Trade tensions between China and the U.S. ratcheted tighter this week over semiconductors. The fight between the two economic giants for dominance of the semiconductor industry could come at a great global cost and heightened investor risk. There is an opportunity for advisors and investors with current exposure to U.S. semiconductor companies to diversify their potential risk should the U.S.-China rivalry escalate further at the cost of U.S. companies.

China remains in a relative place of power for now due to its control of many of the raw metals critical to semiconductor chips and EVs. The latest trade restrictions lean into this positioning, with China’s announcement of substantial metal export restrictions. These restrictions are set to go into effect next month, as reported by the WSJ.

The restrictions cover a number of metals, chief amongst them gallium and germanium. China remains the primary global exporter of the two metals which are used in cutting-edge semiconductor chips for EVs, fiber optics, military applications, and more.

“Gallium and germanium are just a couple of the minor metals that are so important for the range of tech products,” Peter Arkell, chairman of the Global Mining Association of China, told Reuters. “China is the dominant producer of most of these metals. It is a fantasy to suggest that another country can replace China in the short or even medium term.”

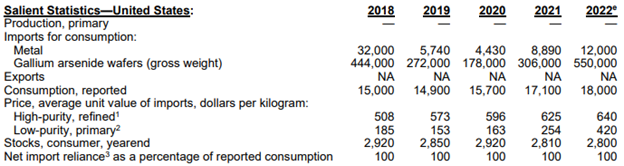

The U.S. Geological Survey reported that China made up 86% of the world’s production capacity of low-purity (primary) gallium in 2022. The U.S. does not contain deposits of gallium but is a primary producer of high-purity refined gallium.

United States gallium imports, exports, and consumption

Image source: U.S. Geological Survey

“This measure will have an immediate ripple effect on the semiconductor industry, especially with regards to high-performance chips,” Alastair Neill, board member of the Critical Mineral Institute, told WSJ.

Semiconductor Trade Tensions Climb Since 2018

The announcement is the latest in a string of ongoing escalations between the two countries that began in the Trump era. While the U.S. and China seek to throw increasingly higher hurdles for semiconductor development in front of each other, they remain reliant on the other.

China maintains its status as the primary source for many of the raw metals and materials used in semiconductors. Meanwhile, the U.S. is home to many of the manufacturers of high-end semiconductor chips.

China’s latest export restrictions come on the heels of the U.S. curtailing export of high-end semiconductor chip manufacturing technology to China. The back and forth between the two countries in recent years include China banning domestic purchases of U.S.-based chip maker Micron, and the U.S. blocking sales and shipments of semiconductor chips and technologies to major Chinese tech companies.

While the latest restrictions are not an outright ban on exports of these metals and materials, they do allow Chinese authorities to deny export applications. This creates the ability to target individual companies and specific industry subsets, creating greater control over the global semiconductor industry.

It’s also worth noting that export restrictions could exacerbate global supply chain stress, leading to further disruption and risk.

The restrictions could provide China with leverage on the eve of Treasury Secretary Janet Yellen’s visit to Beijing. Renewed efforts to establish communication between the two countries resulted in several noteworthy visits of high-level officials between the two countries in the last month.

Diversify Global Semiconductors Risk With KFVG

China continues to work rapidly to become self-sufficient in semiconductor production. The country set goals of 70% domestic use by 2025 and the KraneShares CICC China 5G and Semiconductor ETF (KFVG) offers exposure to this rapidly expanding industry within China. The fund offers diversification opportunities for portfolios and capitalizes on the long runway potential of China’s semiconductor industry growth.

