab in upstate New York.

Additionally, TSMC’s second fab is scheduled to begin producing 3nm process technology in 2026.

Furthermore, Microchip (MCHP) said it would invest $880 million to expand its production of both silicon (Si) and silicon carbide (SiC) chips in its Colorado plant.

Samsung said it would invest $17 billion to build a semi-fab in Texas to create advanced logic chips.

These developments highlight the strong growth in the semiconductor industry. Thus, I think investors can confidently add exposure to semiconductor ETFs knowing the days of compelling returns aren’t behind them.

Semiconductor Report Card: Issues With Concentration

Gordon: I can’t talk about semiconductors without talking about valuations and concentration risk. NVIDIA’s stunning performance this year continues to capture investor attention and money. It’s driven the company’s valuations sky-high as a result. NVDA currently has a trailing 12-month P/E ratio of 234 and a forward P/E ratio of 58. For reference, the SPDR S&P 500 ETF Trust (SPY)’s P/E ratio (TTM) is 20.3, and forward P/E is 20.1 according to Y-Charts data.

While the chip manufacturer is certainly the largest in the industry by market cap right now, increasingly bloated valuations are not confined to just NVIDIA (NDVA). Advanced Micro Devices (AMD), another major player, has a trailing p/e ratio of 483 and a forward p/e of 55.44 this year and 34.56 next year according to Nasdaq.

NVIDIA was a significant contributor to the recent special rebalance that the Invesco QQQ Trust Series I (QQQ) underwent due to superseding the weighting limits of the methodology. Strong concentration in the Nasdaq-100 by seven mega-cap tech companies, including NVIDIA, resulted in a rebalance in July. NVIDIA was the second largest adjustment by weight after the rebalance, dropping 2.74% in weight in the fund.

Beyond tech sector market-cap-weighted funds, concentration risk is high in many semiconductor ETFs. In the iShares Semiconductor ETF (SOXX) NVIDIA represents nearly 9% of the fund. The VanEck Semiconductor ETF (SMH), the largest ETF in the space, carries NVIDIA at a 19.87% weight as of 08/14/2023.

Current overvaluations of key semiconductor companies create cause for concern in my eyes. Given the tendency of valuations to revert to mean over long enough periods, the outlook seems grim. Investing in semiconductors now in hopes of chasing past performance trajectories seems both counterintuitive and incredibly risky

Caruso: P/E ratios can be a useful way to value companies and determine if a stock is overbought. However, for the fast-growing semiconductor industry, I don’t think this is an accurate measure. A stock’s P/E ratio doesn’t consider the company’s EPS growth prospects, and EPS growth will bring that ratio down.

For slow-growing stocks, sure, lower P/E ratios look more attractive. However, a high P/E multiple is often the result of expected growth. NVDA has a high P/E ratio, but its stock has surged 212% year to date and 630% over the past five years. Nvidia stock has continued to grow at an incredible pace and is expected to continue in that trajectory.

