Over the course of the next twelve months, however, there may be a chance to take positions that could reward long-term portfolios.

We are trying to thread a tight needle with our outlook, but the view driving our strategy contemplates AMLO winning the election on July 1. Given the stakes and potential loss of power of the ruling party, there could be considerable upheaval and asset price discounts as the election is contested and results not final for a period of time. The markets will have awoken to this possibility leading into the election and will begin talking about the outcome being a Chavez-lite result. Already cheap markets would look even cheaper in this scenario. The current Price to Earnings ratio (P/E) for Mexico is 16.8x. This P/E ratio is 6.4x less than Mexico’s 5 year average P/E ratio of 23.2x, and represents the largest “discount” of all the countries we follow in the ACWI. The Bolsa will decline further and MXN will weaken if indeed AMLO is declared the winner, but Mexico’s current valuations (versus its own history) suggests that a good portion of political risk has already been priced in.![]()

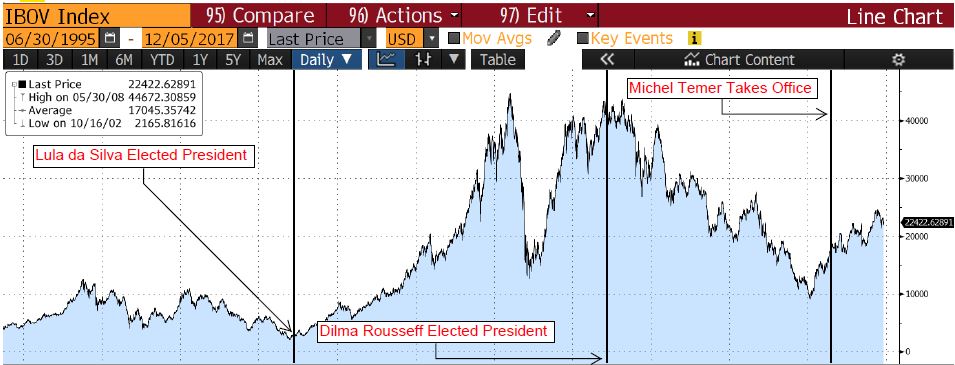

Without trying to pick the bottom, we will build meaningful positions at these lower levels given a fairly broad and time-insensitive view. While conditions are different than Brazil in 2002, the general panorama in Mexico could be similar to the Lula election with Brazilian stocks down nearly 80% in USD terms going into the election, but sprinting over 1900% in USD terms to the upside over the course of several years.

We believe that AMLO will be prudent, at least relative to expectations – more Lula than Chavez. As Mayor of Mexico City was generally considered to be pragmatic and flexible when working with business. While Mayor, he built freeways and worked with business leaders to restore the city’s historic center.

He is likely to roll-back energy reform, push hard against the U.S. while looking for new partnerships, including exiting NAFTA which would place Mexico under WTO rules which would be more favorable for Mexico, and raise taxes significantly on the rich. But he will be attentive to the economy broadly. The country has always benefited from a weak currency and its proximity to the U.S. which will perhaps payoff nicely under WTO rules. Companies will have the ability to grow earnings. Currently, due to the uncertainty, the market is over-looking very strong expected earnings growth. Consensus forecasts suggest EPS growth of 23.8% annually over the next 3 to 5 years, outpacing the expected earnings growth of 13.1% for the average country. If AMLO takes power smoothly and uncertainly declines, Mexico’s high growth potential and attractive valuation will attract global investors and support asset prices.

Mexico is 0.4% of the ACWI. This is not a market that will make or break your year if you have a global mandate. The moves could be big enough, however, that keeping close eye on the political scene in 2018 could add improve your ability to outperform next year. Mexico is a mature country with great people, culture, history (and of course food) and it will bounce back strongly as it always has after crises. Our bet is that there will be a repeat of this kind of scenario; so tune in and stay tuned!

This article was written by Brad Jensen, Managing Director and Senior Portfolio Manager at Accuvest Global Advisors, a participant in the ETF Strategist Channel.