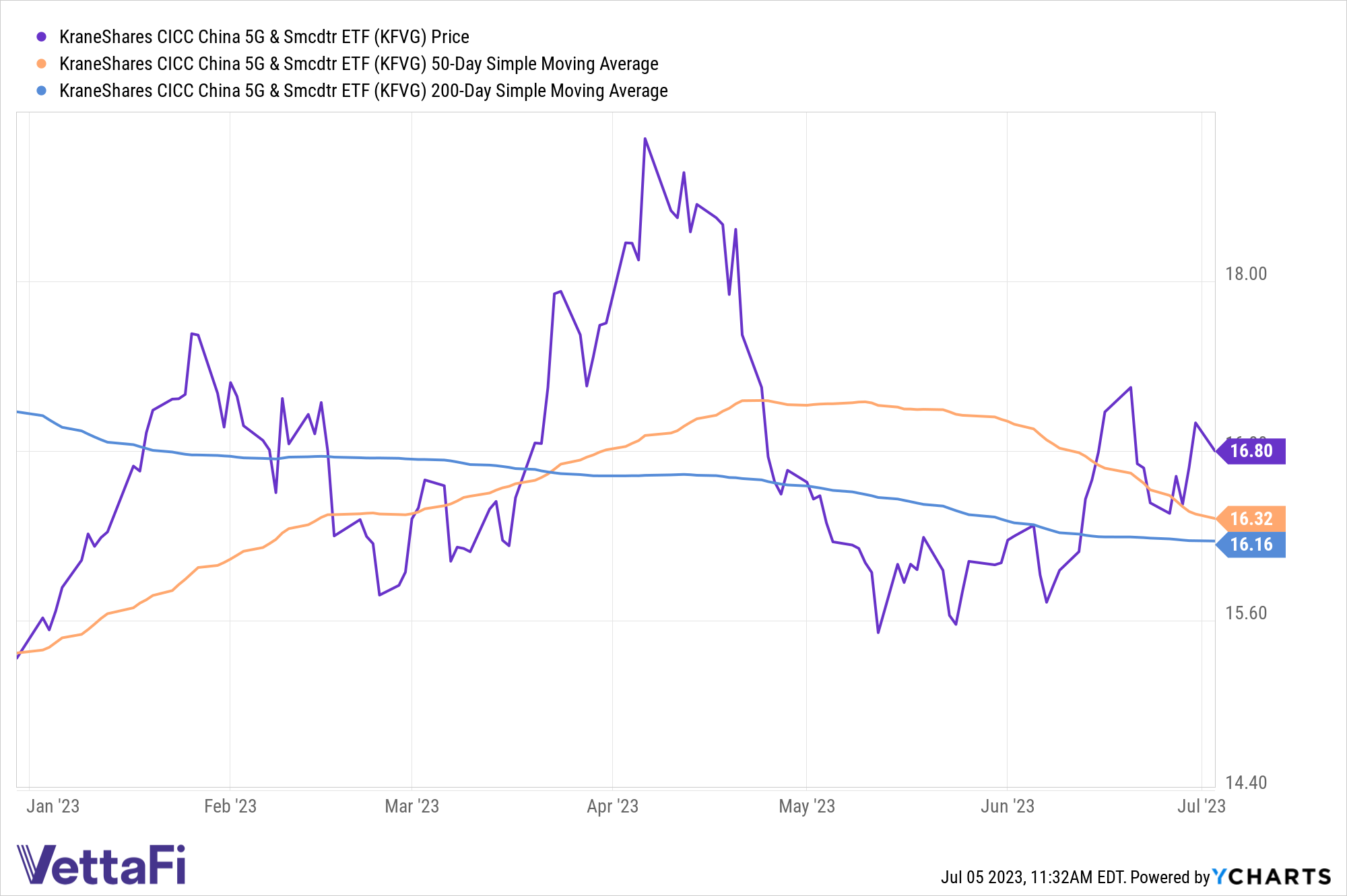

KFVG also provides exposure to China’s continued 5G technology dominance. The fund is up 9.55% YTD.

The fund is currently trending well above both its 50-day Simple Moving Average as well as its 200-day SMA. Funds that trade above their SMAs are considered in buy territory for investors and trend followers alike.

KFVG tracks the performance of the CICC China 5G and Semiconductor Leaders Index. The index contains the top 30 Chinese companies by free-float market cap. Industries tracked include semiconductor manufacturing, manufacturing equipment and services, and internet and data services. The index also tracks electronic components, consumer electronics, commercial electronics, and more.

KFVG has an expense ratio of 0.65% with fee waivers that end on August 1, 2023.

For more news, information, and analysis, visit the China Insights Channel.