The Cyclical Nature of Thematics: Risk for Semiconductor ETFs

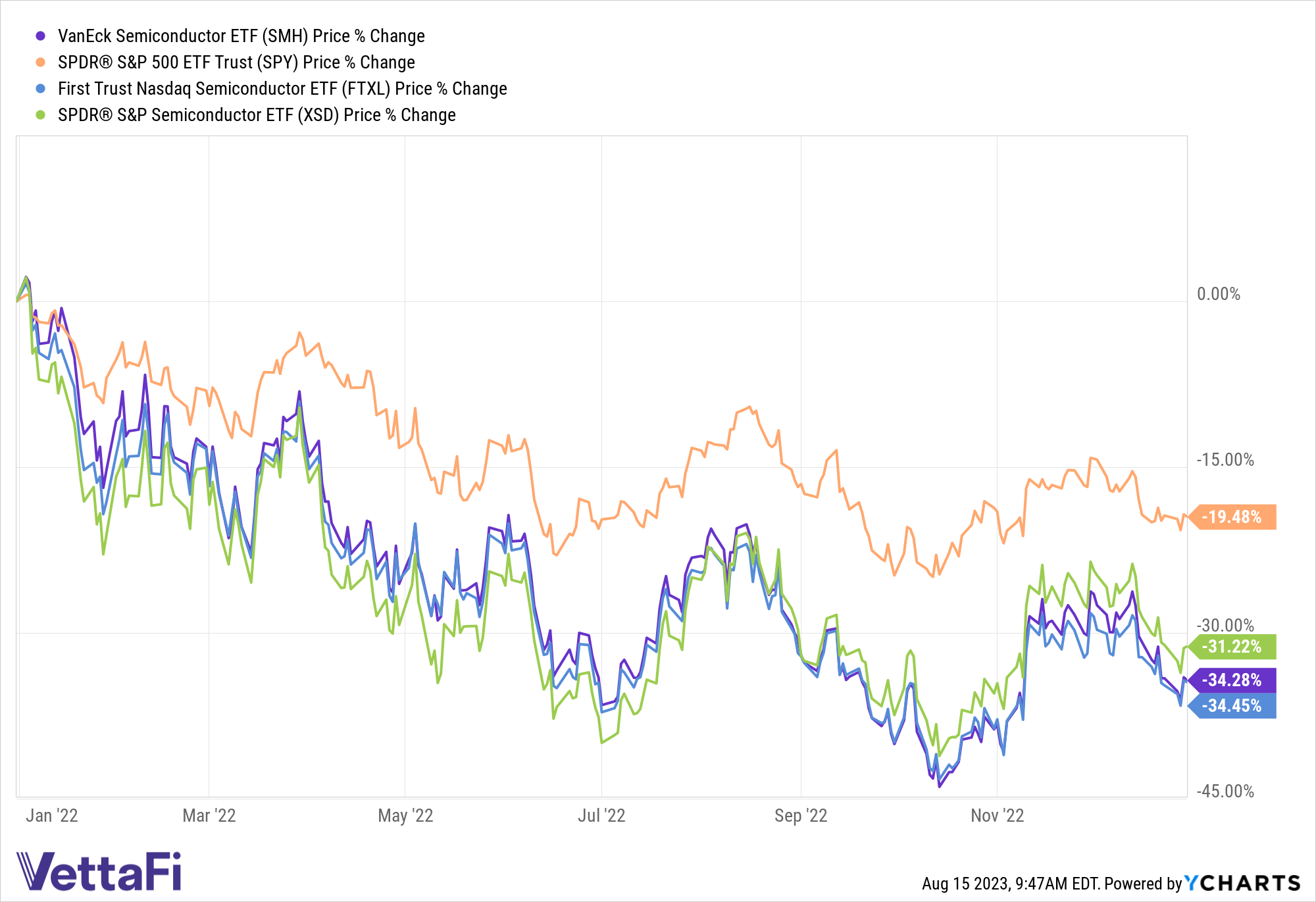

Gordon: Semiconductors might be appealing as an investment but they’re thematic and cyclical and are susceptible to the macro environment. You need look no further than last year to see the pain trade in semiconductors when they bottom.

2022 brought significant drawdowns for semiconductor funds, between 30-40% on average. SMH dropped 33.5% in 2022 — for comparison SPY fell 19.5%. It appears to have been the bottom of the most recent cycle, but it’s a cycle that continues to play out. Semiconductor stocks offer significant upside potential when they gain, but painful and noteworthy drawdowns when they fall.

Image source: JPMorgan

Given the ratcheting tensions and semiconductor bans going on between China and the U.S. as well as the impacts of onshoring efforts by countries, it’s uncertain how the cycle evolves from here. In the wake of the bans, semiconductor investing becomes even more speculative for investors.

Looking Beyond Semiconductor ETFs

For investors looking to capture the potentials of semiconductors and their role within the technology sector with an eye towards concentration, the Invesco S&P 500 Equal Weight Tech ETF (RSPT) is worth consideration.

RSPT doesn’t capture the full upward momentum of market-cap-weighted tech sector ETFs. It does, however, mitigate drawdowns that more concentrated funds experience when the tech sector and semiconductors slide. When SMH dropped 34.28% in 2022, RSPT declined 25%. It’s also worth noting that RSPT currently outperforms broad equities, up 19.31% compared to SPY’s 16.33% as of 08/15/2023.

Elle, it’s been really great taking a look at markets through the lens of semiconductors. Fantastically high valuations alongside changes as countries onshore their semiconductor supply chains give reason for pause. I believe it’s enough to create doubt regarding continued outperformance looking ahead. Much remains to be seen, but this is an allocation that is best included alongside a broader strategy.

Caruso: Karrie, you’ve brought up some excellent points, but I personally just can’t risk missing out on these compelling returns. It will be interesting to see how the semiconductor stocks look next week after Nvidia’s highly anticipated earnings report

For more news, information, and analysis, visit the Innovative ETFs Channel.